Europe’s LNG buildout slows amid anticipated decline in gas demand

Key Takeaways:

Europe’s construction of liquefied natural gas (LNG) terminals is slowing as countries cancel or close projects.

IEEFA expects Europe’s gas consumption and LNG imports to fall by 15% and 20%, respectively, between 2025 and 2030.

Europe’s imports of US and Russian LNG reached a record high in the first half of 2025.

From the beginning of 2022 to June 2025, EU countries spent about €120 billion on pipeline gas and LNG imports from Russia.

30 October 2025 (IEEFA) | Europe’s construction of liquefied natural gas (LNG) import terminals is losing momentum, indicating that countries across the continent overestimated future gas demand.

So far this year, Germany has shut down or shelved terminals, while a court has ordered another in France to leave the port of Le Havre as the terminal has been sitting idle for more than a year.

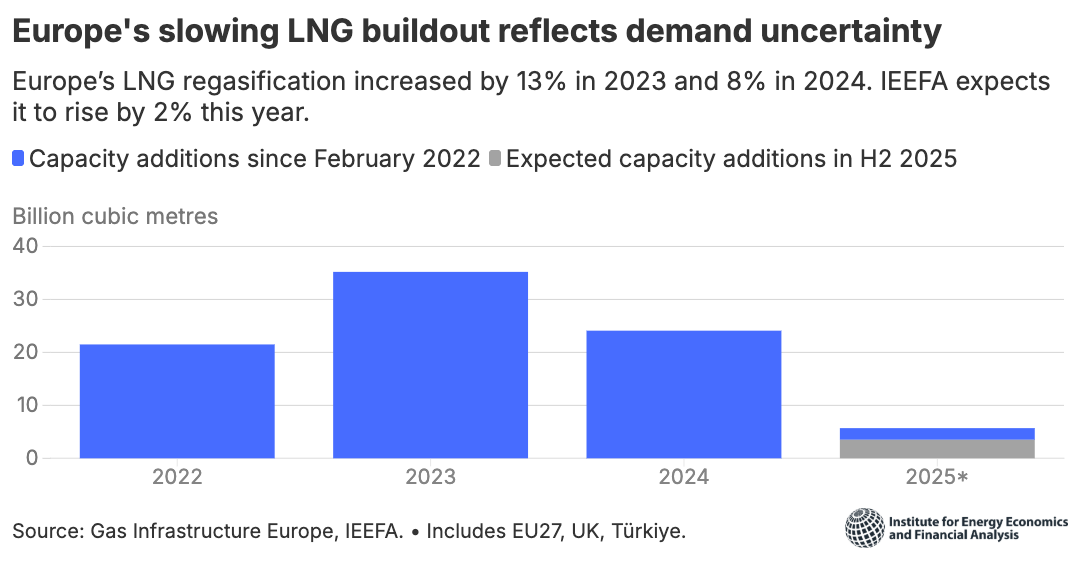

Europe’s LNG regasification increased by 13% in 2023 and 8% in 2024. It will rise by 2% this year, according to the updated European LNG Tracker from the Institute for Energy Economics and Financial Analysis (IEEFA).

The deceleration in Europe’s LNG terminal buildout comes as IEEFA expects the continent’s gas consumption and LNG imports to fall by 15% and 20%, respectively, between 2025 and 2030.

“Europe has installed or expanded 19 LNG terminals since the beginning of 2022 as it pivots away from imports of Russian pipeline gas. Yet a series of recent terminal cancellations and closures suggests that European countries have overstated the continent’s LNG demand,” said Ana Maria Jaller-Makarewicz, lead energy analyst, Europe, at IEEFA.

“European countries that continue to build or expand LNG terminals risk investing in unnecessary infrastructure as the energy transition accelerates.”

Europe has increased its reliance on LNG imports this year after Russian gas pipeline flows via Ukraine ended on 1 January. Europe’s LNG imports jumped by 24% year on year in the first half of 2025 as gas demand rose.

The US has reinforced its position as Europe’s main supplier of LNG. European imports of US LNG increased by 46% year on year in the first half of 2025. This meant the country accounted for 57% of the continent’s LNG imports.

Terminal updates so far in 2025 include a floating storage and regasification unit (FSRU) stopping operations at Germany’s Mukran port about one year after it was commissioned.

In France, a court has ruled that an FSRU at the port of Le Havre should be removed, in part because of the terminal’s low utilisation rate and the country’s declining gas consumption. TotalEnergies commissioned the terminal in October 2023, but it has not been used since August 2024.

Elsewhere, a technical issue at a terminal in Greece reduced its utilisation rate to 2% in the first half of 2025, while commissioning delays led Germany to sublet an FSRU to Jordan.

“The LNG industry often touts the role of LNG terminals in securing energy supply. Europe’s recent experience of terminal delays and technical issues challenges this notion. Reducing gas consumption has been pivotal in providing energy security,” said Jaller-Makarewicz.

Record imports of Russian LNG

Europe’s imports of Russian LNG increased by 2% year on year in the first half of 2025, meaning they reached a record high for any half-year period.

The EU continues to increase its imports of Russian LNG despite sanctioning the country’s LNG operations. While the EU will ban imports of Russian LNG from January 2027, the bloc’s imports of LNG from the country rose by 7% year on year in the first half of 2025.

France accounted for 41% of Europe’s imports of Russian LNG in H1 2025, followed by Belgium (28%), Spain (20%), the Netherlands (9%) and Portugal (2%).

From the beginning of 2022 to June 2025, EU countries spent about €120 billion on pipeline gas and LNG imports from Russia.

Press contact

Sofia Russi | [email protected] | +393493229728