IEEFA Australia: NSW Minerals Council fails to see big picture by claiming mine refusal affects hospitals, schools and exports

1 October 2019 (IEEFA Australia): The proposition touted by the NSW Minerals Council and echoed by NSW Deputy Premier John Barilaro that the rejection of the Korean-owned Bylong coal mine proposal last week by NSW’s Independent Planning Commission (IPC) could have an impact on schools and hospitals, and on the growth in coal exports to South Korea is way off the mark, asserts IEEFA Energy Finance Analyst Simon Nicholas.

NSW thermal coal exports to South Korea peaked back in 2015

“Exports to South Korea were declining already,” says Nicholas.

“NSW thermal coal exports to South Korea peaked back in 2015. In 2018, thermal coal exports from NSW to South Korea were down 35% from that 2015 peak.

The importance of thermal coal mining to the Australian economy will decline in the current financial year

“The Australian Government’s Office of the Chief Economist clearly understands that South Korea has entered an energy transition away from coal and towards renewable energy and LNG”.

The idea also being floated that the rejection of the Bylong proposal will impact on hospitals and schools via reduced mining royalties also fails to see the bigger picture.

“THE DECLINE IN GLOBAL SEABORNE THERMAL COAL MARKET IS WHAT IS GOING TO AFFECT ROYALTIES, not the rejection of the Bylong mine,” says Nicholas.

Weak demand from Japan, South Korea and the EU has coincided with increased supply “resulting in an oversupplied market”

The Office of the Chief Economist (OCE) forecasts that the importance of thermal coal mining to the Australian economy will decline in the current financial year.

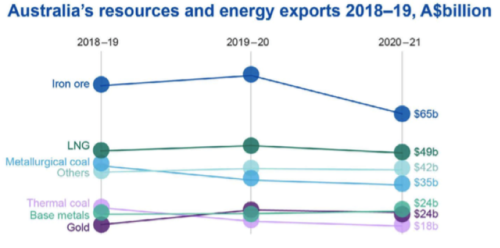

Previously Australia’s fourth largest energy and resources export, thermal coal will decline to the sixth biggest in 2019-20, falling behind base metals and gold. It is forecast to fall further behind in 2020-21.

“The fall in the value of Australian thermal coal exports is being driven by a decline in global thermal coal prices which is itself a result of too much supply in the market, a situation the Office of the Chief Economist acknowledges in its latest report,” says Nicholas.

In its September update, the OCE stated that weak demand from Japan, South Korea and the EU has coincided with increased supply “resulting in an oversupplied market”.

The South Korean government’s intention is clear; it is incentivising a switch from coal to LNG

According to the OCE’s latest Energy and Resources Quarterly report, South Korea’s thermal coal imports were down 10% year-on-year over the first seven months of 2019. Going forward, the OCE forecasts a moderate decline in South Korean thermal coal imports out to 2021.

THE OCE HAS STATED THAT SOUTH KOREA’S COAL IMPORTS WILL CONTINUE TO DECLINE IN THE FUTURE as its energy transition accelerates, with the OCE noting that the South Korean government has been taking a range of measures since 2017 to reduce reliance on imported thermal coal.

These include the cancellation of new coal power projects, plans to close aging coal power plants and the temporary closure of others to address air pollution concerns.

In April this year, the South Korean government raised the coal import tax by another 28% (after a 20% raise the previous year) whilst at the same time reducing the LNG import tax by 75%. The coal import tax has now reached around US$40/tonne.

The seaborne thermal coal market is already oversupplied

“The South Korean government’s intention is clear; it is incentivising a switch from coal to LNG. In the long term, the South Korean power system will switch from reliance on coal and nuclear to reliance on LNG and renewables,” says Nicholas.

IEEFA noted at the time of the Independent Planning Commission’s decision to reject the Bylong coal project on environmental grounds, that the mine could have been refused for economic and financial reasons given the seaborne thermal coal market is already oversupplied and increasingly challenged by lower cost alternatives.

“With the market oversupplied, coal prices falling and the value of Australian thermal coal exports declining, rejecting new greenfield coal mines makes economic sense,” says Nicholas.

“No new thermal coal mines means reduced oversupply, lowering pressure on coal prices which may actually help protect mine royalties in the long term.”

Media Contact: Kate Finlayson ([email protected]) +61 418 254 237

Author Contact: Simon Nicholas ([email protected]) and Tim Buckley ([email protected])

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) conducts research and analyses on financial and economic issues related to energy and the environment. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. www.ieefa.org