My View: Dennis Wamsted – Keep San Juan power plant shut down

Key Findings

Enchant Energy’s $1.6 billion plan to install Carbon Capture & Storage (CCS) at the San Juan Generating Station in New Mexico makes no sense.

Enchant has been unable to secure financing, power buyers, transmission access and carbon storage area.

The CCS project would create more climate-warming CO2 simply to capture it and profit from the federal government’s recently expanded 45Q tax credits.

Nov. 7, 2022 (Santa Fe New Mexican) – The San Juan Generating Station in northwest New Mexico stopped generating electricity Sept. 29, the final step in a retirement planned by its majority owner and operator, Public Service Company of New Mexico (PNM).

An outside company, Enchant Energy, continues to say it wants to buy and reopen the plant, with plans to spend $1.6 billion to eventually install carbon capture equipment at the aging coal-fired power facility.

Yet Enchant:

- Has been unable to secure financing for the project

- Has no contracted buyers for the power it would produce

- Has no coal contract and would face a costly reopening of the coal mine near the plant

- Has no transmission access to sell power from the plant, and

- Has no place to store any captured carbon dioxide.

Now, with the coal plant closed, Enchant needs to face reality — the game is over. Restarting either of the two units that closed this year would amount to nothing more than creating pollution to reap corporate profits from the recently expanded federal 45Q tax credits.

Enchant’s effort to retrofit the aging coal-fired power plant with carbon capture equipment has been troubled from the beginning. It was proposed in 2019 by Enchant’s predecessor, Acme Equities, a small hedge fund backed by two executives with little experience in the electric power sector. At the time, Acme said the planned carbon capture and storage facility would be operating by 2025, but little if any progress has been made in the last three years.

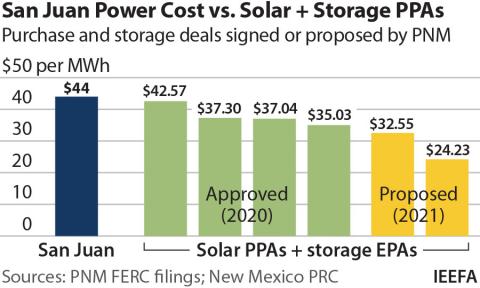

Beyond these myriad issues, the closure of San Juan Unit 4 points to another problem: There is no longer any rationale for the Enchant project because the plant’s power is no longer needed. All four units at the plant — 1,684 megawatts (MW) of total generating capacity — are now closed, and the lights have stayed on. The other owners and power purchasers have moved on to cleaner and cheaper resources. PNM, in particular, has been planning and building replacement power resources, largely solar coupled with battery storage, to cover the electricity it received from San Juan.

In addition, new CO2 emissions regulations under the terms of New Mexico’s Energy Transition Act will make it difficult or impossible to continue operating San Juan without a state-approved variance after Jan. 1, 2023.

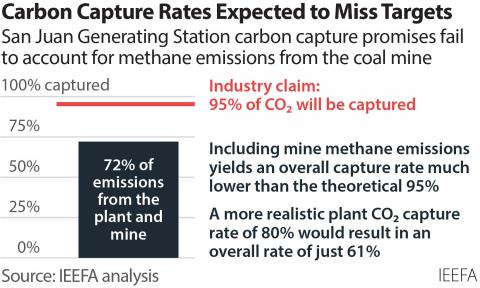

Cindy Crane, Enchant’s CEO, recently said permitting activities for the project are likely to take as long as 15 months. Construction will require an additional three years, meaning the facility would be operating unabated through the end of 2026. In the last four years, Unit 4 (the largest of the four units at San Juan at 507MW) has emitted an average of 3.78 million tons of CO2 annually. This means an additional 15.1 million tons of CO2 could end up in the atmosphere over the next four years — even though the power is not needed and there is no certainty the project will even get built.

Even if the company does go ahead, Enchant’s Crane said the project, which involves restarting both Unit 1 and Unit 4 (totaling 847MW) at the plant, would only net about 500MW of cleaned-up capacity. The remainder would be required to operate the carbon capture equipment, the so-called parasitic load. Assuming Enchant’s construction costs don’t rise even more, that comes out to an estimated $3.2 million per megawatt ($1.6 billion divided by 500MW) — roughly double the average capital cost for both new onshore wind capacity and solar PV linked with battery storage, according to the Energy Information Administration’s latest data.

While Enchant’s legacy coal project has struggled, renewable energy developers in New Mexico have been adding capacity quickly to the state’s grid. One of the most successful is Pattern Energy, a major wind energy developer that built the 1,051MW Western Spirit Wind project in Central New Mexico in just over 12 months, breaking ground in early 2021 and beginning commercial operations at the end of February this year.

Pattern Energy is now developing a 3,000MW wind project in New Mexico, SunZia Wind. Construction is scheduled to begin in 2023, with full commercial operations slated for 2026. In connection with the wind project, Pattern acquired the proposed SunZia transmission line project from SouthWestern Power Group in July, which it also expects to complete by 2026. The 550-mile-long, high-voltage line and the wind project are touted by Pattern as “the largest renewable energy infrastructure project in U.S. history,” with a total investment of more than $8 billion.

If Enchant elects to proceed with the San Juan project, it should be seen for what it is — a corporate decision to create climate-warming CO2 simply to capture it and profit from the federal government’s recently expanded 45Q tax credits. And while that might benefit Enchant, customers in New Mexico would be better served if more capital were invested in cleaner, cheaper and quicker-to-build wind, solar and storage capacity.

This article appeared as an op-ed in the Santa Fe New Mexican on November 7, 2022.