Transmission expansion trails renewable energy growth in India

Policy reforms that aim to enhance institutional coordination, mandate transparency, and enforce performance-based accountability are the need of the hour.

Key Takeaways:

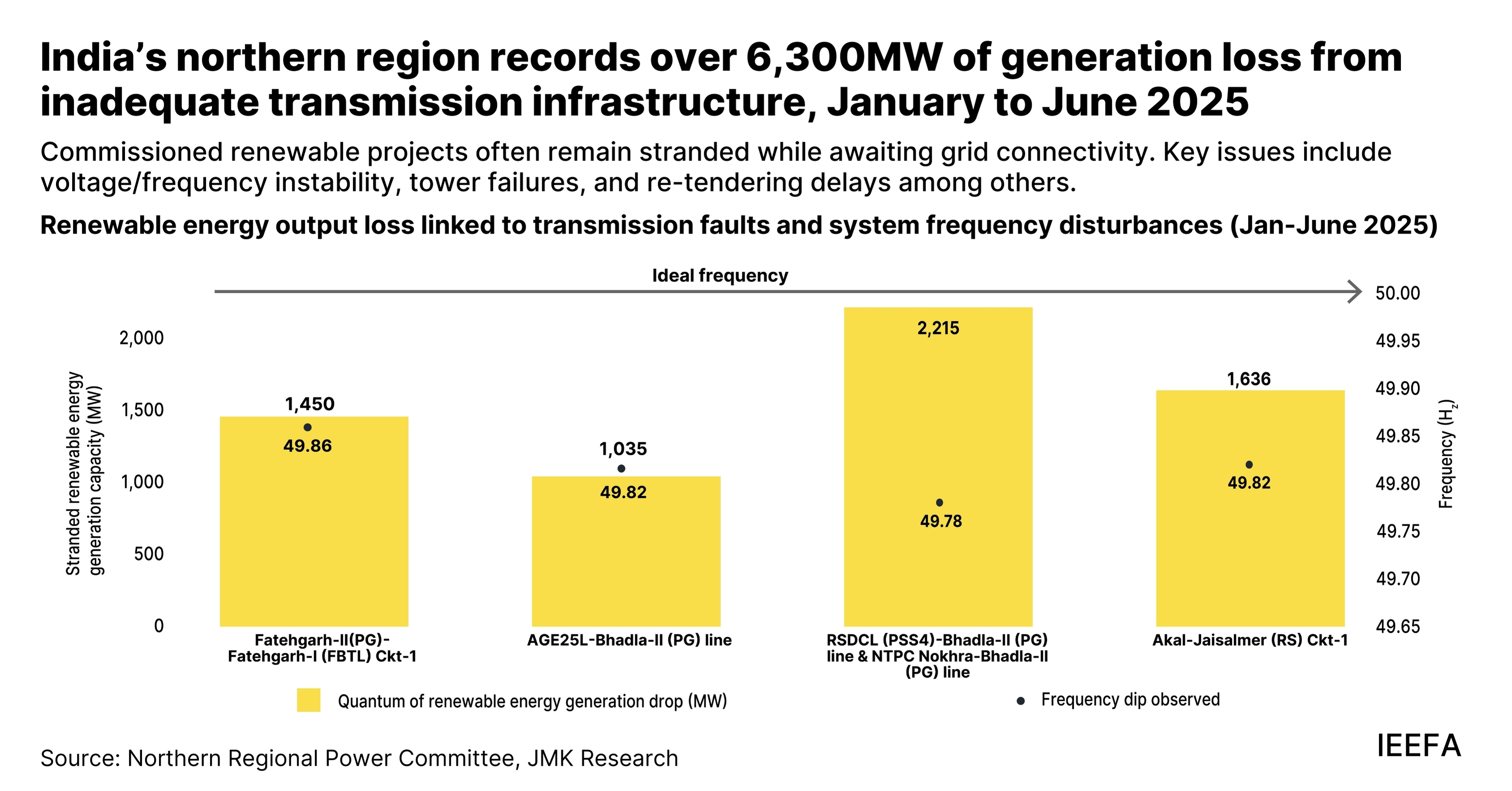

Over 50GW of renewable energy capacity remains stranded nationwide as of June 2025, leading to project delays and increasing per-unit transmission costs. These constraints limit the pace at which new capacity can be brought online.

India’s transition to renewables is limited by the mismatch between variable generation and grid consumption. While solar generation aligns with the afternoon peak consumption pattern, it tapers off in the evening when demand is high. This creates a gap that limits renewable integration and leads to the underutilisation of transmission corridors. Energy storage is vital to bridge this gap.

Renewable corridors often operate below their intended capacity; however, some degree of underutilisation is temporary, as it reflects strategic overbuilding to meet future demand growth.

Transmission planning needs to move beyond the traditional five-year static cycle to a more adaptive approach that reflects evolving generation patterns and demand growth.

24 September 2025 (IEEFA South Asia and JMK Research): India’s power-transmission network, although one of the largest and now fully synchronised, is expanding only gradually relative to the rapid growth of renewable energy, finds a new report by the Institute for Energy Economics and Financial Analysis (IEEFA) and JMK Research & Analytics.

The report calls for aligned planning between generation and transmission, streamlined approvals, and new investment mechanisms so the grid can absorb more renewable energy.

In FY2025, 8,830 circuit kilometres (ckm) of new transmission lines were commissioned against a target of 15,253ckm, representing a 42% gap, with Inter-State Transmission System (ISTS) additions at their lowest in a decade. Furthermore, the report states that up to 71% of ISTS corridors operate below 30% utilisation.

“In several high-demand corridors, speculative hoarding of transmission capacity by entities without genuine project intent has driven up connectivity prices and delayed access for viable projects,” says the report’s contributing author, Vibhuti Garg, Director – South Asia, IEEFA.

“Right-of-way (RoW) issues, extended land acquisition timelines, restrictions on equipment procurement, and multi-agency approvals also contribute to delays,” says Prabhakar Sharma, co-author of the report and a senior consultant at JMK Research.

Despite increased private sector participation under Tariff-Based Competitive Bidding, India’s overall transmission expansion has been slow and remains below National Electricity Policy targets. Annual transmission line additions have fallen short of planned levels since FY2019, with only FY2021 surpassing expectations.

“While government initiatives like the Green Energy Corridor (GEC) and the General Network Access (GNA) framework have given a boost to transmission infrastructure, there is scope to accelerate greenfield development by promoting structured Public-Private Partnership models that enable efficient risk-sharing and faster execution,” says Pulkit Moudgil, Research Associate, JMK Research & Analytics.

As of June 2025, the GEC has enabled the commissioning of 27.45GW of renewable energy capacity, with an additional 36GW in the pipeline across ISTS and Intra-State Transmission System (InSTS) Phases I and II. Other initiatives, such as ISTS charge waivers, indirectly support the expansion of ISTS transmission infrastructure.

The GNA Third Amendment introduces a more flexible allocation model, dividing GNA for renewable projects into solar and non-solar hours. This ensures transmission capacity is better aligned with actual generation patterns, unlocking capacity that would have otherwise remained idle.

The authors highlight the case of Rajasthan, where 8GW of renewable energy capacity remains stranded, with nearly half curtailed during peak solar hours. The ongoing completion of the Associated Transmission System, along with capacity hoarding and ecological directives requiring underground cabling in Great Indian Bustard habitats, have added to evacuation challenges.

“India’s renewable energy transition also faces a growing challenge of underutilised transmission assets. Underutilisation occurs when transmission corridors, designed to carry renewable energy, operate below their intended capacity for prolonged periods. Some degree of underutilisation is temporary, as it reflects strategic overbuilding to meet future demand growth,” says Chirag Tewani, senior research associate, JMK Research and a co-author of the report.

Scaling India’s transmission infrastructure requires unlocking capital through institutionalised asset monetisation and greater public-private participation. “Central and state utilities can adopt standardised monetisation frameworks to recycle capital from brownfield assets,” says Sharma.

“A single-window clearance system with strict timelines can help streamline land, RoW, and connectivity approvals. Performance-based incentives and disincentives tied to asset utilisation metrics can also encourage timely commissioning and sustained operations,” adds Moudgil.

Ultimately, a coordinated approach that combines regulatory reform, operational efficiency, and capital mobilisation will be critical to transforming India’s transmission network into a flexible, resilient system while ensuring cost-effective and reliable power delivery.

Read the report: Green Power Transmission Development in India

Media contact: Prionka Jha ([email protected]); +91 9818884854

Author contacts: Vibhuti Garg ([email protected]); Prabhakar Sharma ([email protected]); Chirag H Tewani ([email protected]) and Pulkit Moudgil ([email protected])

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)

About JMK Research & Analytics: JMK Research & Analytics provides research and advisory services to Indian and international clients across renewable energy, electric mobility and the battery storage market. (www.jmkresearch.com)