IEEFA update: Fracking companies’ 2019 performance signals ongoing crisis

March 19, 2020 (IEEFA U.S.) ‒ The U.S. fracking industry in 2019 continued its unsuccessful decade-long quest to produce positive free cash flow, according to a briefing note released today by the Institute for Energy Economics and Financial Analysis (IEEFA).

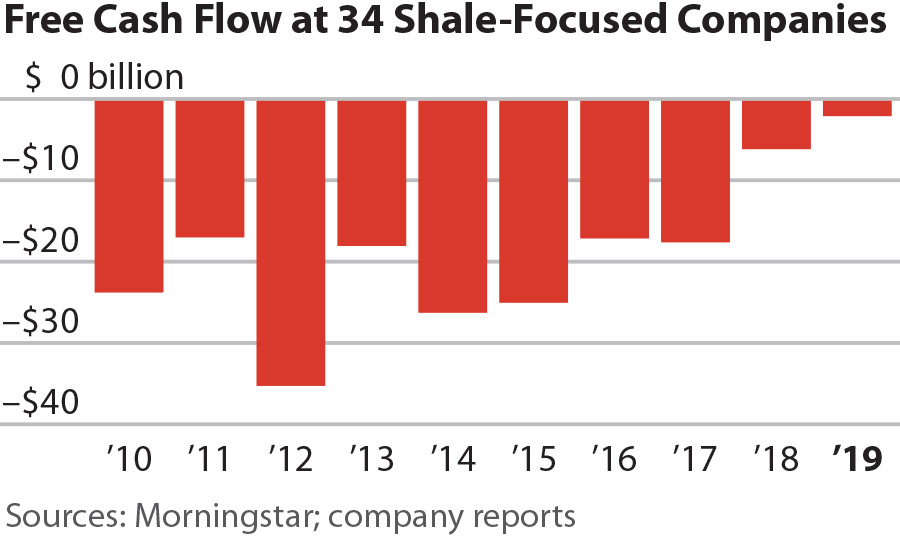

Looking at a cross-section of 34 North American shale-focused oil and gas producers, IEEFA analysts found that the companies spent $189 billion more on drilling and other capital expenses over the past decade than they generated from selling oil and gas.

These results included a disappointing $2.1 billion in negative free cash flows in 2019.

“We have been saying for a long time that Exploration & Production (E&P) companies have created an oil and gas glut that has not been rewarded by anticipated earnings,” said IEEFA financial analyst and briefing note co-author Kathy Hipple. “In what world could this be considered a successful business model?”

The sector’s dismal financial performance in 2019 came despite rapid growth in North American production of both oil and gas. The shale revolution has, in fact, propelled the U.S. into becoming the world’s most prolific oil producer.

“In financial terms, fracking has been an unrelenting money loser for at least a decade, and investors are taking notice,” said IEEFA analyst and co-author Clark Williams-Derry. “It is getting harder and harder for these companies to raise the capital they need to stay afloat.”

The oil and gas industry’s financial underperformance began long before the advent of the coronavirus crisis or the recent Saudi-Russia oil price war. The sector has been facing mounting financial pressures and a deteriorating outlook for most of the last decade. Cash flow losses were just one of many signs of distress among IEEFA’s sample:

- High and rising debt. Total long-term debt rose to $106 billion at the end of 2019, an increase of $1.5 billion from the prior year, and the highest level since 2015. If these companies are unable to produce significant cash flows over the next several years, they may be unable to pay off their debts as they mature—which could trigger debt write-downs or bankruptcies.

- Disappointing revenue. Despite higher production levels, total 2019 revenues among this cross-section of companies fell by $5.6 billion year-over-year.

- Significant net losses. Collectively, these companies reported net losses of $6.7 billion in 2019, largely due to accounting impairments and write-downs of oil and gas assets.

- Declining cash balances. The 34 companies spent down their cash reserves by $14.4 billion from 2016 through the end of 2019. At the end of 2019, cash reserves among these companies were at their lowest level since 2012.

Looking at quarterly results, IEEFA’s cross-section of fracking-focused enterprises achieved modest positive free cash flows in the second and fourth quarters of 2019. But those gains were outweighed by the losses in the first and third quarters.

Only six companies in IEEFA’s sample reported cumulative positive free cash flows from 2017 through 2019. Even in 2019, when negative free cash flows narrowed to their lowest levels of the decade, only 12 of the 34 companies managed to report positive free cash flows.

Moving forward, the oil and gas sector’s financial distress will likely accelerate.

“Even after a decade of technical improvements and increasing investor scrutiny, most shale-focused companies still burn through more cash than they produce,” said IEEFA’s director of finance Tom Sanzillo. “The truth is undeniable: fracking is a failed experiment.”

Kathy Hipple is an IEEFA financial analyst.

Tom Sanzillo is IEEFA’s director of finance.

Clark Williams-Derry is an IEEFA energy finance analyst.

Briefing Note: Shale Producers Spilled $2.1 Billion in Red Ink Last Year

Media Contact

Vivienne Heston, [email protected] tel: +1 (914) 439-8921

About IEEFA

The Institute for Energy Economics and Financial Analysis (IEEFA) conducts global research and analyses on financial and economic issues related to energy and the environment. The institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.