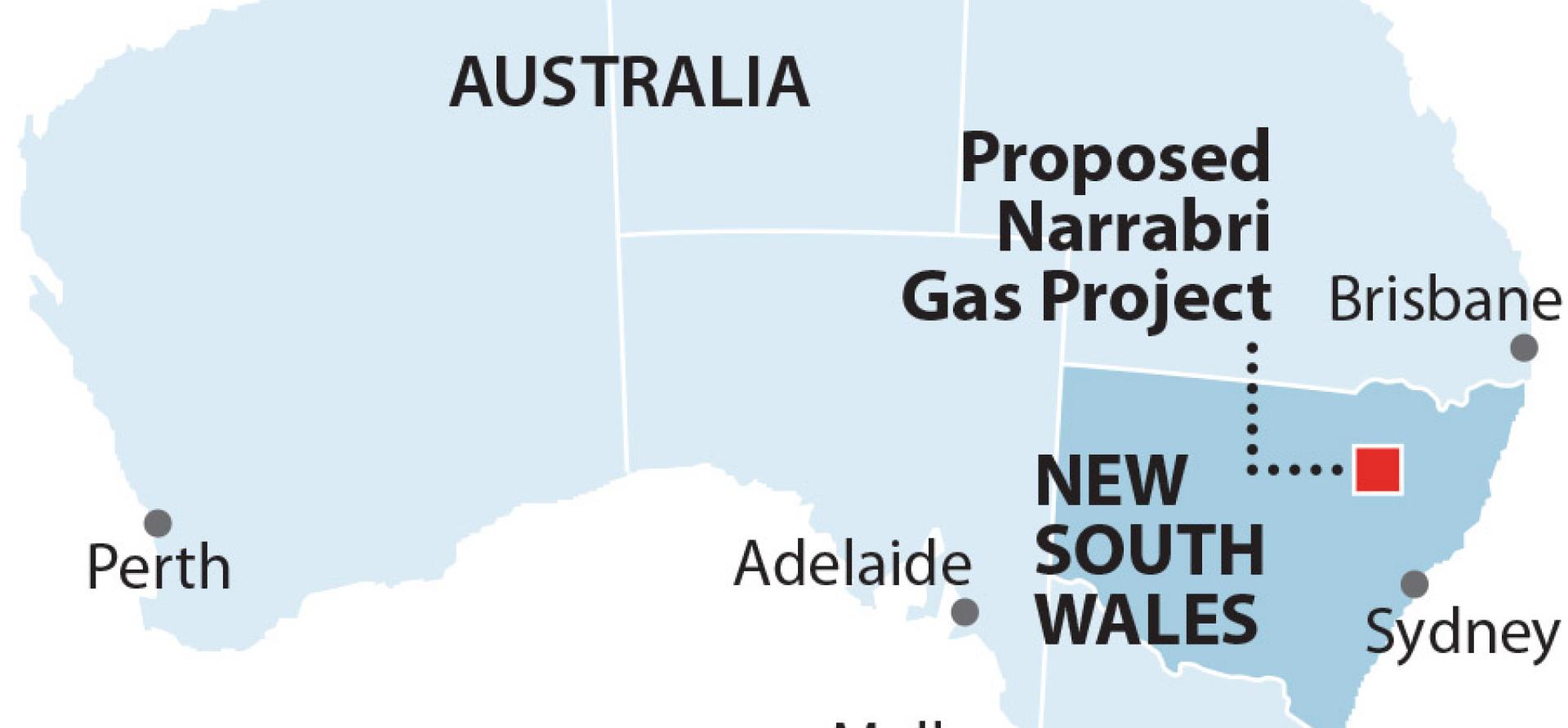

IEEFA Australia: Narrabri gas project’s lack of social licence will make pipeline approval problematic

Key Findings

The project and associated pipeline would embed infrastructure into the system that is not going to see out its economic life.

Narrabri gas, as a very high cost product, cannot boost domestic supply or lower prices for consumers.

Financing for fossil fuel projects is harder to come by and demand is diminishing among major overseas LNG customers.

Santos’ controversial Narrabri gas project in northern New South Wales received final federal government approval yesterday, despite a record number of objections to the project.

This project clearly fails the social licence it needs to operate

In investment there are three factors bankers and investors assess before making an investment. They look at environmental, social and governance (ESG) factors and this project clearly fails the social licence it needs to operate.

Because the project fails on social licence, it will make it very difficult, for example, for it to get a pipeline through people’s private land, because people see there was very strong opposition to the project both locally and also throughout the state. It will have to gain access to private land to be built, it will have to go through an approvals process itself, and it will also have to gain financing from people that want to look at embedding a 30-year piece of infrastructure into a fuel that we’re rapidly moving away from.

Financing for anything that involves the burning of fossil fuels is getting much harder to come by

Financing for anything that involves the burning of fossil fuels is getting much harder to come by. Not only are there specific exclusion clauses from a lot of financial institutions now on coal, but increasingly they’re looking at gas and oil as well and are restricting their exposure to these commodities.

The reason they’re doing that is pretty simple: the risk has gone up substantially. Just in the last few weeks we’ve seen major commitments from all three of our trading partners in LNG, where most of our gas actually goes (it doesn’t go into the domestic market, it goes into LNG). Those three trading partners are Japan, China and Korea and they’ve all committed to net zero emissions: Japan and Korea by 2050 and China by 2060.

With the approval of Narrabri, we’re embedding infrastructure into the system that is not going to see out its economic life, and that’s the key takeout here.

We’re embedding infrastructure that is not going to see out its economic life

We are rapidly moving away from using gas, for example, in the household. It’s cheaper to heat your home with a reverse cycle air conditioner now. As AGL says itself on its website, it’s much safer to heat and cook with electricity rather than gas.

Narrabri gas definitely can’t boost domestic supply or even lower prices for consumers for a very simple reason. That is, Narrabri gas is very high cost gas and producing something at a high price can’t bring down the price of that commodity. It’s that simple.

The market itself for gas on the East Coast of Australia is entirely rigged. There’s rampant price fixing that goes on. We’ve had a price enquiry going on now by the ACCC for 5 years and they all come to the same conclusion: we’re paying too much for gas and the market is not a fair one. We pay way above international prices for our gas domestically.

The problem is that the gas companies are actually fixing the price above international prices for Australian consumers and it’s why gas intensive manufacturing is struggling in Australia today and it’s why we’re not seeing more investment.

The idea of a gas-fired recovery when we can’t even provide gas at a reasonable price is in the realm of a fantasy land.

This commentary is an excerpt from an interview with Bruce Robertson on ABC News Radio.

Related articles:

Australia’s gas-led recovery is flogging a dead horse

Gas and electricity prices will rise if Narrabri gas fields approved

The state of NSW should not sponsor a loss-making, wealth destroying industry

Auditors take note – Santos’ accounts misleading since 2014