Adaro’s coal spin-off highlights gaps in bank coal exit policies

Key Findings

After the spin-off of its thermal coal assets, Adaro Energy Group, the world’s sixth-largest coal mining company, will have access to financing from two banks that previously withdrew funding for its aluminum smelter project in February 2023.

Adaro, renamed Alamtri, is now a 15% shareholder of Andalan, the thermal coal business, and will not have to record revenue from thermal coal.

According to Standard Chartered and DBS Bank’s current coal exit policies, Alamtri would have access to financing for its aluminum smelter project, which includes a coal power plant.

Adaro Strategic Capital owns over 40% of both Alamtri and Andalan. The question arises whether banks’ coal exit policies should be modified to examine coal revenue at the group level rather than the operating level to incentivize the scaling down of coal operations.

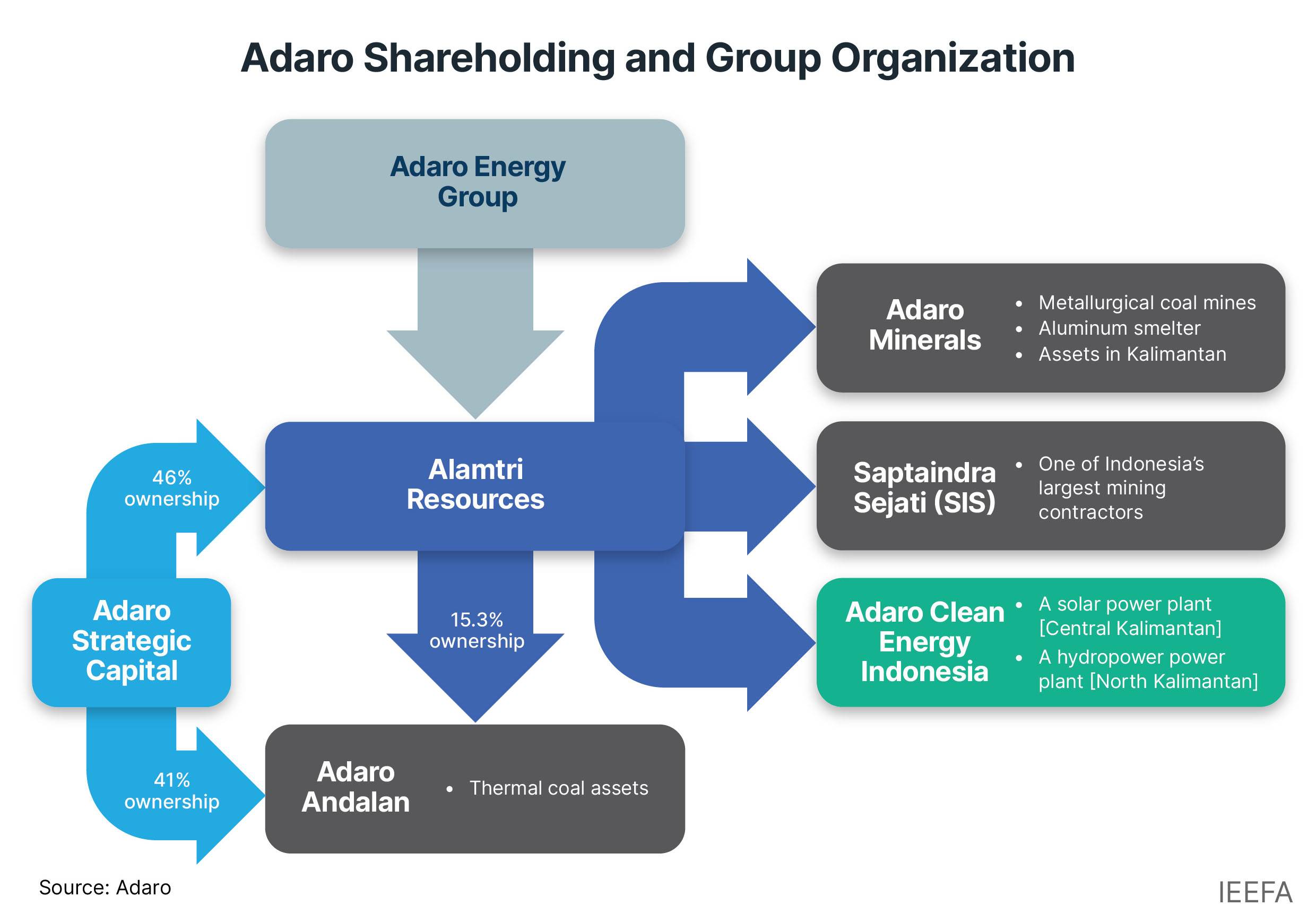

On 5 December 2024, the Adaro Energy Group, the world’s sixth-largest coal mining company, completed the spin-off of its thermal coal assets into PT Adaro Andalan (Andalan). The Adaro Energy Group (ADRO) was renamed PT Alamtri Resources (Alamtri). After the spin-off, Alamtri holds 15% or 1.2 billion (bn) shares of Andalan, with Adaro Strategic Capital holding 41% or 3.2bn shares.

According to current accounting standards and bank thresholds for thermal coal-related financing, two major financial institutions could fund Alamtri. DBS Bank and Standard Chartered had previously withdrawn from financing Adaro’s aluminum smelting project in February 2023 for environmental reasons under their respective ESG policies. The Institute for Energy Economics and Financial Analysis (IEEFA) notes that under the current minority ownership of 15% of Andalan, Alamtri may now be able to access financing from these banks despite their environmental pledges.

Alamtri has three major subsidiaries: Adaro Minerals, Saptaindra Sejati (SIS), and Adaro Clean Energy Indonesia. Adaro Minerals owns metallurgical coal mines in Kalimantan and is also building an aluminum smelter there. SIS operates one of Indonesia’s largest mining contractors. Adaro Clean Energy Indonesia’s projects include an 8-megawatt (MW) solar power plant in Central Kalimantan, an under-construction 1.4-gigawatt (GW) hydropower plant in North Kalimantan, and a 70MW wind project in South Kalimantan.

Reporting requirements and bank coal exit policies

Following International Accounting Standards (IAS) 28, which corresponds to Indonesian Financial Accounting Standards (PSAK) 15, a reporting entity must apply the equity accounting method if it holds 20% shares or more of the investee’s voting power. Under this accounting standard, the reporting entity recognizes its share of the investee’s revenue when it meets this ownership threshold. Since Alamtri owns only 15% of Andalan, revenue from thermal coal would not be consolidated into Alamtri’s revenue. This would be similar to what Adaro did in 2023, before the spin-off, when reporting the results of its 19% share of coal transportation investee PT Bhakti Energi Persada (BEP). Adaro excluded BEP revenue from its total revenue and reported the share under operating profit as earnings from joint ventures.

The DBS Bank coal exit policy states, “From January 2026, we will stop financing existing customers who derive more than 50% of revenue from thermal coal, except for their non-thermal coal or renewable energy activities.” Before the spin-off, Adaro derived more than 50% of its revenue from thermal coal. Phase 1 of its aluminum smelter project would use thermal coal power, while Phase 2 would utilize coal and renewables. In February 2023, DBS Bank withdrew from financing Phase 1 of the project. However, after the spin-off, Alamtri will no longer report thermal coal revenue and could potentially access financing from the bank.

The Standard Chartered coal exit policy states that by 2025, the bank will phase out existing financial services to clients who are more than 60% dependent on thermal coal based on revenue percentage. By 2027, the policy will include clients who are more than 40% dependent, and by 2030, the bank will not provide services to those more than 5% dependent on thermal coal activities. With only a 15% shareholding in the Andalan coal mine, Alamtri would not need to record any coal revenue and could meet the 5% requirement by 2030.

Therefore, Alamtri could comply with DBS Bank and Standard Chartered’s current coal exit policies and have access to financing for its aluminum smelter project. A previous commentary by IEEFA on the Andalan spin-off highlighted that as of June 2024, Adaro Andalan Indonesia (AAI) held 53% of total assets, 89% of total revenue, and 105% of net income. Consequently, before the spin-off, Adaro could not access financing for the aluminum smelter from the banks.

Rethinking bank financing criteria

Considering that Alamtri and Andalan have the same major shareholder, Adaro Strategic Capital (ASC), it is recommended that banks examine the revenue percentage at the group level instead of the operating level. ASC owns 46% of Alamtri and 41% of Andalan. Accordingly, those holdings should be consolidated in ASC’s balance sheet. When implementing coal exit policies, banks must decide whether to assess companies at the operating or group level. At the group level, Alamtri would not meet Standard Chartered’s 2030 requirement of 5% thermal coal revenue.

The advantage of implementing policies at the operating level is that Adaro Clean Energy Indonesia, the renewable energy segment of the larger group, could access capital and build out non-coal assets to scale. For banks to avoid financing high-carbon emitting operations, funding for Adaro Clean Energy Indonesia could be conditional on phasing out and scaling down Alamtri’s thermal coal assets. Currently, it appears that after the thermal coal business spin-off, Alamtri could still access financing for its aluminum smelter, which includes a coal power plant.