Universal owner wealth to erode at alarming rate due to carbon pollution of investments

Key Takeaways:

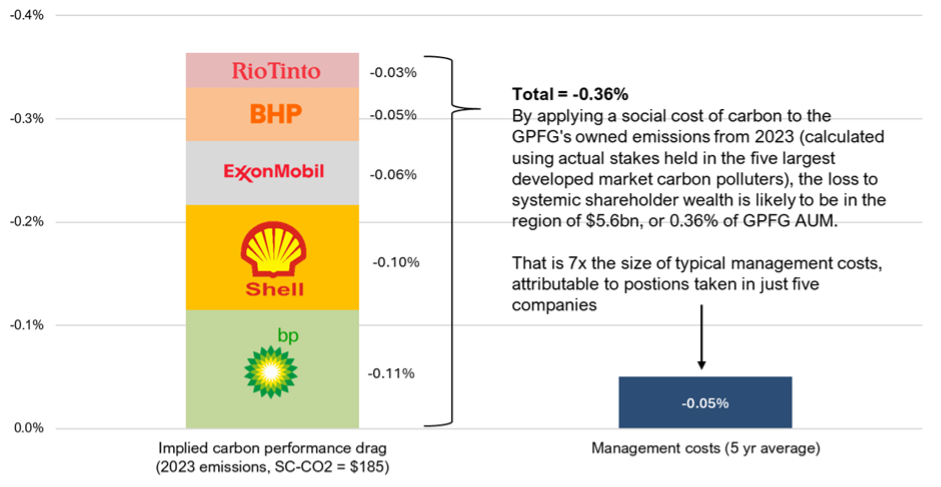

Using the Norwegian Government Pension Fund Global (GPFG) as a case study, holdings in five mega-polluters produce an implied carbon-based performance drag of about US$5.6 billion (approximately NOK 60 billion), or -0.36%, per annum based on current asset levels.

Destruction of shareholder wealth such as that experienced by the GPFG strongly brings the case for universal owners to adopt policies that protect wider market returns as part of fiduciary duty.

Universal owners tend only to adopt principles-based stewardship efforts or join collaborative engagement initiatives but fail to also effectively integrate theory into asset-level decision-making.

IEEFA proposes that universal owners adopt ‘systemically adjusted’ investment models to better value assets in the context of their wider portfolio impact. Such analysis can inform stewardship processes, allow for better resource prioritisation and help frame climate considerations in quantitative, fiduciary terms—reducing reliance on guiding principles.

8 May 2024 (IEEFA) | Universal owners risk exacerbating wealth destruction caused by carbon externalities because they fail to correctly value assets in the context of their impact on their wider portfolios.

With broad economic exposures, universal owners are unable to diversify away from growing environmental risks. Wider market returns must therefore be protected, often through addressing the externalities caused by entities held within a portfolio.

New research from the Institute for Energy Economics and Financial Analysis (IEEFA) lays bare the scale of the problem faced by universal owners by illustrating how the externalities of investee companies will contribute to significant performance drags.

Using the example of Norway's Government Pension Fund Global (GPFG), the report reveals how holdings in five mega-polluters produce an implied carbon-based performance drag of about US$5.6 billion (NOK 60 billion), or -0.36%, per annum based on current asset levels. This figure is more than seven times the annual management cost incurred by the portfolio through the activities of just five companies. The GPFG’s portfolio holds more than 9,000 names.

The GPFG's Implied Carbon-Based Performance Drag Breakdown (%, Based on 2023 Emissions and Assets Under Management)

Source: IEEFA, MSCI, NBIM (GPFG holdings taken from reporting as at 31 December 2023).

These five polluters may have provided pyrrhic capital appreciation for the asset owner at the company level but for a bill picked up, at least in part, by the remainder of the fund—a cost that is to be re-absorbed but is perhaps not fully appreciated.

“The GPFG example illustrates how universal owners should be looking to urgently adopt more explicit beta-protectionist policies as part of fiduciary duty, but prioritising strategies that effect change in the market will require buy-in from stakeholders,” said Alasdair Docherty, author of the report and a sustainable finance and data analyst at IEEFA.

To this end, the author proposes a ‘systemically adjusted’ metric to reveal the extent to which emissions generated by individual companies in the universal portfolio could contribute to the erosion of shareholder wealth. Similar models that value assets holistically could improve valuation techniques and identify companies that have too little upside to justify the wider damage caused to portfolios. Integrating universal ownership theory in this manner could in turn inform stewardship processes and prioritise climate-related responsibilities in quantitative, fiduciary terms—reducing reliance on environmentally based guiding principles.

Systemically adjusted valuation techniques will need to accompany more effective stewardship frameworks that put greater emphasis on investor education, divestment and redirecting resources to more proactive engagement with policymakers and banks.

“The case for universal ownership remains firmly intact but must evolve in the face of new challenges,” said Docherty. “Engaging directly with investee companies has traditionally been favoured, but the ineffectiveness of this approach in meaningfully altering market behaviour means new strategies are required. The urgency of this is brought more sharply into focus by the weaponisation of antitrust concerns and aggressive litigation that is reshaping the relationship between asset owner and asset.”

Read the report: https://ieefa.org/resources/universal-ownership-call-practical-implementation

Press contact

Jules Scully | [email protected] | +447594 920255