IEEFA report: ‘Holy Grail’ of carbon capture continues to elude coal industry; ‘cautionary tale’ applies to domestic and foreign projects alike

Nov. 19, 2018 (IEEFA) — A study published today by the Institute for Energy Economics and Financial Analysis concludes that costly efforts undertaken in North America to develop workable, economic technology to capture carbon from coal-fired generation have come up short.

Nov. 19, 2018 (IEEFA) — A study published today by the Institute for Energy Economics and Financial Analysis concludes that costly efforts undertaken in North America to develop workable, economic technology to capture carbon from coal-fired generation have come up short.

Further, the study concludes that technology developments in the renewable energy and natural gas sectors have obviated the need for continued efforts to retrofit carbon capture technology on the nation’s shrinking coal fleet.

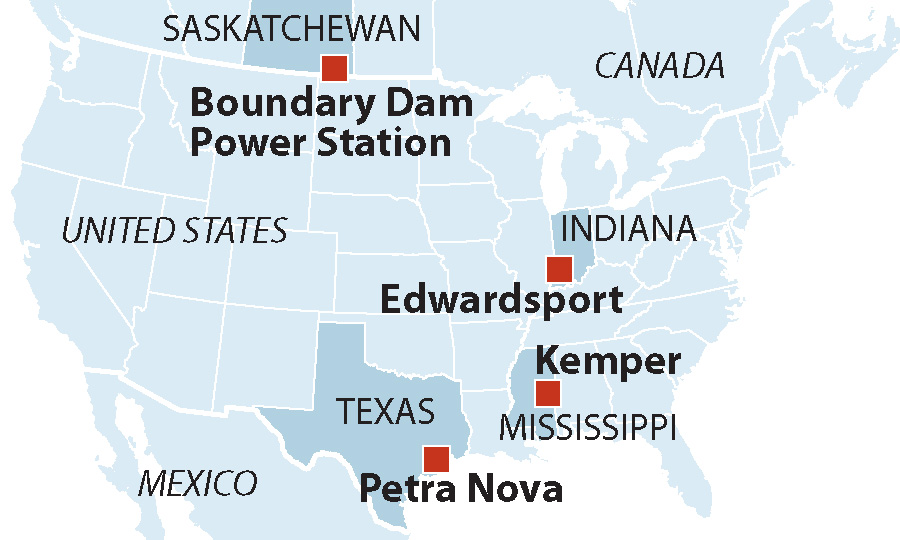

The report— “Holy Grail of Carbon Capture Continues to Elude Coal Industry”—tracks the history and performance of four highly touted projects: Saskatchewan Power’s Boundary Dam Power Station in Canada, NRG’s Petra Nova project in Texas, Southern Co.’s Kemper plant in Mississippi, and Duke Energy’s Edwardsport plant in Indiana.

“What all four of these projects have in common is their dismal performance,” said David Schlissel, IEEFA’s director of resource planning development and lead author of the report. “While Petra Nova and Boundary Dam are both operational, neither in truth can be considered anything other than demonstration units, the integrated gasification combined cycle project at Edwardsport has performed abysmally, and the Kemper clean coal project was essentially abandoned.”

While the report focuses on North American initiatives, it speaks as well to long-standing U.S. coal industry plans to sell carbon-capture technology abroad.

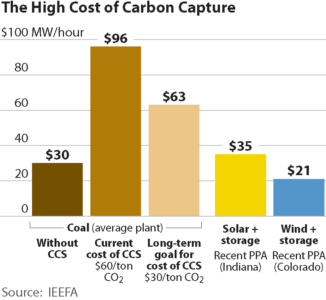

“Our findings serve as a cautionary tale for any country considering broad adoption of CCS for coal,” Schlissel said. “The technology remains unproven at full commercial scale, it is wildly expensive, there are serious questions regarding after-capture transport, injection and storage of the captured CO2 and—most important—more reliable and far cheaper power-generation options exist.”

“Our findings serve as a cautionary tale for any country considering broad adoption of CCS for coal,” Schlissel said. “The technology remains unproven at full commercial scale, it is wildly expensive, there are serious questions regarding after-capture transport, injection and storage of the captured CO2 and—most important—more reliable and far cheaper power-generation options exist.”

The report traces a legacy of costly experimentation that began over a decade ago under the direction of the U.S. Department of Energy, which began in the early 2000s to seek ways to capture coal-generated carbon emissions to address climate change. American electricity markets relied on coal for more than 50 percent of power generation nationally at the time, a figure that has dropped to less than 30 percent and is continuing to shrink as natural gas and renewables gain market share.

“Electricity produced by renewable energy, particularly wind and solar, amounted to little more than a rounding error in the Energy Information Administration’s 2003 edition of its Annual Energy Review,” the report notes. “Today they account for more than 10% of the nation’s electricity generation, and both continue to gain market share fast.”

Meanwhile, technology-driven advances in natural gas production have given the energy sector a huge lift: “Supplies have soared and costs have been cut to the point that gas is now the only viable option for developers looking to build new fossil-fuel generation. Further, the utility industry itself, long a source of support for coal in general and specifically for CCS development financing, is now moving quickly away from coal.”

The report describes further how market forces have undercut the economics of retrofitting carbon-capture technology on the aging American coal fleet.: “High-risk, high-cost CCS investments looked potentially viable a decade ago but are being eclipsed today by less-costly ways to produce electricity while curbing carbon emissions,” it states.

Full report: “Holy Grail of Carbon Capture Continues to Elude Coal Industry”

Media Contact:

Karl Cates [email protected] 917 439 8225

About IEEFA:

The Institute for Energy Economics and Financial Analysis (IEEFA) conducts global research and analyses on financial and economic issues related to energy and the environment. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.