Gas is exiting the global energy mix, providing lessons for emerging markets

Key Findings

Another global gas price spike has left customers scrambling to supply domestic electricity.

Pervasive commercial trends point to continued volatility in global gas prices with periods of very high pricing.

Investment in gas importing, distribution and power production will lead to stranded assets and lost wealth.

An IEEFA paper published earlier this year has proved to be eerily correct with forecasts of doubling or even tripling of the U.S. Henry Hub price and higher and extremely volatile global gas prices.

Gas-fired electricity has become unaffordable in emerging markets

In January 2021, IEEFA warned that over US$50 billion in gas power projects and LNG import facilities were at risk of cancellation in Bangladesh, Pakistan and Vietnam, as gas-fired electricity became unaffordable in emerging markets.

The paper cautioned that particularly price sensitive emerging markets would find the forthcoming gas price environment challenging, as had already been seen in Bangladesh and Pakistan during 2020.

It warned that higher and volatile LNG prices will make operating LNG-powered generation plants more costly and unpredictable, which may lead to the underutilisation of LNG plants and rising gas and electricity tariffs for customers.

IEEFA’s paper also forecast higher and more volatile gas prices over 2021, suggesting that while contract gas prices had been low and relatively stable in recent past years,

The higher more volatile gas price rises are global

“This is unlikely to last. With lower levels of drilling, financial instability in the oil and gas industry, and low levels of industry investment, it is likely that a new era of higher prices and more volatility is upon us.”

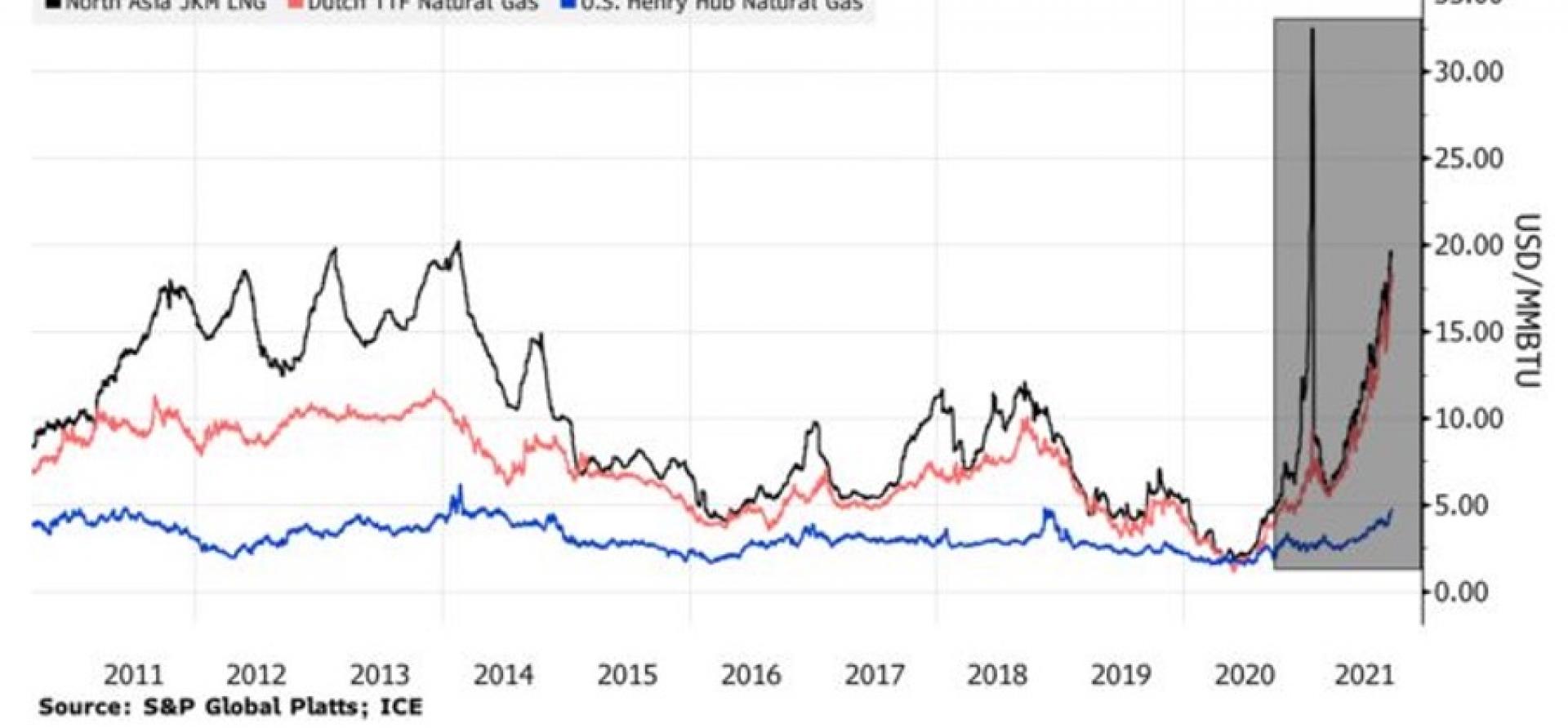

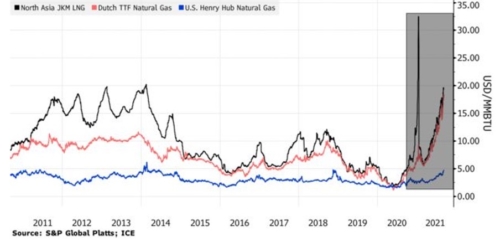

Last night, the U.S. domestic gas price indicator – from which its increasing exports are priced – traded above US$5 per one million British Thermal Units (mmbtu), up 112% for 2021 year-to-date.

The higher, more volatile gas price rises we are seeing are global.

The Asian spot price – the JKM – is up 106% over 2021 to US$21.63/mmbtu and the European gas price is up 270% to US$19.74.

Natural Gas Prices in Asia, Europe and the U.S.

Source: Bloomberg

As with the previous global gas price spike, this one has left customers scrambling to supply domestic electricity.

Both Bangladesh’s state-run Petrobangla and Pakistan have suspended purchases of LNG after tenders came back with unaffordable prices.

If the fuel is unaffordable, why have plans to increase its use?

The inability of a number of countries being able to supply electricity due to exceptionally high prices brings into question further expansion or new development of gas import infrastructure in Bangladesh, Pakistan, Vietnam and India.

If the fuel is unaffordable, why have plans to increase its use?

While spot prices for LNG are currently high, the medium term price outlook is far more clouded. Large rises in supply out of Qatar due to increased production will have a depressing effect on the price, however this is counteracted by four pervasive trends.

- Capital is being withdrawn from the industry

Both superannuation funds and banks are more wary of investing in or lending to the oil and gas industry, as gas has lost its place in the world’s future energy mix. Just last week, Harvard University announced that it was no longer investing in fossil fuels, joining a list of nearly 200 globally significant banks and insurers, asset managers and owners that have announced their divestment from fossil fuels including coal, oil, LNG, gas, oil sands and arctic drilling.

- Customers are fearful of the medium-term financial risks of gas

Customers clearly see that renewable energy costs continue to fall making gas an uncompetitive fuel. As a result, they are not committing to long term gas contracts with contract terms commonly 10 years now compared to 20-year-plus contract terms just 7 years ago. Shorter more flexible contracts make obtaining finance for capital intensive 30-year LNG projects problematic.

- The LNG industry is facing climate headwinds

It is now generally accepted that gas is not a ‘transition’ fuel to cleaner energy systems, but rather just another carbon intensive high emitting fossil fuel, similar to coal. Carbon pricing and carbon tariffs – increasingly common features of the global economy – are stifling gas’ ability to compete in global energy production.

- Exploration and production costs are increasing

The best years of the gas industry are behind it

The best years of the gas industry are behind it with older lower-cost fields now running out. For instance, Australia is facing the terminal decline of its Bass Strait fields with some newer wells coming up dry.

Costs are increasing in the offshore gas sector as new wells are in deeper water, further from the shore, and generally have higher levels of carbon dioxide which is expensive to remove and vent to the atmosphere. And in the U.S., despite record gas prices both domestically and internationally, production from the Bakken Shale field has not recovered to pre-COVID highs and field costs are rising, as the best oil and gas wells have been drilled.

The net effect of these trends is that we are in for continued volatility in global gas prices with periods of very high pricing.

The lesson for emerging markets is that investment in gas importing, distribution and power production assets will lead to stranded assets and lost wealth.

Gas is slowly exiting the global energy system, strangled by the lack of finance and plagued by volatile prices.

Bruce Robertson is an LNG/gas analyst with IEEFA.

This article first appeared in Bloomberg.

Related articles:

- IEEFA: Gas Demand Is Dying Under the Weight of Nose Bleed Prices

- IEEFA: Australia’s Gas-fired Recovery Under Scrutiny

- IEEFA Europe: Overcapacity and investment fever push costs to Spanish consumers, yet Enagás profits

- IEEFA: Over US$50 billion in gas power projects and LNG import facilities at risk of cancellation in Bangladesh, Pakistan and Vietnam

- IEEFA: Santos’ Barossa gas field emissions create major risks for shareholders

- IEEFA: Despite strong Q2, ExxonMobil upstream continues to underwhelm