IEEFA New Mexico: Why Acme’s carbon capture plan for San Juan plant won’t work

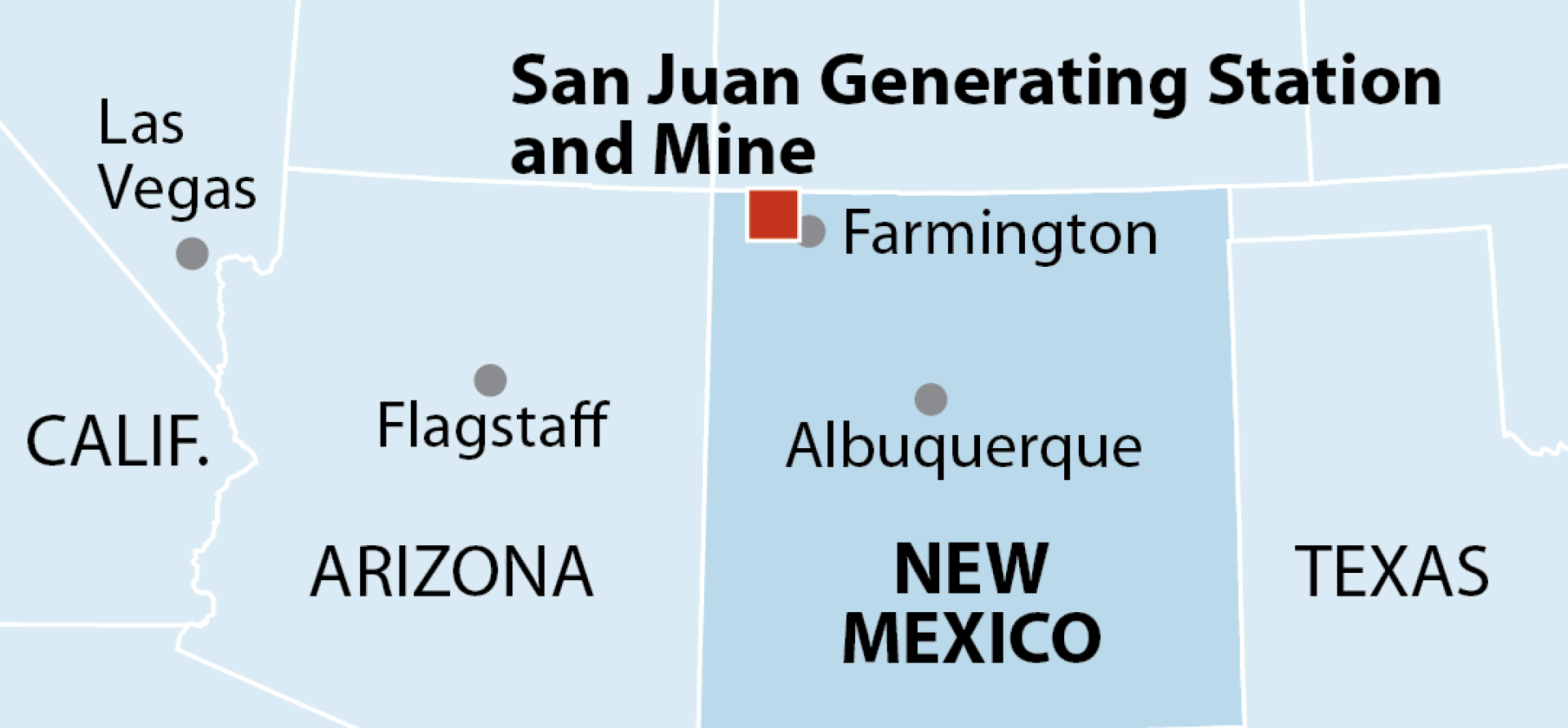

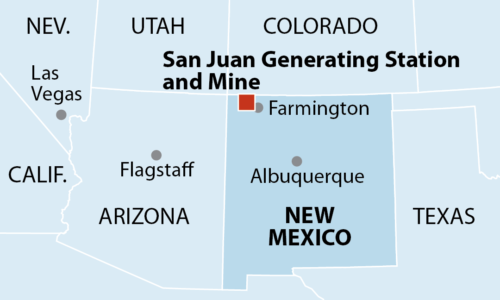

A scheme to keep New Mexico’s two-unit, 847-megawatt (MW) San Juan Generating Station operating past its scheduled 2022 retirement hinges on a poorly detailed 10-page plan from a small and little-known New York investment firm. Acme Equities proposes to retrofit the plant with carbon capture equipment and sell the carbon dioxide for use in enhanced oil recovery activities in the distant Permian Basin.

A scheme to keep New Mexico’s two-unit, 847-megawatt (MW) San Juan Generating Station operating past its scheduled 2022 retirement hinges on a poorly detailed 10-page plan from a small and little-known New York investment firm. Acme Equities proposes to retrofit the plant with carbon capture equipment and sell the carbon dioxide for use in enhanced oil recovery activities in the distant Permian Basin.

The proposal plays well with some members of a community seeking to avoid the economic fallout from closure, but a closer look suggests it is a sketchy proposition at best.

Acme Equities uses the $1 billion Petra Nova CO2 capture complex built by NRG and its Japanese partner at NRG’s W.A. Parish coal plant southwest of Houston as the skeletal basis for its San Juan plan, but offers no substantive detail on how it would achieve what it is proposing.

Worse, it ignores the huge differences between the facility in Texas and the one it is pushing for in New Mexico:

- The Parish unit was 35 years old when the CO2 retrofit was completed; the two units at San Juan would be 49 and 43 years-old in 2025, when Acme says its planned CO2 capture equipment would start operating. Such a project would require significant capital investment to both units to ensure that they could operate for 20-30 years, the time it would take to recover the cost of the CO2 control equipment.

- The Petra Nova facility is one-third the size of what is being proposed for the San Juan plant (the Texas project captures the CO2 from what amounts to a 240MW power plant). Capture equipment at the scale envisioned by Acme would require first-of-its-kind equipment, with all the problems traditionally associated with such builds.

- On the Texas project, NRG owns a portion of the oil field where the captured CO2 is being injected to boost output, meaning it could invest in the CO2 capture process knowing it should be able to recover those costs through its augmented oil production. Acme has no such leverage.

While the Parish plant, which includes four units totaling 3,700 MW of capacity, has managed to remain competitive in the cutthroat Texas electricity market, the same cannot be said for the San Juan plant. Public Service Company of New Mexico, the principal owner and operator of San Juan, has said the plant is no longer viable and should be shut down in 2022. Given that the plant is considered no longer competitive by the company that has run it since the 1960s, it will struggle mightily to operate going forward, especially as the costs of renewable energy and storage continue to fall.

Acme’s proposal comes just as New Mexico legislators are considering passage of the Energy Transition Act, which would require public utilities to get 50% of their electricity from renewable sources by 2030. The law would also establish a ratepayer-funded securitization process to help PNM close the plant. Momentum may favor enactment. New Mexico’s new governor, a Democrat, campaigned on the core promise embodied in the proposed law, and both houses of state government are controlled by Democrats. Passage could well make the Acme pitch moot (a Senate committee yesterday rejected an amendment in support of the Acme plan).

The Acme plan—which in truth is a brief slide show—was published by the Energy and Policy Institute, which seeks to counter fossil fuel and utility resistance to the uptake of renewable energy.

WHILE THE ACME PLAN TURNS ON THE PETRA NOVA EXAMPLE, A MORE APPROPRIATE COMPARISON would be with the Boundary Dam 3 project built by SaskPower in Saskatchewan. That project involved both an almost complete rebuild of the plant’s combustion unit because of its age and the installation of the CO2 capture equipment. All told, it cost C$1.5 billion to retrofit the 150MW unit, or roughly C$10,000 per kilowatt, hardly an economic endorsement for carbon capture (see our November report, “Holy Grail of Carbon Capture Continues to Elude Coal Industry”).

In operation for a little more than four years, the plant has captured an average of slightly more than 600,000 tons of CO2 per year—well under its promised 90% goal of 1 million metric tons/year.

A sketchy proposition at best.

SaskPower has weighed the possibility of trying another carbon-capture project, a possibility that has been touted as potentially viable in a report by the International CCS Knowledge Centre, an industry-friendly group sponsored by BHP and SaskPower. Beyond its optimistic cost projections, which should be taken more as hoped-for results than likely contract costs, the study raises a few points that bear directly on Acme’s proposal for San Juan.

First, the authors of the study note that the CO2 compressor for the second plant would be larger than anything currently commercially available. San Juan would require three such compressors—at unknown cost and performance. Similarly, the report warns that the regenerator unit at the second plant likely would be too large to be built as a single-pressure vessel. How many such vessels would be needed at San Juan is uncertain.

The report also notes that prevailing low oil prices have reduced the demand for CO2 for enhanced oil-recovery activities. There is plenty of oil available without anyone having to pay all the many costs associated with carbon capture initiatives.

Finally, the International CCS Knowledge Center report acknowledges an increasingly accepted truth: That the economics of carbon capture do not pan out. Specifically, the report states, “The economics of retrofitting coal with CCS are further challenged by a supply of natural gas which is available at all-time low prices that have persisted long enough that the price level is perceived to have found a new norm in North America.”

Acme’s proposal should be seen for what it appears to be: An effort by an outfit with no evident electricity-generation experience to cash in before the deal blows up.

Dennis Wamsted is an IEEFA editor.

RELATED ITEMS: