An unregulated ESG rating system reveals its flaws

Key Findings

Environmental, social and governance (ESG) ratings are instrumental in facilitating investment decisions, but can disrupt the stability of financial markets if unregulated.

The widespread MSCI downgrades highlight how subjective and inflated ESG ratings are. Regulating ESG ratings is a crucial step to prevent the next financial crisis or prospects of greenwashing.

The United Kingdom Financial Conduct Authority, the Securities and Exchange Board of India, the European Commission and Japan’s Financial Services Agency are exploring ways to tighten standards on ESG ratings. It is in the best interest of other market regulators to follow suit.

An edited version of this commentary first appeared in Project Syndicate as "Making ESG Ratings Count" (Copyright: Project Syndicate)

Environmental, social and governance (ESG) ratings are instrumental in facilitating investment decisions, but can disrupt the stability of financial markets if unregulated.

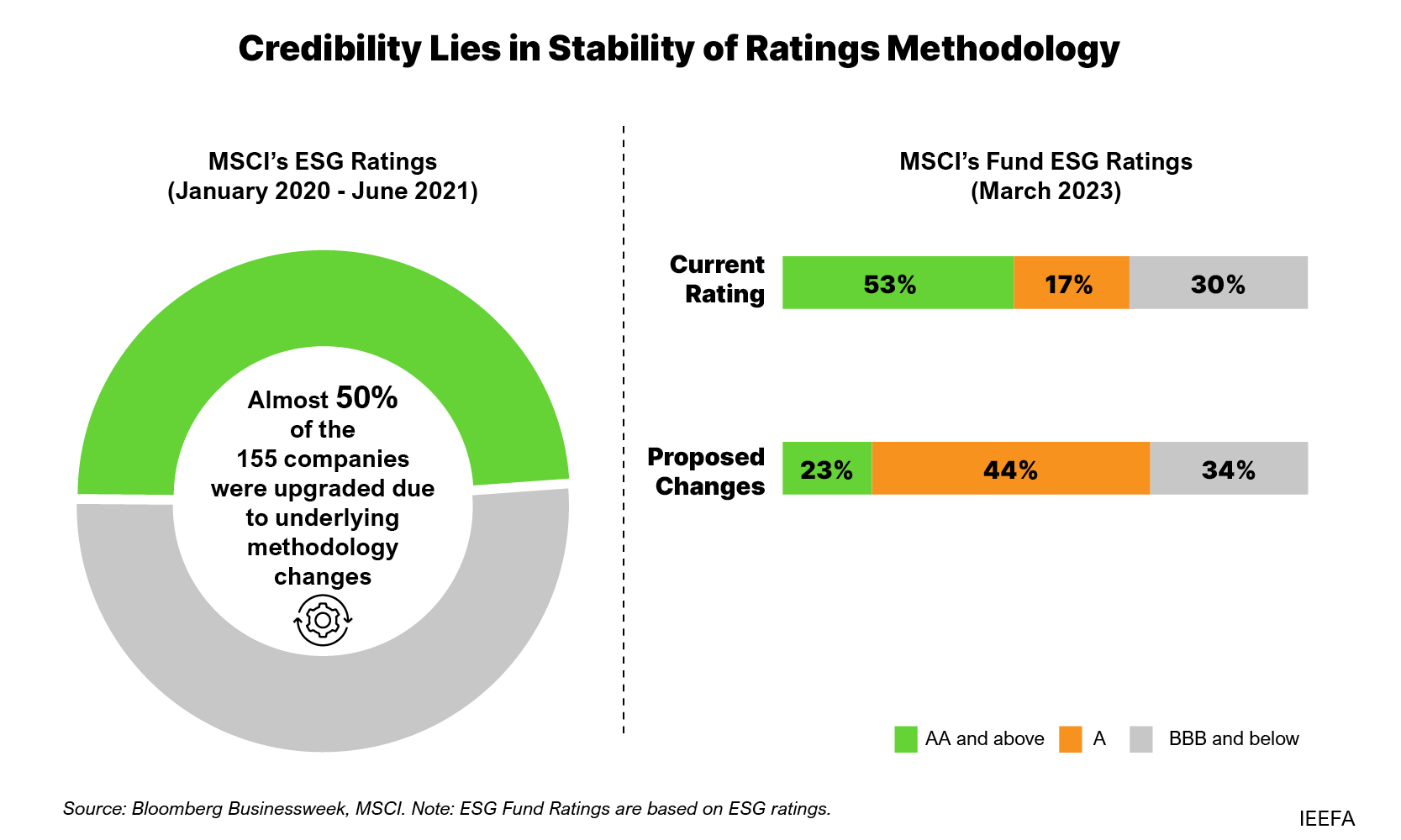

Notable rating downgrades are looming for 31,000 funds soon, when MSCI, one of ESG’s most influential gatekeepers, goes ahead to revise its Fund ESG Ratings methodology, which will affect investors that focus on ESG issues. One would expect advance warning of this magnitude of impact to be scrutinized by market regulators. Alas, ESG rating providers (ERPs) have flown under the radar.

The reality is, a change of this scale signals problems with the ESG rating system – not just MSCI.

Last October, the Institute for Energy Economics and Financial Analysis (IEEFA) published a report on the shortcomings of ESG ratings. It discussed inconsistencies among ERPs’ measurements of risk or impact in ESG ratings, adoption of standard criteria across the rating industry and degree of transparency in methodologies, and concluded that the lack of consensus would inevitably lead to a mispricing of stocks and bonds, or funds in this case, and an inaccurate inclusion in or exclusion from investment funds.

Our views have been reaffirmed. The impending widespread MSCI downgrades highlight how subjective and inflated ESG ratings are. This points to a greater need for regulatory intervention.

What makes a rating system credible?

Credibility lies in the stability of ratings methodology, and the accuracy and predictability of the rating – most of which MSCI seems to struggle with.

A 2021 Bloomberg Businessweek analysis of 155 ESG rating upgrades by MSCI showed that about half of the companies were upgraded due to underlying methodology changes. Just two years later, we are witnessing the same thing, only this time 31,000 funds are expected to have their ESG fund ratings lowered.

Perhaps the issue here is not the change in methodology, but rather the credibility of the ESG rating system.

a) Are the methodologies credible and independently verified from the outset?

b) Have changes to the methodology or internal guidelines been independently validated?

c) Will there be more sweeping rating adjustments in future because of a change in rating criteria?

These questions underscore the need for regulatory intervention. Regulators should require ERPs to provide concrete and structured evidence to support the ratings assigned, the validity of their criteria and how they modify these assessment conditions.

If credit rating downgrades were to occur at a similarly grand scale, regulators would have stepped in. The ESG rating sector should be treated similarly.

Highly rated funds with fossil fuel exposure underplay risks and overplay impact

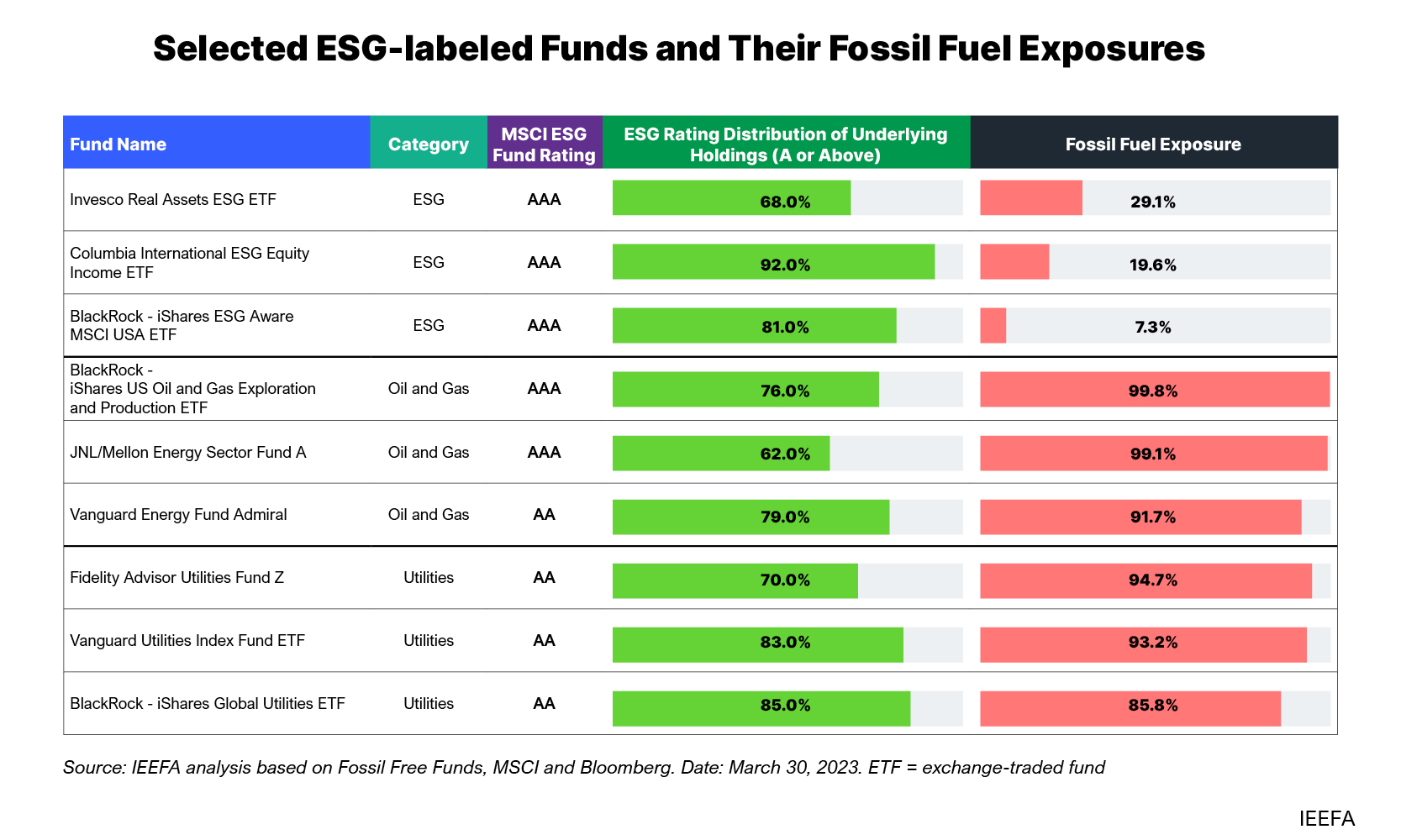

MSCI’s ESG Fund Ratings are based on unregulated assessments that examine a company’s financial risk according to ESG factors, an approach known as single materiality, rather than its influence on the environment or society. While some ERPs profess to measure the latter, these claims are a challenge to ascertain using their disclosed methodologies.

IEEFA’s examination of specific ESG-rated funds under MSCI evaluation shows that:

- ESG ratings are inflated, underplaying risk. Funds with significant weightage in fossil fuel investments, defined as more than 85% exposure, have top ESG ratings. This is at odds with financial prudence as the reliance on fossil fuels exposes investors to global climate risk, and failure to account for it could result in substantial losses through value destruction and opportunity cost.

- ESG-labeled funds can be misleading, overplaying their impact. The ESG label is capable of belying the fact that the fund has some exposure to fossil fuels, albeit less than 30%, including stakes in major oil giants like Chevron and Exxon. Such funds may be rated AAA, but they are not as green as they appear, which may lead investors to incorrectly tilt portfolios toward firms with high ESG ratings but poor sustainability performance.

While it is prudent to incorporate ESG risk, measuring a company’s impact on society and the planet should be an integral component of ESG ratings, a double materiality concept. It is high time that ESG ratings play a role in promoting truly sustainable investments, not the reverse.

The absence of an agreed objective for ESG ratings and stringent regulatory oversight is driving the market deeper into capitalism at the expense of sustainability. Inflated and misleading ESG ratings could be a remake of the mortgage-backed security credit ratings flaws that triggered the 2008-2009 global financial crisis.

Regulation is on the horizon

The arbitrary nature of the ESG rating system, relatively opaque methodology, entrenched bias from input-based disclosures, and de-emphasis on sustainability are problematic when they have the ability to influence trillions of dollars in capital markets.

Regulating ESG ratings is a crucial step to prevent the next financial crisis or prospects of greenwashing. The United Kingdom Financial Conduct Authority, the Securities and Exchange Board of India, the European Commission and Japan’s Financial Services Agency are exploring ways to tighten standards on ESG ratings. It is in the best interest of other market regulators to follow suit.