IEEFA U.S.: Energy transition to renewables likely to accelerate over next two to three years

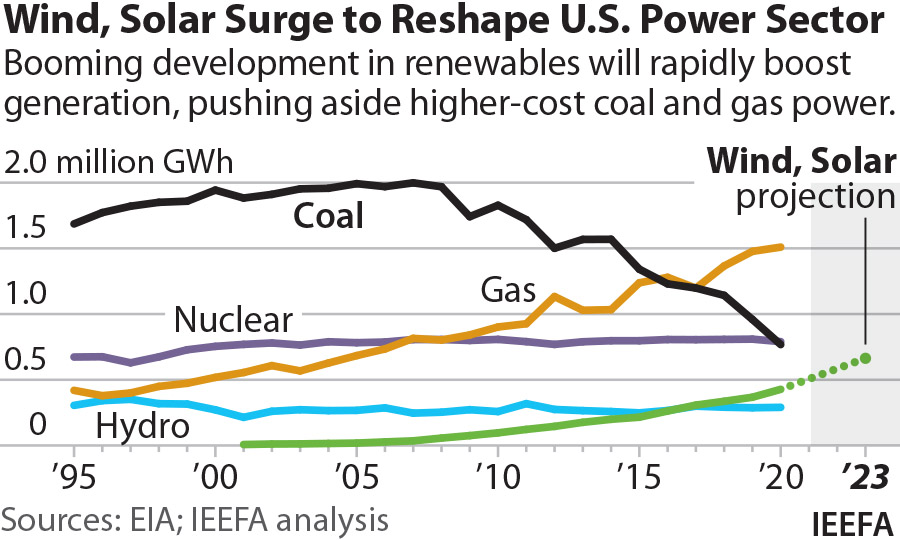

March 31, 2021 (IEEFA) — The speed and scope of the energy transition to renewables will pick up pace over the next two to three years, according to the Institute for Energy Economics and Financial Analysis’ U.S. Power Sector Outlook 2021.

Solar and battery storage adoption is enjoying almost exponential growth, and wind and solar technology improvements have helped turn the two resources into the least-cost option across the United States.

“Coal will be pushed out of the electricity sector completely, with gas set to decline as well,” said Dennis Wamsted, an IEEFA analyst and Outlook co-author. “Cleaner and lower-cost wind and solar, coupled with battery storage, will drive fossil fuels out of the market.”

Even a short-term increase in coal generation caused by higher gas prices is likely to be just that—a short-term increase. IEEFA’s analysis expects that coal’s share of the U.S. generation sector still could fall to 10 percent by 2025.

The increase in renewables is happening largely at the expense of coal. Wind capacity has doubled since 2012, and solar capacity has doubled since 2016. Utility-scale wind and solar accounted for more than 10 percent of total U.S. electricity generation in 2020 for the first time.

“This is just the start of a transition that is rapidly accelerating, driven by sharp declines in cost, stricter environmental regulations for coal generation and mounting public concern about climate change,” said David Schlissel, IEEFA director of resource planning analysis and outlook co-author.

The 2021 Power Outlook observed that changes in Texas may be most indicative of changes happening in the electric sector. At the end of 2011, the state’s installed wind capacity was 9,603 megawatts (MW), making up 8.5 percent of the region’s electricity demand. By the end of 2020, installed wind capacity had climbed to 25,121MW, reaching a 22.8 percent market share. Coal generation, which had accounted for 39 percent of electricity needs in 2011, fell to 17.9 percent in 2020.

“The Texas transition will not be replicated precisely in other areas of the country, but the broad themes are certainly going to hold true, particularly the surge in new wind and solar generation through 2024,” said Seth Feaster, an IEEFA energy data analyst and Outlook co-author.

Full report: U.S. Power Sector Outlook 2021: Rapid Transition Continues to Reshape Country’s Electricity Generation

Author contacts

Dennis Wamsted ([email protected]) is an IEEFA energy analyst.

Seth Feaster ([email protected]) is an IEEFA data analyst.

David Schlissel ([email protected]) is IEEFA’s director of resource planning analysis.

Media contact

Vivienne Heston ([email protected]) +1 (914) 439-8921.

About IEEFA

The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.