India: How companies can incorporate an ESG strategy

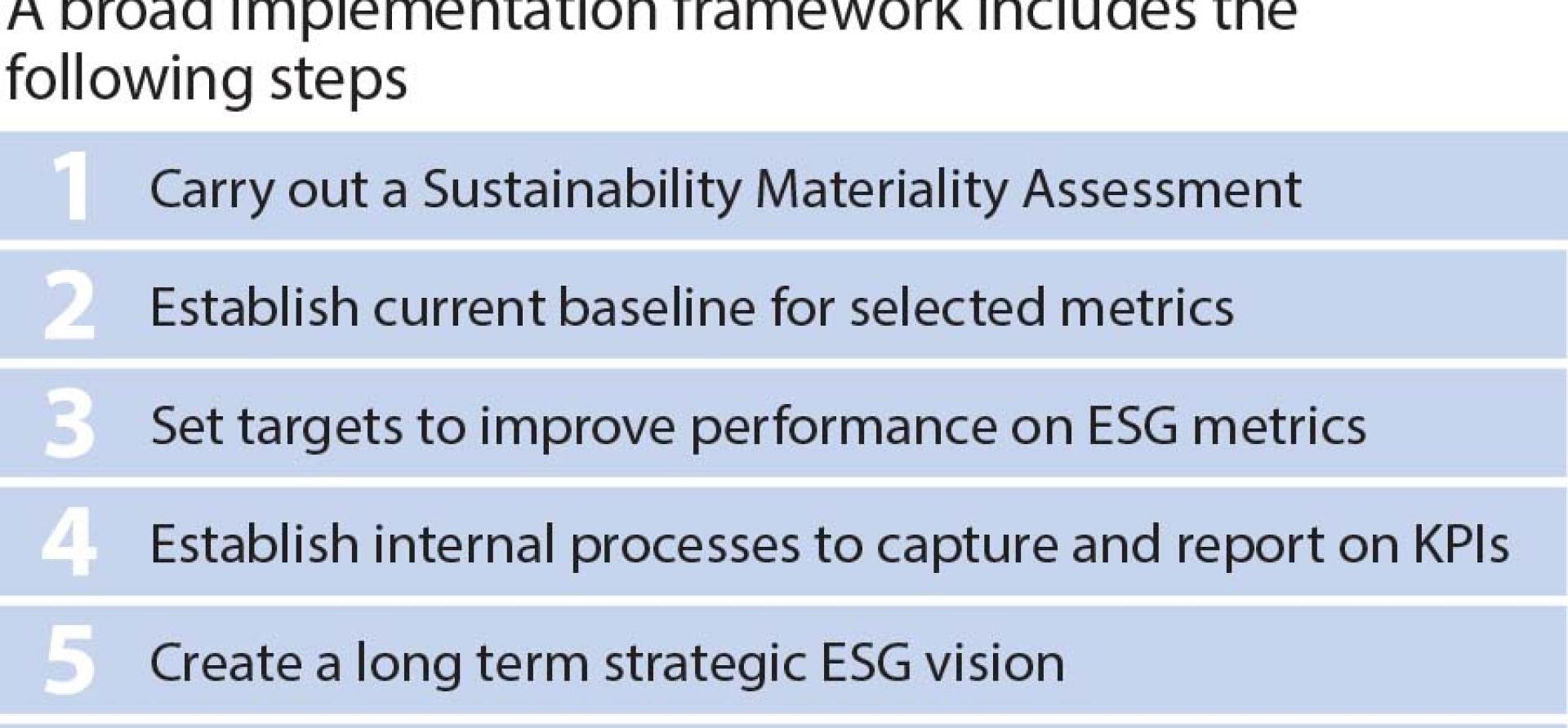

For companies to start on the path to sustainability, it is essential to build environmental, social and governance (ESG) considerations into business strategies. Further ESG considerations need to be included at all levels of decision-making, whether by higher management, company board and committee or on a day-to-day basis by the workforce.

A fundamental first step in ESG strategy development is a sustainability materiality assessment. This typically includes engaging with a company’s key stakeholders to identify and prioritise ESG topics that are most relevant to the business and where a company can make the most meaningful impact.

Each industry has unique ESG factors, some with higher materiality than others. For energy companies, environmental factors are foremost because of the growing existential threat of climate change. These will be a major driver of risk in an energy business’ long-term valuation so it is essential to identify the most pressing factors and create an appropriate ESG strategy.

For an IT company on the other hand, social aspects such as privacy and data security will be more material than environmental factors.

Within a sector, companies may have specific material topics, due to the way in which they have carried out their materiality assessments.

Individual firms must achieve a consensus on the ESG metrics selected

For such assessments, companies take input from stakeholders, align to multiple methodologies, employ consultants, use their own references and benchmarks and have internal management reviews that may prioritise certain topics over others, again varying from company to company.

In the absence of standard, universally accepted metrics for sectors, and given the unique business dynamics of companies, ESG metrics are bound to vary. Individual firms must achieve a consensus among stakeholders and management on the metrics selected, then carry out materiality assessments to capture the greatest number of topics affecting stakeholders.

Despite the exhilarating momentum behind ESG, corporate actions have often been found to fall short on commitment and output alike. This is invariably linked to an organisation’s inability to integrate ESG strategy.

Influence of regulations and investor pressure

Without a change in regulations or a push from investors, companies are not likely to vary their reporting practices and sustainability reporting will remain as a necessary but low priority task. This is evident from the fact that in countries where there is a strong regulatory push for sustainability reporting, such as France and Germany, companies have more comprehensive reporting trends.

A Bloomberg study notes that Europe leads on mandatory sustainable finance and ESG disclosure policies while India is currently a laggard, but that prevailing trends are positive for all nations.

Reporting standards may not be a silver bullet for investors but are a solid first step

In India, the regulatory landscape for sustainability reporting will get a fillip when the mandatory business responsibility and sustainability reporting (BRSR) standards are implemented from April 2022. The standards may not be a silver bullet for investors, as “greenwashing” concerns and data related issues may persist, but they are a solid first step in setting a sustainability disclosure regime in India.

Even if regulations are in place, lack of clarity in the guidance documents provided by regulators is a big problem. As the initial goal is to ease the adoption of new disclosure standards, guidance documents/regulations may not ask for sufficient detail on ESG metrics. ESG disclosures by companies will be a positive move but the depth and quality of disclosures will be key to investors making investment decisions with meaningful information.

There is a gap between the expectations of investors and information disclosed by companies, as evidenced by the fact that companies often get requests from different investors to report according to multiple standards. This goes back to the early adoption of different voluntary standards and frameworks by investors globally.

Lack of standardisation

With voluntary standards comes a lack of standardisation. As per a Duff and Phelps study of valuation experts, almost half of respondents believe the biggest threat to effective ESG disclosures for businesses is the absence of a standard, recognised measurement system.

Currently several standards are being used, with no single system dominating. There have been several steps towards standardisation such as the merger of the International Integrated Reporting Council (IIRC) and Sustainability Accounting Standards Board (SASB) to form the Value Reporting Foundation (VRF) and its ultimate merger with the Climate Disclosure Standards Board (CDSB), an initiative of CDP.

The merged entity will be part of the new International Sustainability Standards Board (ISSB), announced by the International Financial Reporting Standards (IFRS) foundation in November last year in an attempt to develop a “comprehensive global baseline of high-quality sustainability disclosure standards”.

Company-specific issues

From a company-specific view, several challenges act as roadblocks to efficient ESG reporting, such as lack of access to relevant expertise, limited subject knowledge within organisations, limited access to tools and methodologies to capture and report on ESG metrics and the risk of an adverse impact on reputation if disclosed information is misrepresented.

Inconsistent data from multiple sources prevent integration of ESG into the investment process

Another deterrent is lack of targeted incentives or key performance indicators (KPIs) for management and workforce to take on additional burdens tied to the organisation’s ESG strategy.

Further, information regarding ESG performance is primarily self-reported. In larger companies with more resources at their disposal for ESG reporting, reporting may be more comprehensive as compared to smaller companies.

For investors, inconsistent data coming from multiple sources prevent integration of ESG into their investment processes. The flood of ESG investment products in financial markets, each with overlapping definitions, can have further adverse effects – confusion among investors and a higher risk of “greenwashing”, or using misleading claims to make an investment appear ESG-compliant.

Unregulated nature of ESG ratings and data providers

ESG ratings are an important source of information for investors but come with caveats. ESG ratings are measured differently across agencies and so can be an inconsistent measure of performance. Ratings by different agencies can vary widely for the same company.

The key material issues, the weightages given to those metrics and the algorithms used to arrive at ESG scores vary widely between ratings providers. Further issues to be resolved include setting definitions for specific ESG rating products.

There is also the potential conflict of interest that can arise due to many of the ESG ratings providers also being credit rating agencies for companies. With the growing influence of ratings on investment decision-making, regulatory and legislative focus on these products is going to increase.

SEBI consultation paper on ESG ratings providers

The consultation paper recently floated by the Security and Exchange Board of India (SEBI) on regulation of ESG ratings and data providers in India is an important first step. The paper, among the first of its kind in the world, identifies several issues with the current ecosystem for ESG ratings and other related products.

Some proposed regulations include: mandating only SEBI accredited ESG rating providers (ERPs) to provide ESG ratings and data products; only credit rating agencies (CRAs) and research analysts registered with SEBI being eligible for accreditation as an ERP; standardising symbols and ESG rating scales; providing transparency of rating methodology; and putting in place internal controls, robust due diligence mechanisms and proper ratings processes.

Shareholder activism on ESG issues also will continue to grow

Several of its recommendations point in the right direction but SEBI may need to recognise the dynamic nature of ESG and not stifle the growing industry with overly restrictive regulations.

As global best practices in sustainability reporting emerge, as consensus grows around what needs to be reported by a company and as the definition of materiality for every sector is universally accepted, companies and investors alike will be able to better decipher the regulators’ guiding documents.

In India, as the institutional investor community slowly but steadily realises the importance of ESG, shareholder activism on ESG issues also will continue to grow.

Further, as organisations build in understanding of ESG risks and opportunities and link ESG into overall strategy, they will be more equipped to recognise, measure and report on ESG metrics. A key deliverable for companies will be to learn from industry peers who are leading on ESG reporting and to imbibe the culture of linking the non-financial and financial aspects of business.

This article first appeared in Carbon Copy. Read part 1 and part 2.

Shantanu Srivastava is an energy finance analyst at the Institute for Energy Economics and Financial Analysis (IEEFA).