Energy Security Board proposal likely to be expensive and delay decarbonisation

Key Findings

Australia's heavy reliance on coal-fired electricity has dramatic implications when power plants fail to produce.

Paying generators for their potential capacity, on top of what they are paid to produce electricity, could add billions to power costs.

Proposed reforms for the National Electricity Market lack essential details.

Australia remains heavily reliant on coal-fired power plants and – as we have seen unfold over the past few weeks – when they fail to perform as expected it can have dramatic implications for reliability and price of electricity.

The Energy Security Board (ESB) is recommending that, to reduce the risks of such events in the future, electricity consumers should pay an additional fee to coal, as well as other generators, for their potential to generate electricity, on top of what they are paid for the electricity they generate.

The argument is that as wind and solar generation have grown, this has reduced the amount of generation needed from other, conventional power plants – limiting their potential to earn revenue. Conventional generators fuelled by coal, gas and hydro, remain important for keeping the lights on because they can be ramped up to meet demand regardless of weather conditions.

Therefore, the argument goes on, to ensure these generators stay in the system, we need to compensate for their lost revenue from generation with a new payment based on their installed generating capacity.

Paying all generators a capacity payment is a very expensive way to address reliability risks

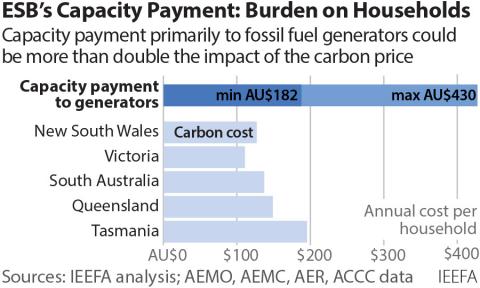

However, paying all generators a capacity payment is a very expensive way to address reliability risks. It will also make it more expensive to achieve our emission reduction goals. Official costing of the capacity mechanism proposal has not been released by the ESB but, based on experience with the Western Australian capacity market, the cost to NEM consumers could be in the realm of $2.9 to $6.9 billion each year. This means an average cost per household of $182-$430 per year – higher than that of the carbon price.

Better options are available and these options enjoy support from the electricity industry. The initial design of the capacity mechanism option (in the form of the Retailer Reliability Obligation, RRO) had opposition from many stakeholders.

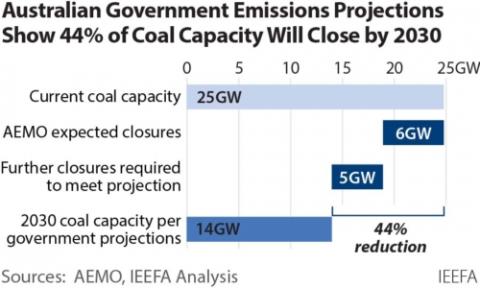

The ESB is correct that numerous generators, particularly coal power plants, will face significant challenges for their viability as wind and solar grows. In February 2021 we issued a report highlighting that an influx of renewable energy supply expected by 2025 could reduce the revenues earnt by coal power plants by 44% to 67% (based on wholesale spot market outcomes).

This loss of revenue was likely to be so severe that five coal generators could be operating at a loss by 2025 – Yallourn, Eraring, Vales Point, Gladstone and Mt Piper. Our analysis was subsequently proven correct with the closures of Yallourn and Eraring being brought forward. The operators have given several years’ advance warning of the closures.

The ESB proposal has failed to deal with the issue at hand

This is where the ESB proposal has failed to deal with the issue at hand. The issue is not so much that coal power plants will withdraw, which is inevitable if we are to meet climate goals, but rather the problem is the potential timing mismatch in which they might withdraw before we have built replacement capacity.

The issue for potential investors in new dispatchable replacement capacity is that the financial viability of their investment in new plants hinges on the exit of coal power plants. Investors are better placed holding off on an investment in new capacity until they have confidence that coal capacity will exit permanently.

This is the case under a capacity market, as much as it is under the existing energy-only market. That’s because in both cases an existing power plant, with its capital cost already sunk, will substantially depress the available returns for a new entrant. Only when the market enters a shortage will prices rise to support the new entrant.

Yet a shortage is exactly what we are trying to avoid. So we remain stuck in the same timing mismatch problem with the ESB’s proposal as we were without it. Except consumers are now saddled with an extra burden to pay not just to the new entrants, but also every other generator, whether or not these existing plants actually need a capacity payment to remain in the market, and whether or not these plants make sense in a decarbonised electricity system.

There are more targeted options that impose far more modest costs on consumers

We suggest that, instead of paying every single generator a capacity payment, Energy Ministers consider options that are more targeted and impose far more modest costs on consumers.

Our report, There are better ways to manage coal closures than paying to delay them, outlined alternatives for governments to consider in managing and containing the risks of premature withdrawal of coal power plants.

It is not unreasonable for governments to expect that owners of large power plants (with individual generating units greater than 250MW) will operate their power plants responsibly, given the significant risks these plants pose to system reliability if they withdraw abruptly. This should include keeping plants in good working order such that unplanned outages are rare.

If unplanned outages exceeded a level defined as manageable by the Australian Energy Market Operator (AEMO), then owners could either be fined (or surrender a pre-paid bond) or opt to enter into a wind-down agreement with the Government. Under such an agreement, a generator’s operations could be phased down in line with the entry of new capacity.

There are several alternatives for encouraging new dispatchable capacity

On the other side of the equation, there are several alternative options for encouraging the entry of new dispatchable capacity. The NSW Government’s Electricity Infrastructure Roadmap provides one pathway. Another is Professor Bruce Mountain’s Renewable Energy Storage Target. Associate Professors Tim Nelson and Joel Gilmore meanwhile have suggested AEMO could build up a reserve of standby dispatchable capacity, in addition to the reserves it holds under the Reliability and Emergency Reserve Trader (RERT).

This reserve would be composed of resources that could be brought in at short notice to deal with extreme situations of the kind witnessed in May and June. Although, unlike the RERT, over a period of time these resources would be progressively rolled out of the reserve payment mechanism, and instead permanently take the place of exiting coal. At this point, their revenue would come from the overall wholesale electricity market.

A broad-based capacity market has never enjoyed widespread support

It is crucial to note that the ESB’s proposal for a broad-based capacity market has never enjoyed widespread support and acceptance by those with the most at stake in electricity market outcomes. The ESB acknowledged this in a paper it released in April 2021 summarising the feedback received from stakeholders (this paper, Post 2025 electricity market design Stakeholder Feedback - themes and issues raised in submissions, no longer appears on the ESB website). The ESB noted,

“Of the 76 out of 104 submissions that discussed RAMs [Resource Adequacy Mechanisms – which means mechanisms ensuring enough power to avoid black-outs], stakeholders were most engaged with the modifications to the RRO [the Retailer Reliability Obligation] sections and generally unsupportive of modifications to the RRO [where it would be converted to a capacity market] without a clearer case for change.”

More recently, news has emerged in The Australian newspaper that when the ESB sought the views of a technical working group of experts on its preferred model – a capacity market versus alternatives, such as Nelson and Gilmore’s capacity reserve – the majority voted against the ESB’s model.

This drawn-out process is creating uncertainty

It is now more than three years since the ESB was tasked with examining options for reforming the National Electricity Market. Yet we are faced with a proposal that still lacks essential details surrounding critical design elements, including, most importantly, how much it will cost consumers. This drawn-out process is creating a level of uncertainty that is harming investment in new capacity rather than supporting it.

Energy Ministers cannot continue to defer critical decisions about this to yet another meeting. They need to make it clear whether they support the ESB’s proposal to pay existing coal and gas generators a capacity payment.

If the Energy Ministers do not support the proposal, then it is probably time to consider winding up the Energy Security Board and restoring the original governance structure for the electricity market where the rule maker stands independent of the regulator and the system operator.

This article first appeared in RenewEconomy