IEEFA Australia: NSW’s transition plan for a declining coal market is still missing

SYDNEY –The pipeline of coal-fired power projects in New South Wales’ biggest coal export destination is collapsing.

In January 2019, the 2 gigawatt (GW) Chiba coal power project in Japan was cancelled. This follows the cancellation of the 1GW Soga coal-fired power project in December 2018. The 1.3GW Akita project has reportedly been cancelled according to Japan’s Nikkei and confirmation of this may be released any day now.

However, you can be forgiven for not being aware of what’s on the horizon by reading the New South Wales (NSW) state government’s coal export forecasts. Furthermore, the major state political parties do not have a significant transition policy for the thermal coal industry in the run-up to the state election on 23 March 2019.

A classic example comes from the state government’s NSW Freight and Ports Plan 2018-2023 which predicts total coal freight volumes will increase 11% from 189 million tonnes (mt) in 2016 to 210mt by 2036. At the Port of Newcastle, the major thermal coal export terminal in NSW, freight volumes are forecast to increase 23% from 153mt in 2016 to 188mt by 2036.

Digging into the source of this forecast reveals just why they are so overly optimistic.

The source of the forecast is the NSW Freight Commodity Forecasts 2016-2056 prepared by Transport for NSW Performance and Analytics (TPA) team whose coal freight forecast is itself based on a 2015 forecast from Japan.

In the context of rapidly changing global energy markets, data from 2015 is hopelessly out-of-date. Coal demand forecasts have changed significantly since then.

Hopelessly optimistic coal export forecasts are nothing new in NSW. The planned T4 terminal at the Port of Newcastle was intended to ship increasing volumes of coal, but after it turned out it would never be needed, it was cancelled last year. Even after the cancellation, the port still has 24% unused capacity.

The NSW coal industry was quick to trumpet record high value of coal exports in 2018 but this was driven by temporarily high prices, not high volumes.

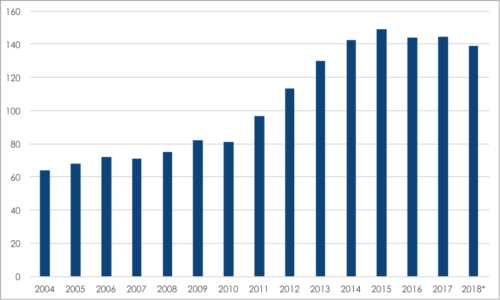

Thermal coal export volumes from NSW peaked in 2015 (Figure 1) and there is no guarantee that volumes will rise above the 2015 figure in the short or medium term. In the long term exports will certainly fall, as any rise in thermal coal imports by smaller Asian electricity markets will be more than offset with declining imports by current major destinations, as set out in a recent IEEFA report on the NSW coal industry’s long-term outlook.

It’s no surprise then that the Port of Newcastle’s chair has recognised an “urgent need” for the port to diversify away from a reliance on coal.

Figure 1: NSW Thermal Coal Exports by Fiscal Year Ended 30 June (Million Tonnes)

Source: Coal Services.

*2018 figure is an annualised projection based on data for the first nine months of fiscal year 2017-18.

The NSW government would do well to take note of more recent forecasts from the International Energy Agency (IEA). In its November 2018 World Energy Outlook, the IEA predicts global seaborne thermal coal trade volumes will decline 65% by 2040 under its Sustainable Development Scenario – a scenario in which nations take further action to limit climate change.

The impending global thermal coal downturn is also reflected in a recent IEEFA report showing over 100 global financial institutions are exiting coal, with a new announcement occurring on average every two weeks, making it increasingly more difficult for coal producers to secure finance.

Leading corporations and financial institutions are rapidly re-assessing their business models, pivoting towards cessation of the development of all new coal-fired power plants globally, and accelerating investment in renewables.

Japan is shifting away from coal at a rapid rate and this is characterised by more than just its coal-fired power project cancellations. Its influential trading houses are shifting from thermal coal too.

Marubeni Corporation, one of the world’s most significant developers of new coal plants globally outside of China and India, announced their coal exit in September 2018. Itochu of Japan likewise announced their exit in February 2019 and Sojitz Corp followed suit in March 2019. Other major Japanese trading houses Mitsui and Mitsubishi have also turned away from thermal coal investments citing climate concerns.

Major Japanese financial institutions are also exiting coal including Sumitomo Mitsui Trust Bank and insurance giants Nippon Life and Dai-Ichi Life.

When the coal export forecasts you are using increasingly do not bear any resemblance to what is actually happening in your major export destinations, it is time to call those forecasts into serious question.

With export volumes stagnating, NSW needs to rationalise its thermal coal industry while reorganising in preparation for the major downturn in export volumes that will occur in the longer term. The opening up of further thermal coal mining capacity will introduce more supply into a market that will shortly go into permanent decline. This needs to be avoided in order to maximise the value of remaining thermal coal production.

The global energy transition is happening whether governments, corporations and communities like it or not. Thanks to the unstoppable spread of ever-cheaper and more efficient renewable energy, electricity markets are undergoing a technology-led transition away from fossil fuels around the world.

The NSW government and business community must urgently and carefully plan for the progressive transition away from a reliance on thermal coal exports. Workers and communities in the coal producing Hunter Valley region of NSW rely on realistic futures, not aspirational ones.

Simon Nicholas ([email protected]) is an energy finance analyst with IEEFA.

Tim Buckley ([email protected]) is director of energy finance studies, IEEFA Australasia.

Related articles:

IEEFA Australia: New open cut mine development refused with climate change cited as key reason