IEEFA report: Business case for acquiring failing plant and Kayenta mine poses ‘serious financial risk’ to Navajo Nation

February 22, 2019 (IEEFA Arizona) — The Institute for Energy Economics and Financial Analysis (IEEFA) published a report today concluding that a tribal company’s plan to acquire the failing Navajo Generating Station (NGS) and its companion mine would most likely create a money-losing enterprise.

The report—“NTEC’s Plant/Mine Acquisition Plan Puts Navajo Nation at Serious Financial Risk”—concludes that the Navajo Transitional Energy Company (NTEC) is probably overstating the odds of success in its proposal and that it has not made a viable case for backing the plan.

“Barring a more detailed and persuasive business case, IEEFA sees the NTEC proposal as a project that stands little chance of operating NGS and the Kayenta mine profitably or reliably,” said David Schlissel, IEEFA’s director of resource planning analysis and lead author of the report.

“The current owners of NGS, who have decades of experience in operating large coal-fired generators and profitably selling large amounts of electricity into the power markets, have concluded that it will be unprofitable to run NGS after 2019,” Schlissel said. “There is no reason to believe that NTEC can succeed where the current owners have concluded that they cannot.”

The report recommends that before any deal proceeds, NTEC produce “a comprehensive business plan that meets professional standards and that openly addresses the unlimited and uncertain levels of liabilities that would come with acquisition.”

The report recommends that before any deal proceeds, NTEC produce “a comprehensive business plan that meets professional standards and that openly addresses the unlimited and uncertain levels of liabilities that would come with acquisition.”

Navajo Generating Station is slated for retirement in December after its utility-company owners concluded two years ago that the aging plant could no longer compete with gas-fired and renewable forms of generation.

NTEC, at the direction of some tribal leaders, has proposed acquiring NGS and its companion Kayenta Mine, which is owned by Peabody Energy.

The IEEFA report views as problematic several gaps or omissions in the NTEC proposal, including:

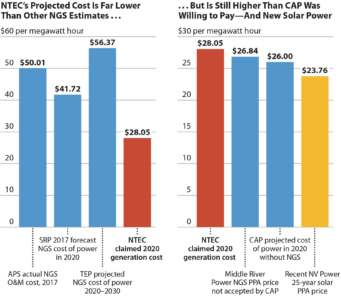

- An absence of evidence of any potential buyers willing to enter into contracts for power from NGS at financially viable prices;

- Unsupported assertions that similar mine-plant business models have worked (at one other power plant, in Texas) while omitting to acknowledge that the same formula has generally failed due to low natural gas prices and increasing competition from renewables, the same market forces that have made NGS unviable;

- No description of the exact steps NTEC would take to achieve its stated goals of reducing plant and mine costs while continuing to operate reliably without causing serious hardship for plant workers and miners;

- No estimate of how much NTEC will have to pay to bring NGS up to date on maintenance that has been deferred since early 2017;

- No case for how anything other than razor-thin profits—under an unlikely best-case scenario— would work and no acknowledgement of market forces that would create ongoing risks for the plant and mine if they were kept open;

- No recognition of the long-term liabilities associated with the proposed acquisitions that would require costly cleanup in and around the plant and mine sites.

Under NTEC’s proposed business model—accepting all of NTEC’s assertions about its ability to reduce plant and mine operating costs—”NGS and the Kayenta Mine, if kept open will produce, at best, minor profits,” the report states. “What is more likely is that the actual costs of operating NGS and the Kayenta Mine after 2019 will be much higher than NTEC acknowledges.”

Full report here: NTEC’s Plant/Mine Acquisition Plan Puts Navajo Nation at Serious Financial Risk

NTEC Fact Sheet: Plan to Acquire Navajo Generating Station/Kayenta Mine Will Most Likely Lose Money

Media Contacts:

Karl Cates [email protected] (New Mexico) 505-780-8344

Vivienne Heston [email protected] (New York) 914-439-8921

About IEEFA:

The Institute for Energy Economics and Financial Analysis (IEEFA) conducts global research and analyses on financial and economic issues related to energy and the environment. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.