China’s falling iron ore demand is only half the story

Key Findings

With China’s steel production falling faster than expected, demand for lower-grade ore used for coal-consuming blast furnaces will decline as a result.

Meanwhile, demand for higher grades suitable for low-carbon iron and steel making is on the rise, and miners outside Australia are positioning themselves to take advantage.

As the market for its blast furnace-grade ore goes into permanent decline, Australia must choose: shift attention to its higher-quality reserves; or let overseas competitors dominate the growing high-grade market.

This analysis is for information and educational purposes only and is not intended to be read as investment advice. Please click here to read our full disclaimer.

With Chinese steel demand now dropping faster than expected, the outlook for Australian iron ore – and its impact the Australian economy – has become a hot topic.

What’s often overlooked, however, is that it is demand for lower-grade ore used for coal-consuming blast furnaces that is entering decline. Meanwhile, demand for higher-grade ore suitable for lower-carbon steelmaking is on the rise. And miners outside of Australia are positioning themselves to capitalise on this opportunity. Australia needs to catch up.

With China passing peak steel back in 2020, a slow decline in Chinese steel production was expected as its economy matures. Now it looks like China’s steel sector is much more challenged, with the world’s biggest steelmaker China Baowu warning of a “harsh winter” that will be “longer, colder and more difficult to endure than we expected.” In August, China suddenly suspended approvals for new steel plants.

Instead of plateauing around the 1 billion tonnes per annum mark, there is now the possibility that Chinese steel demand will fall faster. One Chinese steel insider reportedly sees steel demand dropping to 750-800 million tonnes per annum (Mtpa) in the next five to 10 years. And as China shifts towards more steel recycling, iron ore demand is likely to drop faster than steel demand.

However, not all iron ore is equal. The decline in Chinese steel production will impact demand for lower-grade iron ore used in the coal-consuming blast furnaces that currently produce 90% of China’s steel. But as some big miners are pointing out, demand for higher-grade iron ore suitable for low-carbon steelmaking is set to rise as steelmakers shift away from blast furnaces towards cleaner technology.

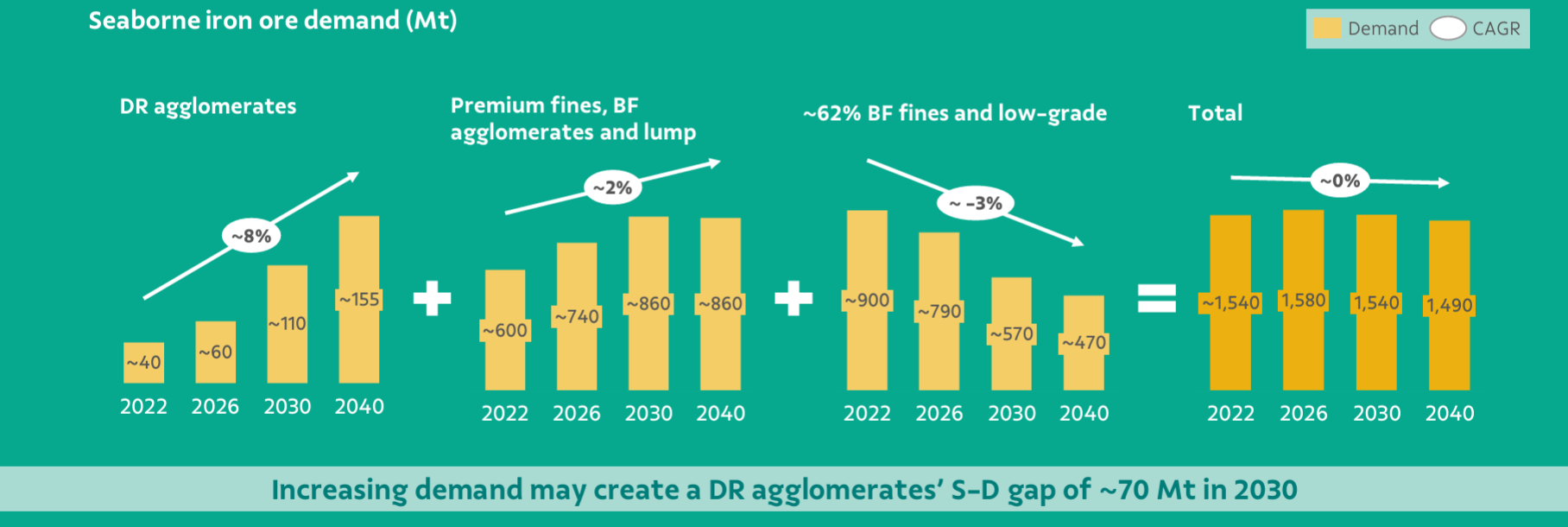

Figure 1: Vale seaborne iron ore demand forecast

Source: Vale

Direct reduced iron (DRI) is made using gas rather than coal, but it can also run on green hydrogen to produce green iron and steel.

Vale – the world’s biggest producer of high-grade iron ore suitable for direct reduction-based (DR-grade) steelmaking – sees seaborne demand for benchmark, blast furnace-grade 62% Fe iron ore almost halving by 2040, while shipments of DR-grade more than triple (Figure 1).

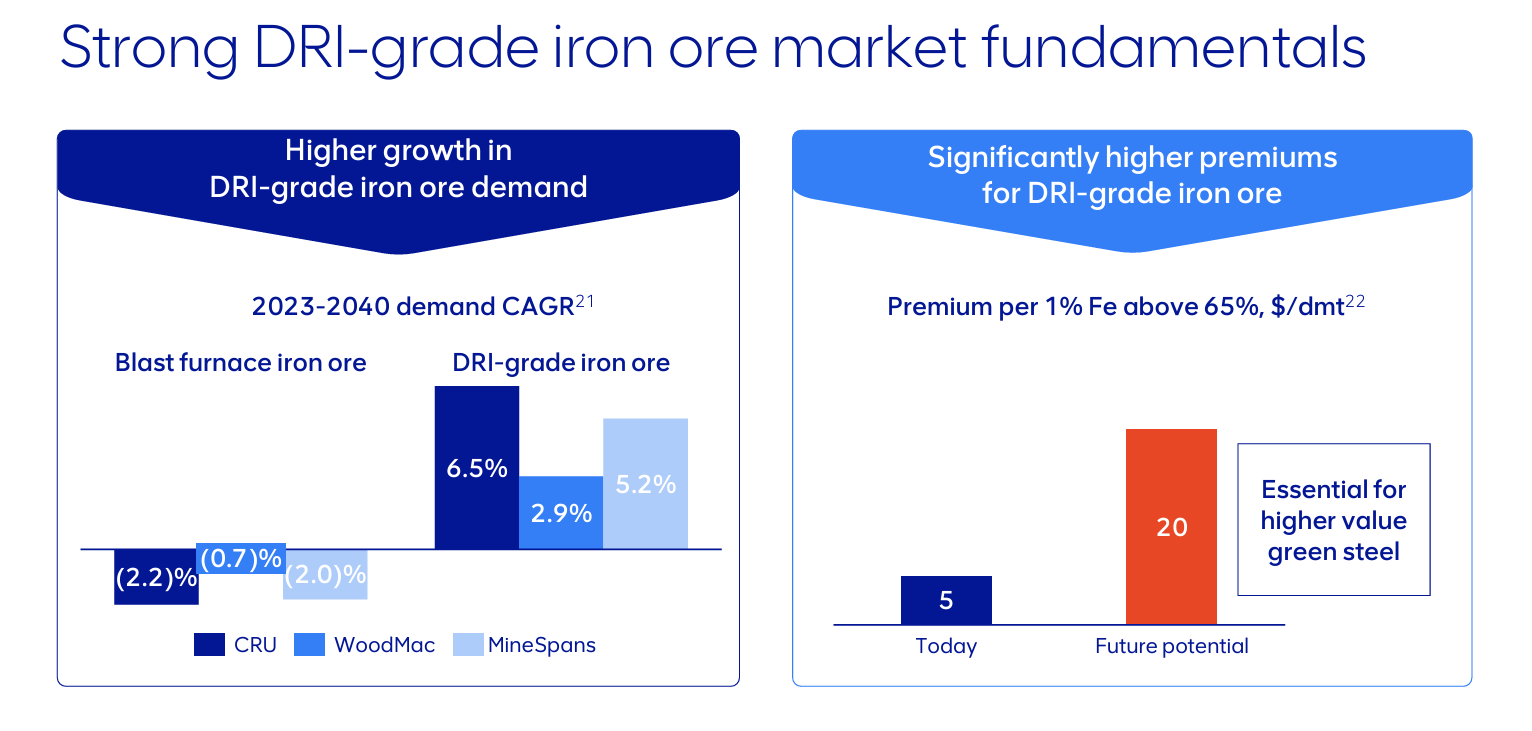

Similarly, Anglo American highlighted several industry forecasts in its recent interim results presentation showing strong demand growth for DR-grade ore as blast furnace-grade product enters long-term decline (Figure 2).

Growing demand for high-grade iron ore set to be met by operations outside Australia

Both Vale and Anglo American are setting themselves to take advantage of this long-term opportunity. Vale’s newly announced incoming CEO, who takes over the Brazilian giant in January 2025, has already made clear that his first objective will be the delivery of high-grade iron ore to steelmakers as they seek to cut emissions. Vale intends to bring an additional 50 million tonnes (Mt) of supply online in Brazil within two years.

Anglo American already has plans to increase DR-grade iron ore production at its own Brazilian operations. Then in August 2024, the company announced a $428 million investment to upgrade iron ore processing at its South African operations, allowing it to treble production of high-grade ore at its Sishen mine.

Australian iron ore miners are also developing high-grade operations overseas. Most obviously, Rio Tinto is part of one of the consortia that are developing the Simandou iron ore deposits in Guinea, West Africa. Already under construction, first shipments are expected in 18 months before ramping up to 90Mtpa by 2028 and then continuing to 120Mtpa.

Fortescue is continuing to ramp up DR-grade production at its Iron Bridge project in the Pilbara, but it is also eyeing high-grade production at its Belinga project in Gabon, Central Africa.

Figure 2: Anglo American summary of iron ore forecasts

Source: Anglo American

Meanwhile, BHP is sticking with lower-grade ore (and metallurgical coal) in the belief that the answer to steel decarbonisation is fitting carbon capture and storage to blast furnace-based steel plants. This is despite there being no such facilities in existence anywhere in the world at commercial scale, virtually nothing in the pipeline, and the growing likelihood that it will never happen at scale.

Australia is now starting to focus on the opportunity to process its iron ore onshore using green hydrogen to produce and export green iron. With its high-grade iron ore reserves and a power grid that will be fully decarbonised by 2027, South Australia has an early advantage.

Fortescue stated in an August 2024 investor and analyst call that “our vision is in the longer term, to convert all our iron ore into green iron metal.” The great majority of Fortescue’s current production is low-grade, so fulfilment of this vision will mean finding ways to use low-grade ore in DRI-based steelmaking. Fortescue, Rio and BHP are all working on this, and Rio recently suggested such technology may not proliferate until after 2040.

Given the predominance of low-grade ore in the seaborne market, success in these efforts would be highly significant. But for now, green iron and steel needs more high-grade ore, and mine project lead times are long.

As the market for its blast furnace-grade ore goes into permanent decline, Australia faces a choice: it can shift attention to its higher-quality reserves; or it can let overseas competitors dominate the growing high-grade market.