State-level issues prevent India’s green open access market from reaching its full potential

Key Findings

Commercial and industrial (C&I) consumers in India are keen to buy electricity directly from renewable energy generators to contribute to their financial and decarbonisation goals.

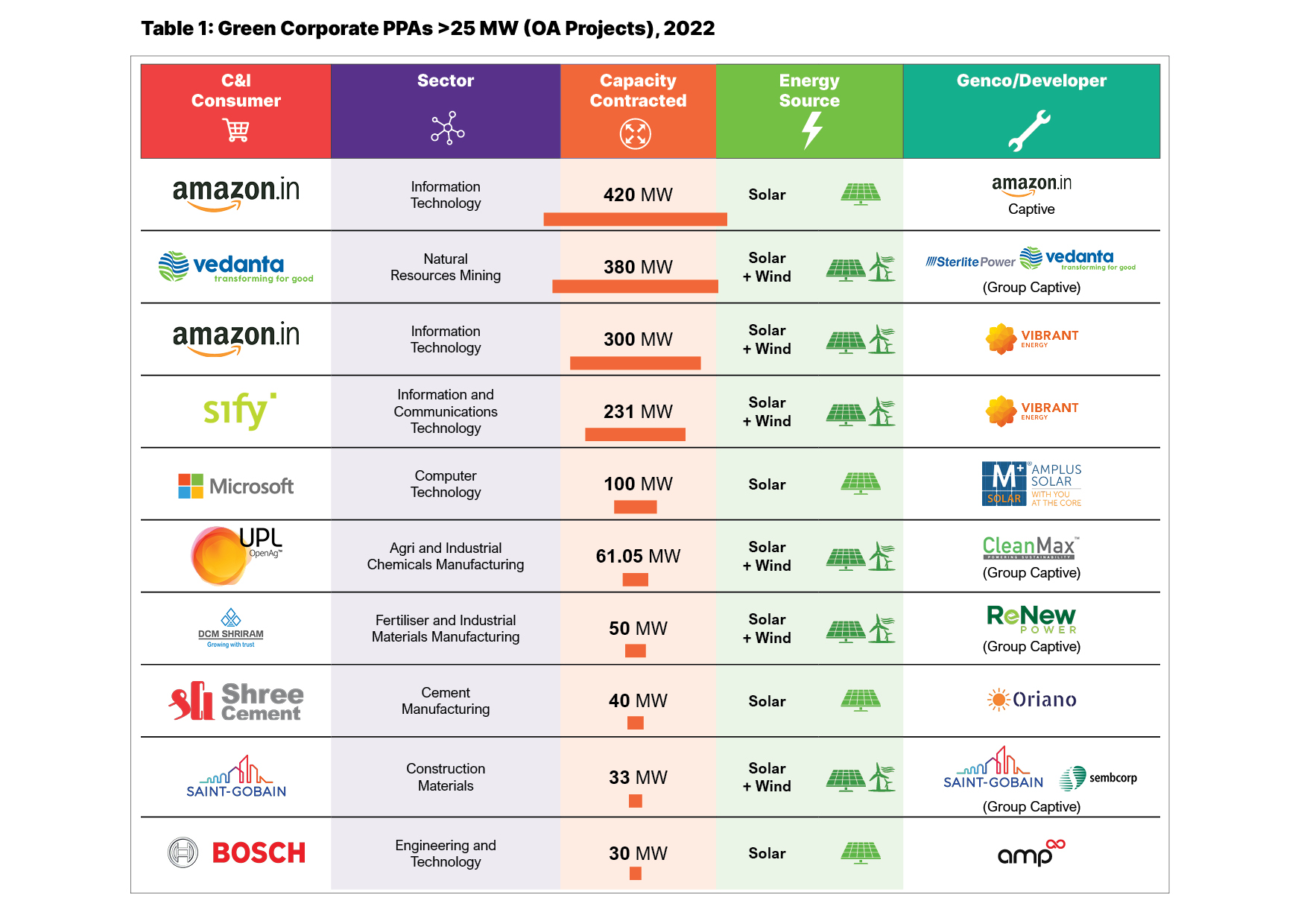

In the past 12 months, technology companies, cement, steel, and textile manufacturers have opted to purchase renewable energy through the open access route by signing corporate power purchase agreements (PPAs).

Removing state-level bottlenecks can help the country’s green open access market to grow further and reach its full potential.

Even though the state-owned electricity distribution companies fear losing their most profitable consumers, a growing green open access market also benefits them as renewable energy's overall share increases.

Commercial and industrial consumers are keen to buy green power from the open market, but several state governments are not supportive

In recent years, commercial and industrial (C&I) consumers are increasingly seeking to buy electricity directly from renewable energy generators through the open access (OA) route by signing corporate power purchase agreements (PPAs). While this has helped in the steady growth of the green OA market, removing several state-level hurdles can help it reach its full potential.

India will add a record 3.6GW of renewable energy OA capacity in FY2022-23.

India added renewable energy OA capacity of 9.7 gigawatts (GW) between fiscal year (FY) 2015-16 and FY2021-22. According to an August 2022 report by the Institute for Energy Economics and Financial Analysis (IEEFA) and JMK Research, India will add a record 3.6GW of renewable energy OA capacity in FY2022-23.

C&I consumers are keen on procuring renewable energy directly because of two reasons – financial and decarbonisation goals. While grid electricity tariffs keep increasing, renewable energy prices are less inflationary, making green corporate PPAs financially attractive. Secondly, many C&I consumers have voluntarily committed to decarbonising their businesses or are facing increased scrutiny by global investors under Environmental, Social, and Governance (ESG) frameworks.

Not just interest but the variety of C&I consumers opting for green corporate PPAs is also increasing. For example, in the past 12 months, technology companies, cement, steel, and textile manufacturers have opted to purchase renewable energy directly from generators.

Further, some entities are opting for green corporate PPAs to improve their environmental credentials, even though they are paying competitive industrial tariffs offered by the electricity distribution companies (DISCOMs).

Removing bottlenecks to propel green OA market growth

While the green OA market is growing, several state-level bottlenecks hinder the pace of growth.

DISCOMs remain reluctant to encourage direct power procurement by corporates as they do not want to lose their most profitable consumers. This becomes a significant bottleneck for green corporate PPAs as most consumers depend on the state electricity grid for transmitting the electricity they procure from the open market. In most states, C&I consumers typically cross-subsidise the tariffs paid by low-income households and agricultural consumers, which is why DISCOMs are unwilling to lose them.

While the green OA market is growing, several state-level bottlenecks hinder the pace of growth.

While the central government appears to be moving in the right direction in easing green OA power purchase (e.g., publishing Electricity (Promoting Renewable Energy Through Green Energy Open Access) Rules, 2022), some states remain reluctant to fully embrace the idea.

Rules published by the central government are guidelines, and states have to draft implementation policies.

Several states are trying to find loopholes in laws and regulations to discourage OA projects' offtake. As a result, they are either delaying approvals (e.g., Rajasthan or Haryana), removing or restricting power banking facilities (e.g., Andhra Pradesh and Gujarat), increasing transmission and wheeling charges (e.g., Andhra Pradesh) or introducing new charges (e.g., an additional surcharge in Maharashtra or reliability charge in Haryana).

The policy uncertainty and delays in approvals increase the complexity of executing green corporate PPAs.

Fully tapping the green OA market will help achieve energy transition goals

The Green OA Rules, 2022, will likely open up a new segment in the renewable energy industry. It enables smaller C&I consumers (with a connected load of 100 kilowatts (kW) or above, changed from the earlier 1MW or above) to directly procure electricity from green power producers.

The green OA market also allows smaller independent power producers (IPPs), who do not have the wherewithal to participate in large centralised government renewable energy procurement auctions, to install and run clean energy plants.

Furthermore, the green OA market helps consumers decarbonise their operations at a faster pace driven by their own environmental goals rather than depending on the transition of the national grid.

Finally, project developers could build a steady pipeline of projects rather than the stop-and-go approach that they have to adopt in case of state auctions. This will build a healthy supply chain for the renewable energy industry and expedite clean energy capacity deployment.

Renewable energy developers should adopt superior forecasting and scheduling technologies for this market to grow fully. This will reduce the impact of variability and intermittency of renewable energy on the grid and improve acceptability.

Meanwhile, regulators and policymakers should work toward providing a stable regulatory and policy environment.

Opportunities for DISCOMs too in a growing green OA market

Even though DISCOMs fear losing their most profitable consumers, a growing green OA market also benefits them as renewable energy's overall pie increases.

DISCOMs can find new revenue-generating opportunities in providing grid and balancing services, such as power banking and energy storage, in addition to conventional avenues, such as transmission and wheeling charges.

Alternatively, DISCOMs can also take advantage of the appetite for renewable energy among corporates by introducing competitive green tariffs and garnering a share of this growing market.

This commentary first appeared in Renewable Watch