CCS and fossil fuels an uncompetitive mix

Gloomy outlook for much-hyped carbon capture technology

Key Takeaways:

The use of fossil fuels with carbon capture and storage (CCS) is unlikely to be competitive with renewable-based solutions.

The International Energy Agency (IEA) halved its outlook for the use of fossil fuels in association with CCS in just two years, in particular slashing its outlook for gas use with CCS.

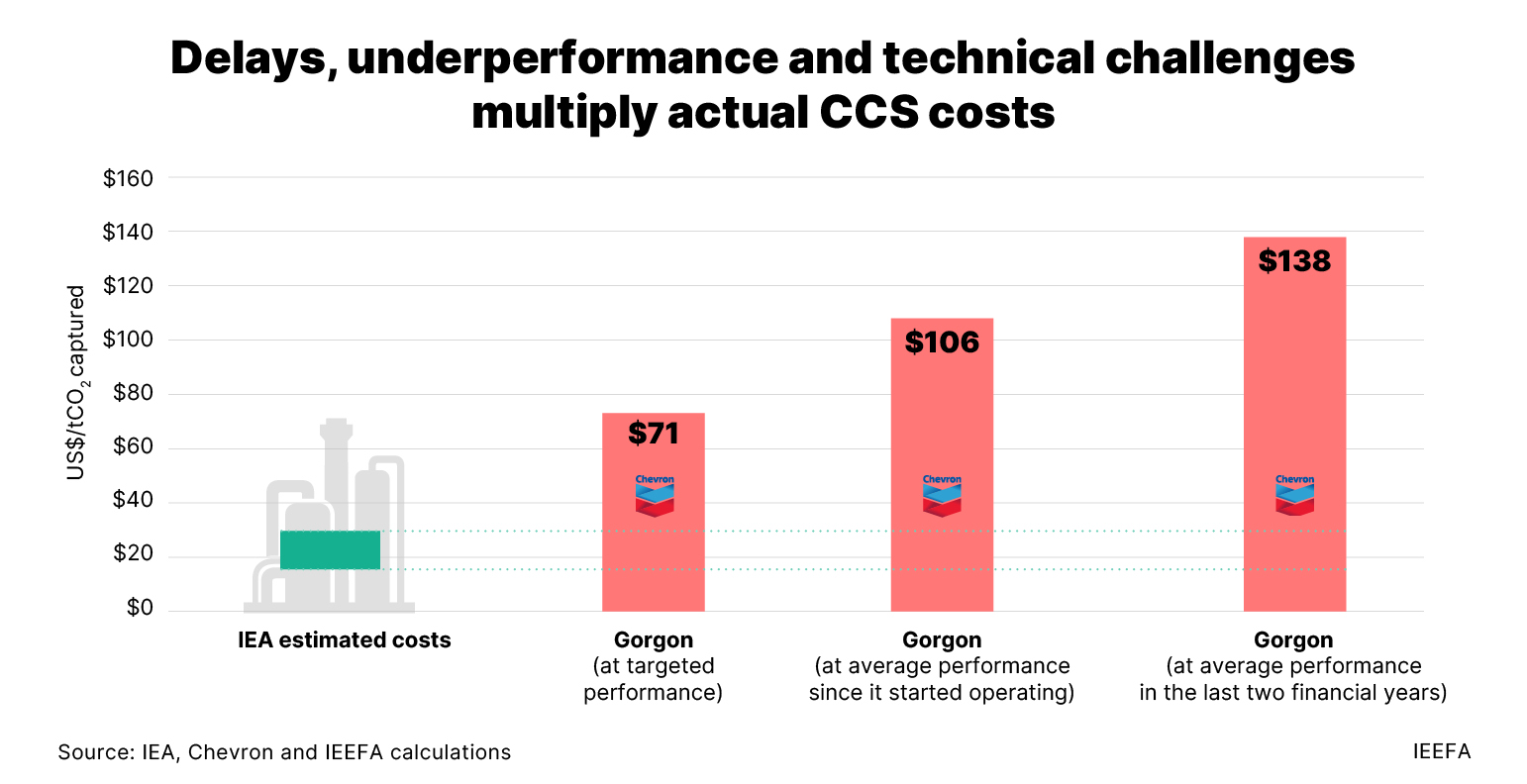

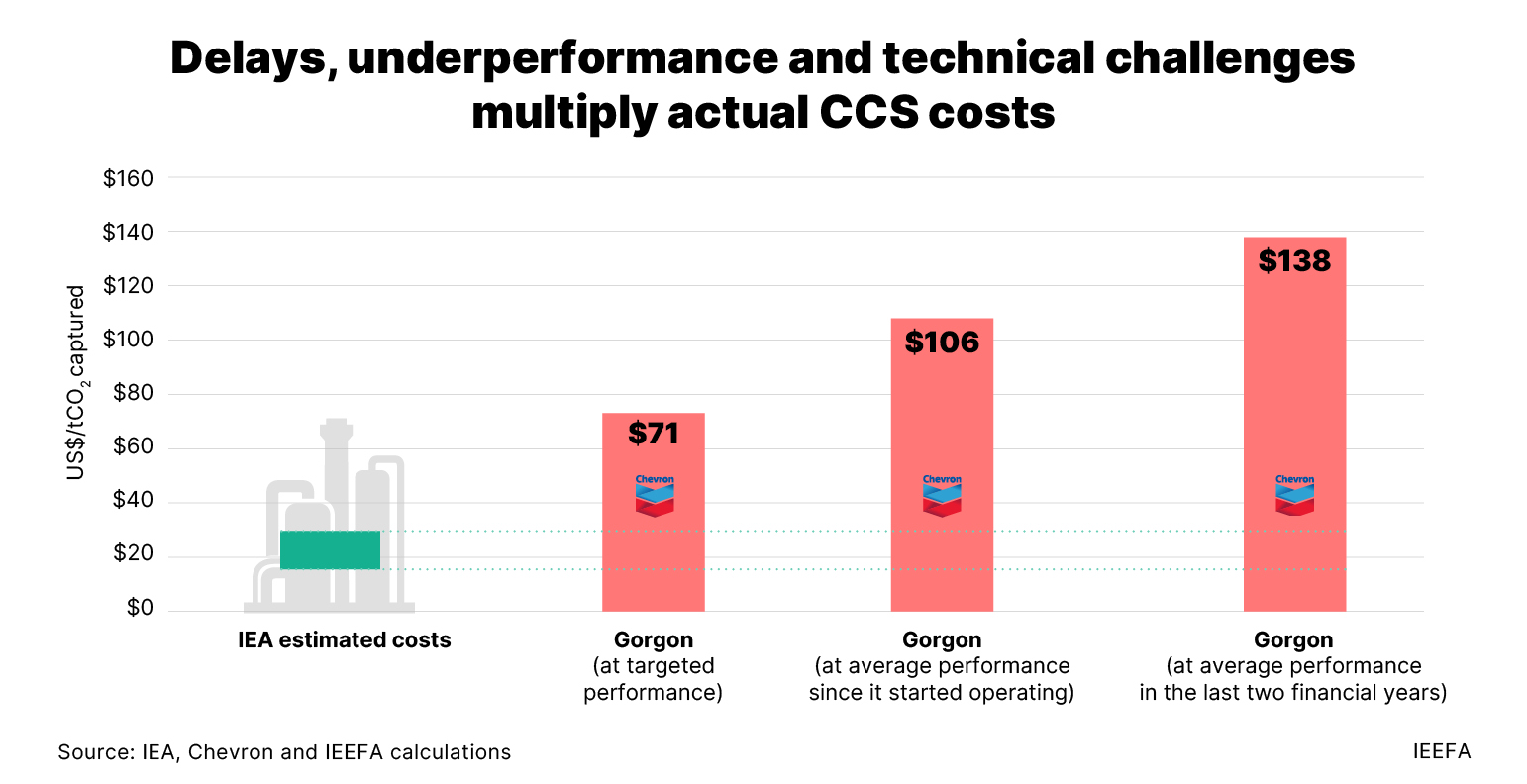

Delays, underperformance and technical challenges have a significant impact on CCS costs. Gorgon, the world’s largest CCS project, costs about A$206/tCO2 captured (US$138/tCO2 captured), about five times the IEA’s estimate for CCS in gas processing.

9 October 2024 (IEEFA AUSTRALIA) | Stubbornly high costs and performance issues threaten the prospects for carbon capture and storage (CCS), touted as vital to reducing global greenhouse gas emissions, according to the Institute for Energy Economic and Financial Analysis (IEEFA).

In just two years, the IEA has halved its outlook for fossil fuel use in association with CCS by 2040 and 2050 in its Net Zero Emissions (NZE) scenario. Driving this decrease is a 57% reduction in the expected use of CCS with fossil gas, including projected declines in its use with gas power generation (-47%) and hydrogen production (-44%). CCS use with coal also decreases by 15%, and the share of CCS-based equipment in steel production decreases by 30%.

The main reason for this projected decline is cost competitiveness.

“CCS is just not competitive with renewable-based solutions – neither on cost nor on emissions,” says Amandine Denis-Ryan, CEO of IEEFA Australia and author of a new briefing note on the subject.

In the power sector, the IEA estimates that fossil fuels with CCS will only generate about 1.5% of global electricity by 2050 in both its 1.5°C and 1.7°C global warming scenarios.

“The capital cost of coal generation with CCS is expected to be about six times higher than large solar plants in 2030, making it uncompetitive with renewables even when associated with firming (complementary flexible energy supply),” Ms Denis-Ryan says.

In the hydrogen sector, blue hydrogen (made from gas with CCS) is likely to have carbon emissions well above clean hydrogen benchmarks, and be more expensive than green hydrogen (made from renewable electricity) by 2030 in most markets.

In the steel sector, CCS has never been used at commercial scale in coal-based blast furnaces, and only three CCS projects are being considered, all at early development stages. The pipeline of low-carbon steel projects is dominated by direct reduced iron (DRI) projects using electric arc furnaces (EAFs) powered by gas and green hydrogen.

“In the gas sector, only some gas fields have a very high carbon dioxide (CO2) content, with many of the largest fields having a low CO2 content,” Ms Denis-Ryan says. “In the context of an imminent LNG supply glut, the most cost-effective solution is simply not to develop carbon-intensive gas fields.”

CCS’s competitiveness is likely to worsen as its actual costs become apparent. An IEEFA review of 13 global flagship CCS projects found most had either failed or underperformed by 20%-50%. Of the three CCS projects that met their targets – one experienced a geological fault while another had to find a new storage location after only 18 months – at a high additional cost.

Australia is home to the world’s largest CCS project at Chevron’s Gorgon LNG facility on Barrow Island in Western Australia. In its first five years, Gorgon has been beset by delays and operational challenges, capturing just 43% of the CO2 removed from its reservoir, well short of its 80% target.

“The impact of delays, technical challenges and underperformance on costs is material,” Ms Denis-Ryan says. “Those challenges have both decreased the volume of CO2 captured and increased capital costs for the project, making actual costs much higher than theoretical costs.”

IEEFA calculates Gorgon delivered a cost of A$206 (US$138) per tonne of CO2 captured in the past two years. Since it started operations, the cost amounts to about A$159/tCO2 (US$106). This is four to six times higher than IEA’s median cost estimate for the sector.

“Today, about three-quarters of CO2 captured is used for enhanced oil recovery, which provides a revenue stream but increases global emissions,” Ms Denis-Ryan says. “Shifting to permanently storing CO2 to reduce global emissions makes the financial case much more challenging.

“Due to its high cost and low performance, CCS associated with fossil fuels is unlikely to be competitive with renewable alternatives. IEEFA expects the outlook of CCS will continue to decline in coming years.”

Read the report: CCS hype and hopes sinking fast

Media contact: Amy Leiper [email protected] +61 (0) 414 643 446

Author contacts: Amandine Denis-Ryan, [email protected]

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)