IEEFA India: Volatile LNG prices present opportunity to switch to cleaner fuel sources

19 January, 2022 (IEEFA India): High and volatile liquefied natural gas (LNG) prices are an opportunity for India’s gas-dependent industries and the city gas distribution network to switch to cleaner, non-fossil fuel alternatives like biogas and biomethane, says a new report from the Institute for Energy Economics and Financial Analysis (IEEFA).

LNG price volatility dampens demand, as does high prices

This will also avoid locking the country into an expansion of expensive LNG import infrastructure and the associated risks of under-utilisation and stranded assets.

“In the past few years, LNG prices have fluctuated from record lows to record highs. This price volatility dampens demand, as do high prices,” said report author Purva Jain, an energy analyst and guest contributor at IEEFA.

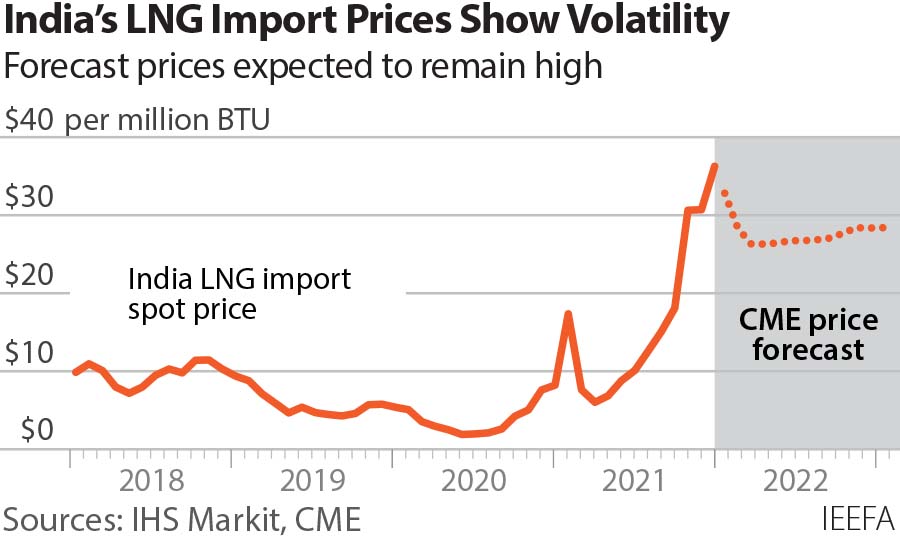

The report notes that with the onset of the COVID-19 crisis, demand fell and LNG prices tumbled. In April 2020, the Japan Korea Marker (JKM), considered a benchmark for spot Asian LNG prices, reached its lowest point, at US$2/MMBtu (million metric British thermal unit). But once the economic recovery started, gas supply couldn’t keep pace and prices started rising, and the JKM peaked at US$35/MMBtu on October 5, 2021.

“Such price volatility can have major implications for demand, capital and infrastructure, especially in price-sensitive emerging economies such as India – raising the operating costs of downstream projects in the industrial, power and city gas distribution (CGD) sectors, harming product competitiveness, utilisation rates and returns on investment,” said Jain.

“India is planning a massive expansion of LNG import infrastructure to spur gas demand. However, volatile and skyrocketing LNG prices and increased attention on the global warming potential of methane will more than likely lead to a major risk of under-utilisation of this infrastructure with billions of dollars’ worth of investment becoming stranded.”

At more than US$10/MMBtu, LNG becomes unaffordable in India

Declining domestic production and the Government of India’s ambition to increase the share of natural gas in the final primary energy mix from 6% to 15% are expected to increase dependence on LNG imports.

“A tenfold increase in LNG prices in the past year makes this government target even less likely than it was when first set,” said Jain.

At more than US$10/MMBtu, LNG becomes unaffordable in India, according to the report. In fact, recent peak LNG prices forced industrial consumers to turn to highly polluting petroleum fuels such as naphtha and furnace oil – a move that sets back India’s Nationally Determined Contribution (NDC) commitments under the Paris Agreement, said Jain.

Instead, the policy focus should be on developing non-fossil fuel alternatives to LNG, such as biogas for transport and biomethane for industrial use, that would not only be more affordable but also help India transition to a low-carbon economy.

In addition, the report urges the government to increase efforts to promote electricity for cooking and mobility in urban areas where the electricity load is relatively stable.

“In a nutshell,” Jain says, “there is an urgency to invest in alternatives to natural gas to insulate India from energy security and balance of payments risks and from the fuel’s inflationary pressure – and, most importantly, to meet low-carbon goals.”

Full report: Impact of LNG Price Volatility

Author Contact: Purva Jain ([email protected])

Media Contact: Kate Finlayson ([email protected]) +61 418 254 237

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. IEEFA’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.