The CCUS entourage in Southeast Asia: A convenient ride to delay the hard questions?

Key Findings

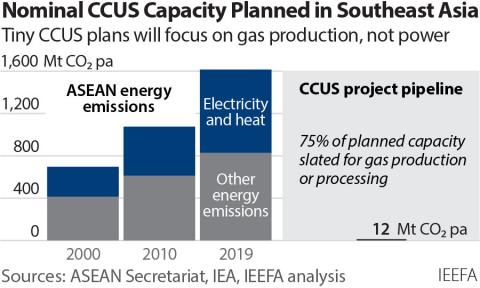

Three-quarters of the planned CCUS project in the region is for gas processing, not from where the bulk of emissions comes from – the power sector.

Aside from Singapore, the region has a practically non-existent carbon price.

Capture cost tends to dominate project budget.

‘Carbon capture’ has increasingly become a magic word for many investors and regulators. ‘Carbon capture potential for project [insert name here] will be evaluated in the future’ presents a convenient way to wing questions on emissions and to get the project through the last miles.

While media reports may captivate the public imagination of having low-to-no emissions power delivered from coal or gas plants, many do not distinguish the relatively low-cost gas processing carbon capture, utilization and storage (CCUS) and the prohibitively expensive power sector CCUS.

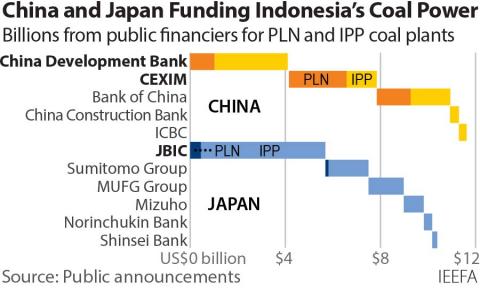

In Southeast Asia, discussions on CCUS have also been gaining traction. With sizeable coal plant fleets, many of which are relatively new and locked in rigid long-term contracts, the region is touted as a good place to explore CCUS. There is also the promise of capitalizing depleted oil and gas field in the region as CO2 storage.

Three ‘small’ details are often missed.

First, three-quarters of the planned CCUS project in the region is for gas processing, not from where the bulk of emissions comes from – the power sector. Gas processing CCUS has been around since the 1970s. The region is catching up to this past trend, given its sizeable gas resources with high embedded CO2 content.

Separating embedded CO2 from the gas is already a commercial necessity as consumers has little use of CO2 which lower the energy content. In many projects, the separated CO2 is vented to the air, while CCUS allow these emissions to be reduced. This process is nevertheless still rife with challenges, as exemplified in the Gorgon Australia project, which repeatedly failed to meet its targeted capture commitments despite having all the big names in the game: Exxon, Chevron and Shell.

The problem with the current plan relates to public perception, as in most cases, gas processing is not what the public think of when they hear ‘carbon capture’.

Secondly, aside from Singapore, the region has a practically non-existent carbon price. Proponents seem to conveniently overlook the fact that CCUS essentially represents a ‘tax’ to continue CO2 emissions. In a cost-sensitive region where carbon pricing is largely non-existent, how would this contradiction be reconciled? The elephant is still in the room, and it is not going anywhere anytime soon.

The euphoria in promoting cluster-based CCUS, which combines multiple CO2 sources to reduce investment risks, often glosses over the fact that current cluster plans in the UK and Norway comes with hundreds of millions of dollars of public funding support. This is despite both countries already having some the highest carbon prices in the world.

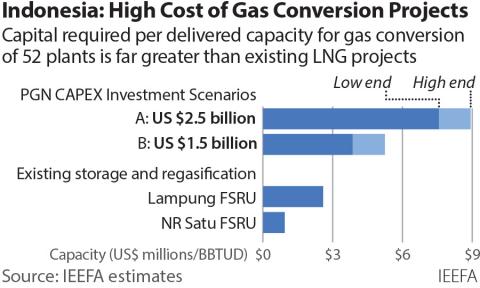

Thirdly, capture cost tends to dominate project budget. The promise is to build gas processing CCUS facilities which can later be tied-in to the power plants as the technology develops. Yet there is little mention that the capture cost is the key barrier, where more than 60 to 70% of the total cost typically lies. Thus, while shuffling the cards in the transport and storage stage may help, its impact will likely remain limited before the capture cost decreases substantially.

CCUS in the power sector has had a patchy history, with only one CCUS power plant operating globally. Capturing CO2 in a coal or gas power plant currently comes at a hefty price tag north of US$60 per tonne of CO2, not to mention the transport and storage cost, and investments to accommodate the lower emissions standards.

Retrofitting a CCUS facility into a 240-megawatt (MW) coal power plant can cost up to US$1bn and experimenting with CCUS is more likely to be affordable for developed economies.

While the current CCUS plan in the region is to produce more gas, the entourage of outside supporters are growing: power plant owners, investors in coal gasification, and public officials seeking to pass the carbon baton to the next elected government.

The CCUS train risks becoming a convenient ride for many to buy time, while knowing full well the slim chance of seeing a viable CCUS in their projects in the near decades.

There is no easy way to chart decarbonization pathways, but the greatest ‘cost’ of CCUS to the emerging economies will likely be the stalled decisions. Promising power generation CCUS in emerging economies with a non-existent carbon price is outlandish at best, and distracts policymakers and businesses from asking the hard questions and enabling long-term solutions.