Slump in eastern Australia gas demand shows no signs of easing

Key Findings

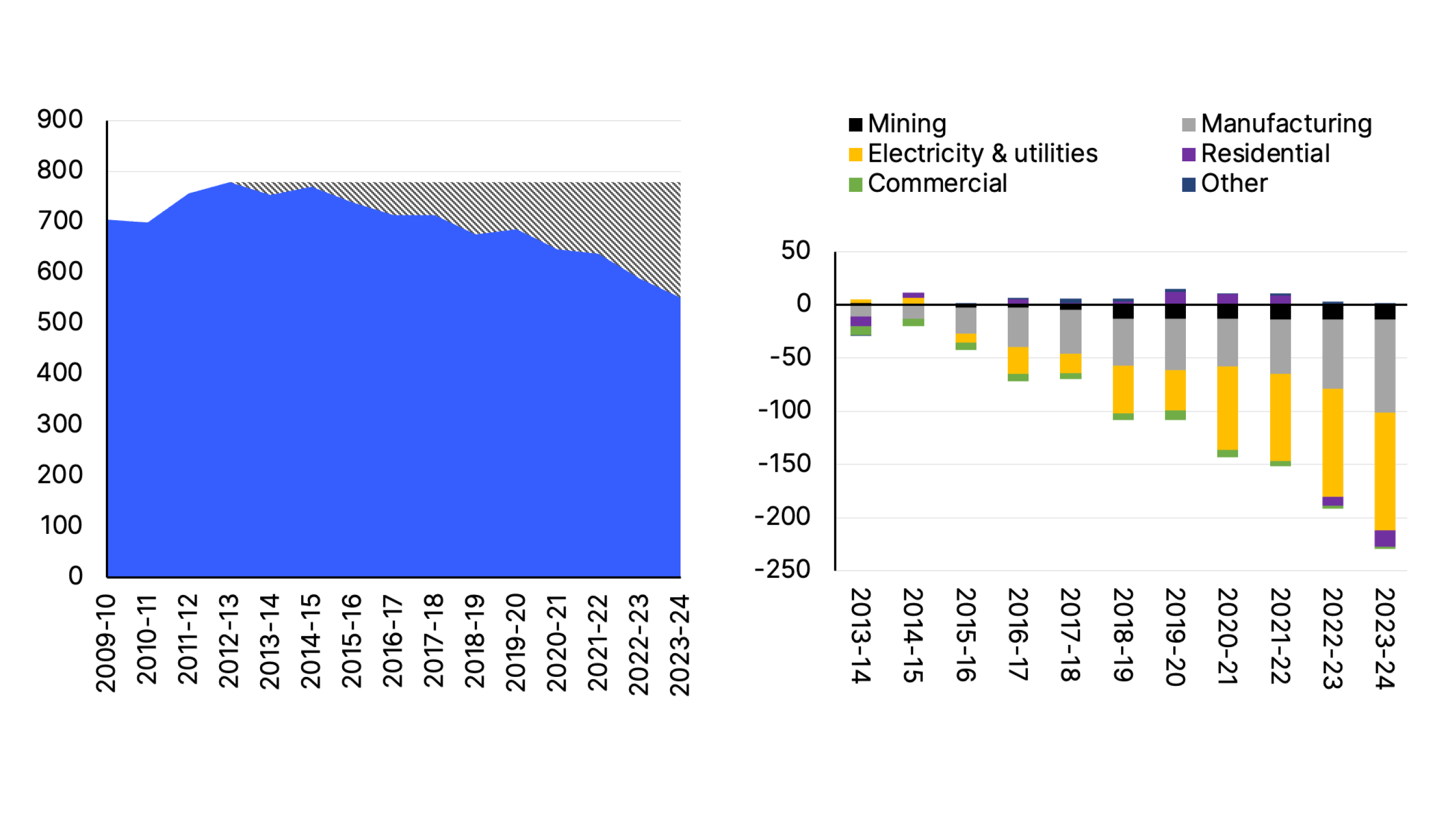

Gas consumption in eastern Australia continues to fall, down almost 30% since its peak in FY2012-13. Recent data shows gas use in manufacturing fell materially in FY2023-24, down by about 11% in that year alone.

Residential demand increased over the period from 2012-2022, but is now falling due to residential electrification and cost of living pressures.

Gas consumption in the National Electricity Market has fallen materially, down by 57% from FY2012-13 to FY2024-25 as renewable energy generation displaced coal and gas. This undermines arguments that increasing gas volumes will be needed to support renewables.

Eastern Australia’s gas market has experienced challenging conditions in recent years, with increasingly tight supply and high prices having an impact on gas users. Since peaking in FY2012-13, gas consumption in eastern Australia has been falling.

The Department of Climate Change, Energy, Environment and Water’s (DCCEEW) Australian Energy Update 2025 shows gas demand continues to fall in eastern Australia, down by more than 6% in FY2023-24 alone, following a longer-term trend of decline (Figure 1).

Figure 1: Eastern Australia’s gas demand falls across most sectors, petajoules (PJ)

Source: DCCEEW Australian Energy Update 2025.

Specifically, the Australian Energy Update shows that from FY2022-23 to FY2023-24:

- Manufacturing gas consumption fell by 23 petajoules (PJ) or 11%.

- Consumption for electricity, gas, water and waste services fell by 8PJ (4%).

- Residential demand fell by 8PJ (6%).

Longer-term declines are significantly larger, with total gas consumption in eastern Australia (excluding gas used for oil and gas extraction) falling by 29% in just over a decade from FY2012-13 to FY2023-24. Most of this demand decline has come from manufacturing and electricity generation, sectors that tend to be price-sensitive.

More recent data from the Australian Energy Market Operator (AEMO) shows residential and commercial and industrial demand declined further in FY2024-25, falling by an additional 11PJ year on year. In contrast, demand for gas for LNG exports from Queensland increased by 16.6PJ in FY2024-25.

Manufacturing in Victoria has been particularly affected, with gas consumption falling by almost 33% from FY2012-13 to FY2023-24. This is despite Victoria being a net exporter of gas to other states for much of the past two decades. In addition, AEMO’s Quarterly Energy Dynamics (QED) Q2 2025 report shows that in Victoria, industrial demand (Tariff D) recorded the largest quarterly fall (year on year) in more than 25 years, down 8%.

Residential switch-off gas gains pace

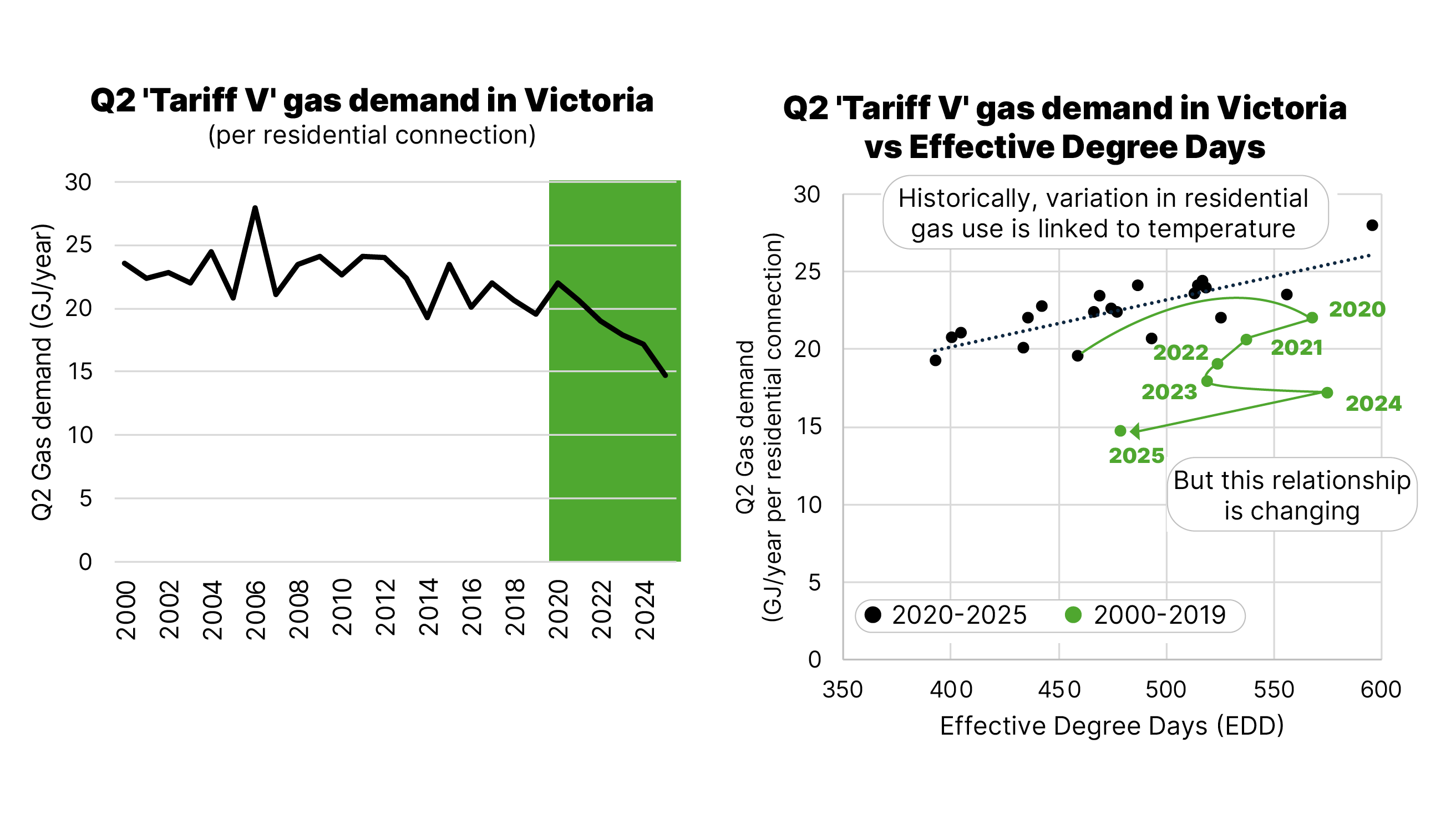

The decline in residential gas demand is relatively new. In contrast with gas use in manufacturing and electricity generation, residential gas demand grew from FY2011-12 to FY2021-22. However, gas use in households declined in 2023 and 2024. AEMO attributed this to increasing residential electrification, particularly of heating load, and high gas prices in the context of broader cost of living pressures.

The QED report shows the decline in gas demand for residential and small commercial use (Tariff V) accelerated in the second quarter of 2025, with a 28% drop year on year, the lowest Q2 level in 20 years.

Figure 2 shows the volume of Tariff V gas demand per residential connection has declined sharply in recent years, with a 33% reduction between Q2 2020 and Q2 2025. Historically, most variability in Tariff V gas demand has been weather-related, with cooler winters driving higher gas demand for heating. However, this relationship is changing rapidly, and weather alone cannot explain the downwards trend in recent years.

Figure 2: Victoria’s declining residential gas demand

Source: IEEFA analysis based on AEMO and Australian Energy Regulator (AER) data.

Gas (and coal) power generation falls on rise of renewables

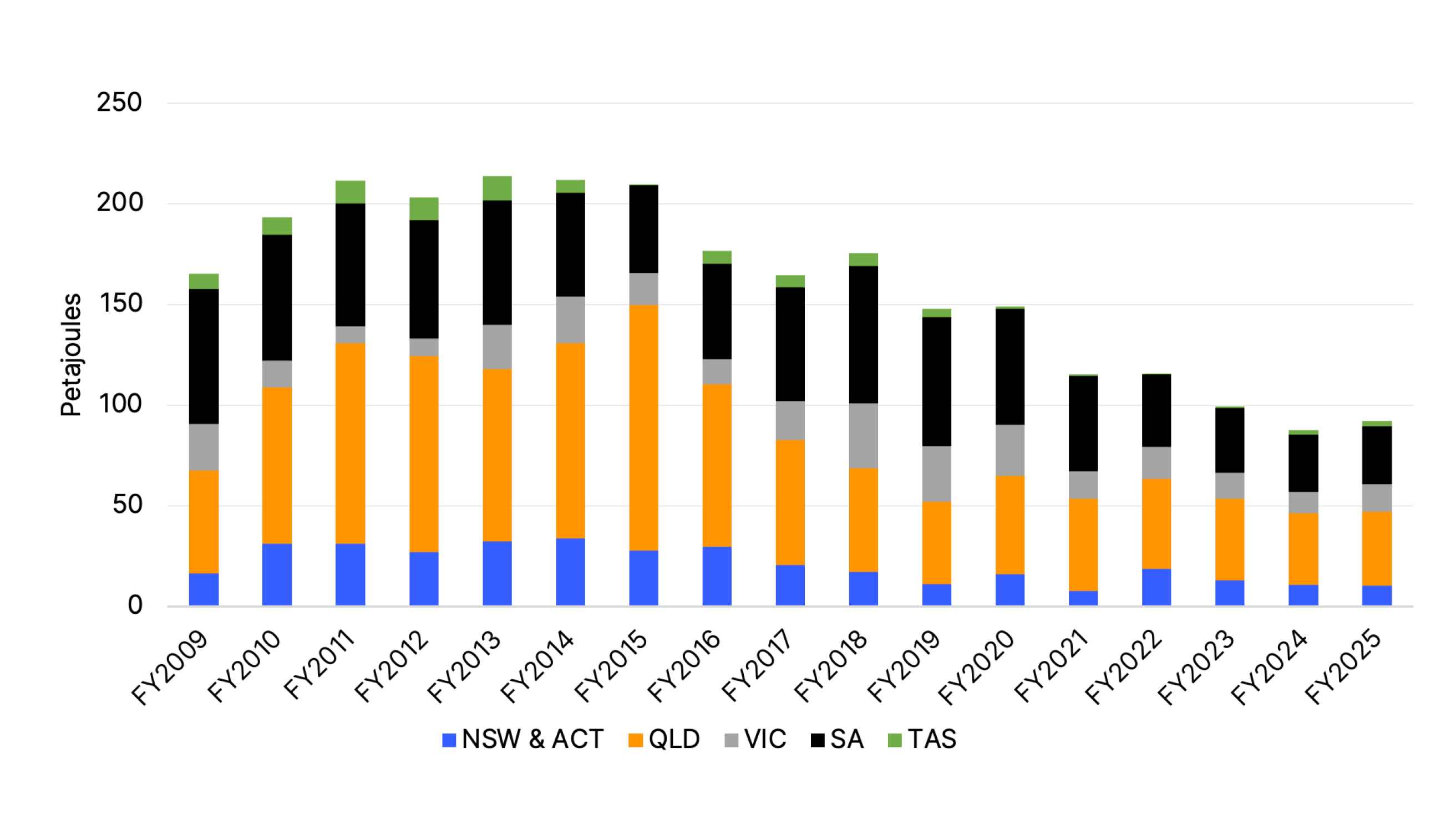

Gas consumption for electricity generation in eastern Australia’s National Electricity Market (NEM) has also fallen materially over the past decade, from 214PJ in FY2012-13 to 92PJ in FY2024-25, or about 57% (Figure 3). However, FY2024-25 marked a slight reversal of the declining trend for gas generation, albeit still well below pre-2020 levels.

Figure 3: Gas consumption for electricity generation in the NEM

Sources: IEEFA; AER: Average daily gas used for gas powered generation at 5 September 2025.

Note: The AER’s data relates to gas used for generation in the NEM. It does not include off-grid generation, which the Australian Energy Update 2025 does include.

The largest declines in gas use in electricity in the NEM have been in Queensland and South Australia, which collectively account for most gas-based power generation.

Declining gas and coal generation has coincided with increasing generation from renewable energy sources, particularly wind and solar. From FY2012-13 to FY2023-24, the share of gas-based power generation in the NEM fell from 15% to 7% and coal-based generation from 70% to 53%, while renewable generation increased from 15% to 39%.

Grid-scale and distributed solar generation increased by 17% and 15%, respectively, in the year to Q2 2025. Wind generation was also higher, up 31% year on year due to higher wind speeds. Meanwhile, battery output more than doubled, increasing by 119% since Q2 2024.

In contrast, gas-based power generation fell by 12% on an average quarterly basis across Q2 2025, in part due to strong wind generation. However, colder temperatures and lower renewable generation caused a spike in gas generation in June 2025, with average generation in that month the highest since 2007.

Despite arguments that more gas volumes will be needed to support renewables in the NEM, it is clear the role of gas in the NEM is narrowing, indicating the transition to a cleaner energy system is well advanced.

This article was first published by Energy News Bulletin.