New Fortress Energy: Increasing indebtedness, but still paying big dividends to shareholders

Key Findings

New Fortress Energy has taken on additional indebtedness to pay off loans coming due next year.

The three major credit ratings agencies—Moody’s, S&P, and Fitch—have all downgraded NFE’s credit rating deep into “junk bond” territory over the past several months.

The company’s shares have shed 75% of their value so far this year, and shareholders have filed a growing docket of class action suits.

Any prospective lender or government partner looking at the company’s financials would find ample reason to avoid relying on New Fortress Energy as a stable, reliable business partner.

In early November, New Fortress Energy (NFE), a company that focuses on developing new liquefied natural gas (LNG) projects, revealed that it may have to declare bankruptcy if it can’t refinance $875 million in debt by next July.

Just before Thanksgiving, the company revealed that it had staved off the bankruptcy threat by taking on $2.7 billion in additional indebtedness at substantially higher interest rates.

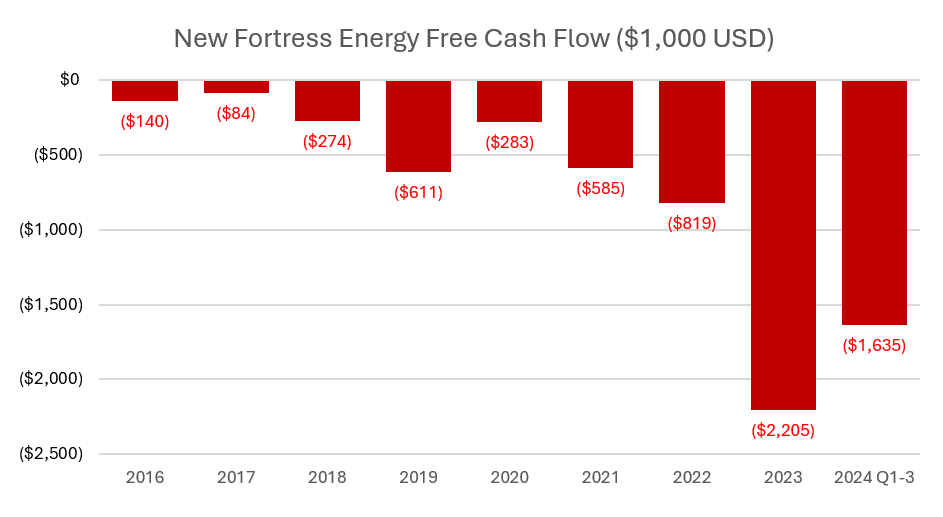

For well-informed investors, the news of NFE’s financial fragility came as little surprise, given that the company has racked up a dismal track record of financial losses and canceled and delayed projects. Perhaps the clearest indicator of NFE’s financial stress is the company’s massive negative free cash flows (FCF).

Figure 1:

Free cash flow—a company’s operating cash flows minus its capital expenditures—demonstrates how much cash a company’s core operations generate. Companies with positive FCF can afford to repay their debt and reward stockholders with dividends and share buybacks. Companies with negative FCF typically must borrow money, issue new stock, sell assets, or draw down cash stockpiles just to stay afloat. Since 2016 NFE has accumulated negative free cash flows of $6.6 billion and roughly $8 billion in debt—digging itself into a deep hole from which it may not emerge.

When it launched in 2019, NFE promised to develop projects along the entire LNG value chain, including liquefaction terminals, tanker trucks, LNG ships, floating storage units, import terminals, and gas-fired power plants. But many of its projects have suffered from cancellations, delays, and financial impairments:

- In its initial public offering (IPO) prospectus, NFE claimed to be developing an LNG liquefaction project in the Marcellus area of Pennsylvania. NFE later revealed that it planned to produce LNG in northeastern Pennsylvania and transport it by truck or rail to a port in New Jersey, along the Delaware River. But the project faced intense public opposition and appears to have been put on indefinite hold, with the company no longer mentioning the project in either of its last two annual reports.

- NFE also intended to build five to ten additional liquefaction projects over five years, but only succeeded in launching one small liquefaction terminal in Miami by the fifth anniversary of its IPO.

- In August 2024, NFE launched its long-delayed Altamira Fast LNG facility off the coast of Mexico. In October 2022, the company claimed that the project would achieve “mechanical completion” in March 2023, and would be delivered to Mexico for “commencement of operations” soon thereafter. In June 2023, the company stated that the project would begin operations in the third quarter of that year. But the project suffered repeated setbacks, culminating in a fractured pipe in April 2024. After quick repairs, the project shipped a partial cargo in August 2024, but immediately shut down again for maintenance. Although it has shipped several additional cargoes since then, LNG shipping data shows that the Altamira facility continues to underperform expectations.

- NFE has taken write-offs or impairments on assets in Brazil, Cameroon, Puerto Rico, and elsewhere.

The three major credit ratings agencies—Moody’s, S&P, and Fitch—have all downgraded NFE’s credit rating deep into “junk bond” territory over the past several months, especially on the heels of the poor performance of its Fast LNG project. Fitch and S&P cited the delay in the Fast LNG project as part of their rationale for downgrading the company in August 2024.

Despite its ongoing financial difficulties, New Fortress has paid over $1 billion in dividends to

shareholders since 2020—a shockingly large payout that has exceeded the $900 million in total capital contributions by equity investors since the company’s inception. These huge dividends to equity investors have undoubtedly been a thorn in the side of debt investors, who are at risk of receiving cents on the dollar for debt that New Fortress may not be able to repay.

Equity investors are losing patience with the company as well. The company’s shares have shed 75% of their value so far this year, and shareholders have filed a growing docket of class action suits, alleging that the company repeatedly lied to investors about the schedule and progress of the company’s Fast LNG project. Reflecting this investor skepticism, the announcement of the recent refinancing barely moved stock prices.

While it looks like New Fortress will be able to avoid bankruptcy next year as a result of its latest financial transaction, the question remains of how long it will be able to continue rolling over its debts. The company's financial history is littered with massive red flags. Any prospective lender or government partner looking at the company’s financials would find ample reason to avoid relying on New Fortress Energy as a stable, reliable business partner.