IEEFA: Air Products’ coal gasification proposal triggers looming policy disputes in Indonesia

27 January, 2022 (IEEFA Indonesia): Air Products & Chemicals and the Indonesian government’s deal on coal gasification projects has triggered a looming policy conflict because it may be impossible to meet the business interests of all parties, according to a report by the Institute for Energy Economics and Financial Analysis (IEEFA).

Air Products, a U.S.-based industrial gas company, recently signed additional memoranda of understandings reportedly worth US$15 billion for coal gasification projects in Indonesia. Two of the gasification plants would be used to create dimethyl ether (DME) as a substitute for Indonesia’s domestic liquefied petroleum gas (LPG) imports.

Air Products’ business model is to cut out commodity price risks, effectively insulating returns

“Many optimistic statements have been made about Air Products’ downstream coal plan in Indonesia,” says Ghee Peh, an IEEFA energy analyst and the report’s author. “But it may be hard for all of the parties involved to realize their dreams.”

The report focuses on a previously announced $2.1 billion project to build a DME plant in Sumatra (which was the subject of a November 2020 IEEFA report). All parties—coal supplier Tambang Batubara Bukit Asam (PTBA), DME plant operator Air Products, and DME offtaker Pertamina—are unlikely to achieve their objectives at the same time. It would require a scenario that includes reduced stranded asset risks, low-risk fixed returns to pay for the DME plant, and selling DME for a profit.

Air Products’ business model is to cut out commodity price risks, effectively insulating returns. PTBA’s DME project could make this low-risk business model difficult to implement, and the conflict could be passed on to the off-taker, Pertamina.

A higher DME purchase price would mean a government subsidy for Pertamina so that the DME can be sold at an affordable price for Indonesian households.

Further compounding the economic unviability of the proposed projects is the difficulty in calculating DME prices, because coal, LPG and oil prices all move in the same direction.

Over the last 20 years, the DME price has been cheaper than LPG for 15 months, or about 6% of the period

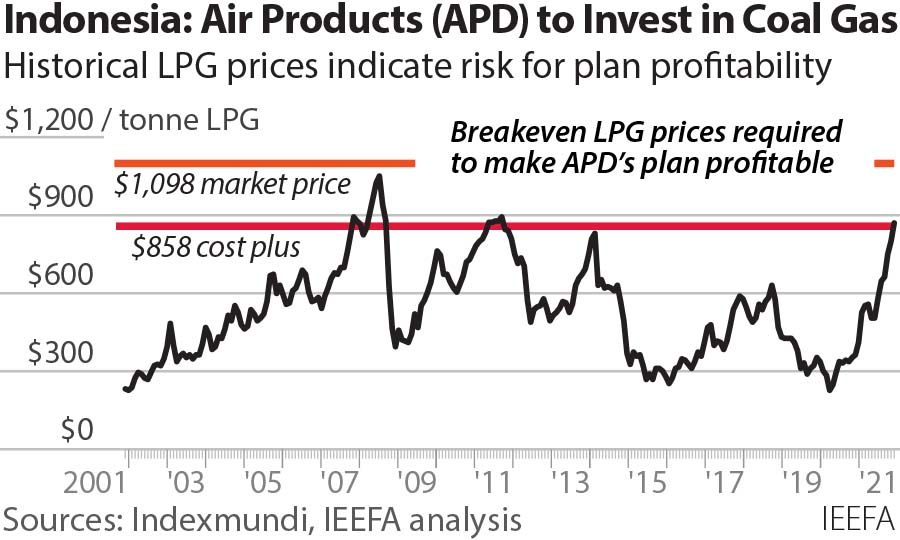

“Over the last 20 years, the DME price has been cheaper than LPG for 15 months, or about 6% of the period, on an ‘apples to apples’ basis,” says Peh.

IEEFA’s report suggests that a government subsidy similar to the current LPG subsidy from Indonesia’s Ministry of Finance is necessary for DME because of its high production cost of US$601/tonne, which includes a 15% DME production margin for Air Products.

“From the government’s point of view, the savings only work when the LPG price is above a certain level—about US$858/tonne,” says Peh. “Since this has only happened for 6% of the last 20 years, the DME project in its current form would not be able to justify any savings, nor would it be able to satisfy all four stakeholders at once.”

Full report: Indonesia’s Downstream Coal Plans Add up to a Black Hole

Read the press release in Bahasa.

View the presentation.

Author Contact: Ghee Peh ([email protected])

Media Contact: Paige Nguyen ([email protected]) +61 433 048 877

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. IEEFA’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.