IEEFA India: Continued decline in Indian thermal capacity additions

April 3, 2019 (IEEFA India): India’s fiscal year (FY) 2018/19 was marked by a record slowdown in thermal generation capacity additions in the electricity sector.

From the highs of 20 gigawatts (GW) of new coal-fired power plants commissioned every year between FY2012/13 to FY2015/16, net capacity additions from coal over the last three years have been 7 GW, 5 GW and 1.2 GW respectively.

The FY2018/19 net capacity additions for coal account for 3.3 GW of new capacity added during the financial year minus 2.1 GW of capacity retired up to 11 months (plant retirement data is not yet published for March 2019).

The continued decline in thermal capacity additions is the result of a fundamental change in electricity market dynamics driven by competition from cheaper renewable energy sources.

Lack of policy clarity and power evacuation infrastructure, the imposition of trade duties on imported solar modules, and the high number of tender cancellations materially tempered the momentum in renewable generation capacity as well.

Only 6.7 GW of renewable capacity was added until February 2019 compared to 12 GW added during the previous financial year.

IEEFA views the slowdown in renewable capacity additions as temporary – a “shock” from short-term headwinds rather than a trend.

Renewable energy tendering activity is still exhibiting the pace required to achieve the government’s ambitious target of 175 GW of renewable capacity by FY2021/22.

As per the Ministry of Renewable Energy’s recent statement, 75 GW of renewable capacity has been installed, 28 GW auctioned and 38 GW of capacity is under various stages of tendering and bidding. Further, more than 95% of awarded variable renewable capacity last year came in at sub-Rs3/kWh.

India’s timely transition to a low-cost, lower-emission, domestic focussed electricity sector is inevitable.

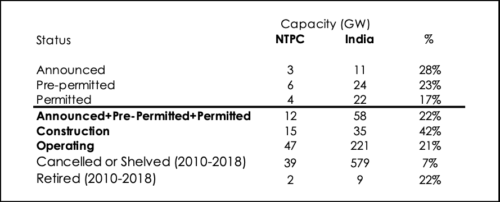

New Global Energy Monitor (GEM) data released January 2019 shows majority state-owned thermal power giant NTPC has proposed more than one fifth of the country’s pipelined capacity that currently lies in various pre-construction stages.

NTPC also owns 42% (15 GW) of India’s total coal-fired capacity currently under construction. (Figure 1)

Figure 1: NTPC Coal-fired Capacity

Looking at the disarray in India’s thermal power plant (TPP) sector, which carries a massive US$60bn of stranded assets, only a state-owned giant like NTPC has the balance sheet, political clout and operational prowess to risk building new thermal power capacity.

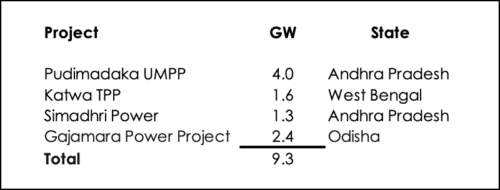

NTPC has also signalled intentions to abandon 9.3 GW of coal-fired projects during FY2018/19 alone. (Figure 2)

Figure 2: NTPC Project Cancellations FY2018/19

IEEFA calculates that NTPC commissioned new coal-fired capacity of 1,160 megawatts (MW) during the financial year — just one quarter of its target of 4,740 MW for FY2018/19.

Three new generation facilities were commissioned during the last two months of the financial year – Unit 3 of Nabinagar TPP (250 MW) in Bihar, Unit 3 of Bongaigaon TPP (250 MW) in Assam and Unit 2 of Solarpur STPP (660 MW) in Maharashtra, which was commissioned on the second last day of the year.

NTPC also acquired the Barauni Thermal Power Station (720 MW) from Bihar State Power Generation Company in December 2018. The power station has two operational units of 110 MW each and two units of 250 MW under construction.

Retiring the end-of-life 705 MW Badarpur power plant in New Delhi during October 2018 meant only 455 MW of net new capacity was added by NTPC during the year.

For India as a whole, the retirement of 2.1 GW of thermal power plants during the year (1.9 GW of coal and 0.2 GW of gas capacity) is a clear sign of things to come.

India’s National Electricity Plan 2018 (NEP) directs 49 GW of end-of-life coal-fired power plants to be retired over the period to FY2026/27, within which, NEP identifies power plants lacking enough space to implement flue-gas desulphurisation (FGD) for emission control to also be retired.

Recently, the Cabinet Committee on Economic Affairs (CCEA) approved four long-delayed power projects worth Rs31,000 crore (US$4.4bn). As per GEM data, there are 93 GW of coal-fired power plants in the pipeline, roughly the same new capacity that NEP prescribes to be commissioned by FY2026/27.

If end-of-life thermal plant closures are to be maintained, the government of India might look to fast-track some of these long-delayed projects. Doing this would keep up with a sustained 5% annual electricity production growth (accounted after reduced grid losses on 6% electricity demand growth) induced by 7% annual GDP growth, and now supported by the massive rural electrification effort.

An alternative, potentially lower-cost and cleaner strategy would be quadrupling annual variable renewable energy installs in line with the elevated tendering of the last year.

For this to be sustainable in terms of grid integration, it would require a long term time-of-day pricing signal to incentivise accelerated deployment of peaking capacity (using pumped hydro-storage, batteries, demand-response management and gas-peakers), and a sustained national grid capacity expansion.

Reflecting on capacity growth stalling, Plant Load Factors (PLF) during the 11-month period to February 2019 improved from 59.3% in FY2017/18 to 60.9% in FY2018/19, supporting electricity production growth of 5.5% for the same period.

Generation from renewable sources for the 11-month period was up 25%.

This shows that incremental electricity demand is increasingly being served through cheaper renewable energy sources.

The sluggish rate of thermal capacity additions validates two important phenomena for a sector fending for survival.

Firstly, future electricity markets will increasingly be technology-agnostic with the cheapest domestic source taking over the market share. Secondly, coal-fired power plants will have to adapt and add value by offering flexible demand response management and peak-demand power supply.

In IEEFA’s view, the cost competitiveness and bankability of a new coal-fired power plant has become more questionable than ever.

Whilst coal will remain a significant part of India’s electricity system for decades to come, its role in the system needs an overhaul.

The electricity sector will have to be supported by improved coal supply, short-term power purchase agreements, and ‘time-of-day’ pricing mechanisms in order to encourage flexible operation as renewables increasingly supply all the new incremental demand growth in the system.

Kashish Shah ([email protected]) is an energy analyst with IEEFA India.

Tim Buckley ([email protected]) is director of energy finance studies with IEEFA Australasia.

Related Links:

IEEFA India: New record with renewable energy installations 40 times higher than thermal

IEEFA India: Improving India’s electricity sector through time-of-day pricing

IEEFA India: Removing the roadblocks to accelerate renewable energy deployment