PREPA’s proposed debt plan creates billion-dollar gap in funds to fix the grid

Key Findings

The current plan to refinance PREPA’s $8+ billion in old debt will also leave a large capital cost to complete the grid unfunded, creating a debt burden that precludes the utility from borrowing in the future

The $14 billion in federal funds that Puerto Rico is slated to receive is not enough to rebuild the grid—additional amounts needed to pay for the grid rebuild will come out of rate increases

The rate implications of paying for both legacy debt and continued use of high-priced fossil fuels will produce ongoing fiscal dysfunction in Puerto Rico’s electric grid

The current debt restructuring plan sacrifices sound capital and debt management planning for the needs of legacy debt holders. In effect, the plan mortgages the future

IEEFA has raised several issues regarding the newest restructuring agreement for the Puerto Rico Electric Power Authority (PREPA). Those issues pertain to the economy’s ability to carry legacy debt, increased electricity prices needed to cover old debt, and an inability of PREPA and its successors (LUMA, New Fortress Energy and others) to actually deliver operational improvements.

The current plan to refinance PREPA’s $8+ billion in old debt will also leave a large capital cost to complete the grid unfunded. It will create a debt burden that precludes the utility from borrowing in the future to raise the money necessary to complete the rebuild of the grid.

Here is how the overall situation looks:

On the plus side of the ledger, Puerto Rico is to receive some $14 billion in federal funds. This is not enough to rebuild the grid. At minimum, a rebuilt grid (assuming proper management of existing dollars) is likely to require over $20 billion over the next 10 years. The fiscal plan warns that additional amounts needed to pay for the rebuild of the grid will come from rate increases.

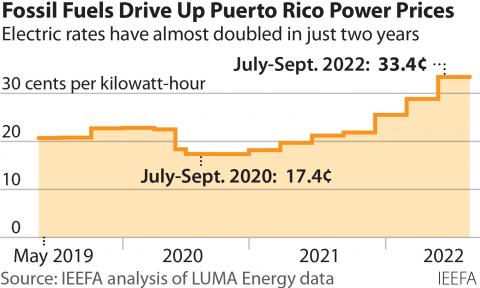

The government’s plan for the electrical system is spelled out in the approved Integrated Resource Plan (IRP). The plan is reasonable, as its chief priority is renewable energy, promising improved environmental compliance and reduced fuel costs. Fuel currently can run as much as 60 percent of the electricity system’s annual budget when oil and gas prices are high—and they have been in the last few years. At times, the skyrocketing oil and gas prices have pushed Puerto Rico’s electricity price beyond 30 cents per kilowatt hour (kWh).

Continued reliance on fossil fuels makes the system vulnerable to wild swings in prices. The recent appointment of New Fortress Energy to run the generation system from a policy point of view means that decisions regarding the current generation system will likely expand and extend the life of natural gas usage on the island. New Fortress Energy sells natural gas as its core business—it has no incentive to reduce the use of fossil fuels. The IRP’s concerns about increasing renewable energy sources in the Puerto Rico grid are likely to be subverted by the appointment of this company.

On top of that, laying on $5.4 billion in new debt (as proposed by the debt restructuring plan) adds 3 to 4 cents to the price of electricity. This will push rates near 30 cents per kWh at a time of shrinking population and customer base and increasing demands by the public for adoption of rooftop solar. The legacy debt burden will crowd out future borrowing to complete the grid.

With the risk that there will be no fuel savings from the reorganization plans that LUMA is expected to implement, it becomes even more urgent that there be no debt service. The rate implications of paying for both legacy debt and continued use of high-priced fossil fuels will produce ongoing fiscal dysfunction, including non-payment of debt, more shortchanges to the pension system, and a continuing shell game of payments to fuel producers.

This conflict is not reconcilable. The current debt restructuring plan sacrifices sound capital and debt management planning for the needs of legacy debt holders. In effect, the plan mortgages the future.

The $14 billion of federal funds is a once in a lifetime gift to Puerto Rico. It does not require debt service—that is, money paid each year to pay off the loan. But, under the proposed debt restructuring agreement, the assets created by the federal money would be generating revenue that would then be used to pay back the legacy debt. The federal money would effectively be used to bail out the failed bonds, but the purpose of the federal money is to rebuild the grid.

The new debt plan should be rejected.

Tom Sanzillo ([email protected]) is IEEFA director of financial analysis