A billion lessons for green iron in Australia

How to avoid the mistakes of Europe and the US

Key Takeaways:

As Australia pours $1 billion into its Green Iron Investment Fund, it can learn important lessons from the US and EU, where several low-emissions steel projects backed by capital grants were subsequently cancelled or delayed.

Projects with a “gas first, green hydrogen later” approach struggled, while those focused instead on locations with sufficient clean firm power were more successful.

Gas-based direct-reduced iron (DRI) did not command a premium and failed to establish offtakes whereas hydrogen-based DRI was able to secure offtakes at a 20-30% premium.

Many of the US and EU projects were unable to secure affordable supplies of gas or hydrogen (despite separate government support for hydrogen developers) but integrated projects with secure electricity supplies had more success.

7 November 2025 (IEEFA Australia): As Australia banks $1 billion on a green iron industry, it should heed the lessons of Europe and the US to avoid squandering the opportunity, according to a briefing note released today.

Governments in Europe and the US issued billions in capital grants to low-emissions steel projects only for several to be cancelled or delayed, the note How to spend a billion dollars finds.

IEEFA’s analysis of the EU and US schemes revealed shortcomings and commonalities pertinent to Australia, particularly focusing on steelmakers alone without clean, firm electricity supplies or offtake agreements in place.

“In all cases, the grants were issued to steelmakers to transition specific sites from blast furnaces to direct reduction to enable the switch from coal to gas or hydrogen,” says the author Lachlan Wright, Energy Finance Analyst, Global Steel at IEEFA.

“However, the grants were provided to steelmakers without any firm commitments on hydrogen supply, meaning there was a disconnect with the most costly and capital-intensive part of the supply chain. When the steelmakers were subsequently unable to secure suitably priced hydrogen (despite other support for potential suppliers) the projects/grants had to be either cancelled or amended.”

Half of the $1 billion Green Iron Investment Fund (GIIF) will support the Whyalla Steelworks transformation, with the remainder available in capital grants now open to greenfield and brownfield projects across Australia on a 25:75 cost share basis.

Gas has been promoted as a bridge fuel for the transition to low-carbon iron and steelmaking, including in Australia. However, IEEFA’s analysis found “gas first” projects struggled with few takers let alone premiums for gas-based iron projects as opposed to a 20-30% “greenium” for hydrogen-based direct reduced iron.

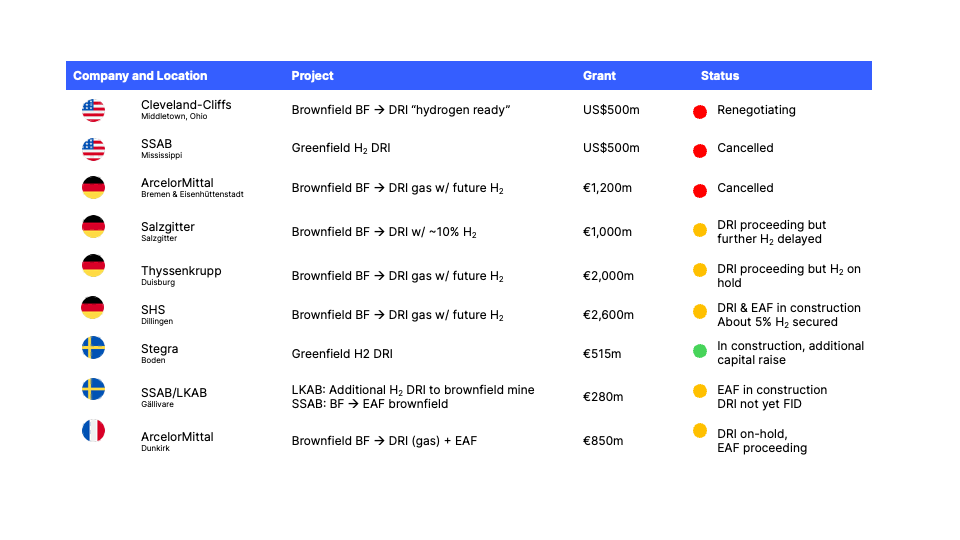

US and EU green iron and steel projects supported by government grants

Source: Government and company announcements

“Projects often failed where grants were targeted only at the iron or steel producer,” Mr Wright says. “Green hydrogen DR projects require significant investment in ironmaking, electrolysers and renewable energy. Therefore, integrated projects which controlled progress across all elements were more successful.

“Similarly, failures occurred even where government support was provided both to the steelmaker and separately to hydrogen developers. This highlights the importance of focusing hydrogen production support to projects closely linked with priority-use cases.”

To avoid these failures and delays, Australia should pursue an integrated approach that combines significant investments across ironmaking, electrolysers and renewable energy.

“Grants alone were not sufficient to offset rising gas and electricity prices,” Mr Wright says. “In Australia this can be avoided by directing grants to projects that can demonstrate binding, long-term supplies of low-cost energy.

“This will be particularly important in Australia due to the uncertainties in the gas market and the difficulties steelmakers already face to secure affordable gas.

“Successful projects have emphasised the reinforcing nature of a comprehensive policy suite to both directly help projects as well as provide confidence to other stakeholders to execute offtakes and supply agreements.”

Read the note: How to spend a billion dollars

Media contact: Amy Leiper, ph +61 414 643 446, [email protected]

Author contact: Lachlan Wright, [email protected]

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)