Is Italy unknowingly importing Russian LNG via Spain and other routes?

Key Findings

There is a lack of clarity about whether additional Russian LNG is being imported into Italy besides reported import volumes.

Spain continues importing Russian LNG and re-exporting LNG to other countries. The largest European importer of Spanish LNG is Italy, and there is uncertainty around the source of the gas.

It is imperative to understand why Spain’s imports of Russian LNG have been increasing since January 2022.

While Italy is planning to build two new LNG terminals, IEEFA estimates that the country’s gas demand and LNG imports will continue decreasing by 2030.

From May 2022 onwards, Italy began importing LNG from Russia. In Q1 2023, Qatar and the U.S. were the main sources of LNG shipped to Italy, accounting for 39% and 28%, respectively, followed by Algeria, Spain, Nigeria, Egypt, Russia, Equatorial Guinea and Mozambique. Besides the 3% of Russian LNG imports in Q1 2023, how much more Russian LNG could Italy be receiving re-exported from other countries?

Spain started importing Russian LNG in 2018, and since then imported volumes have been increasing, reaching a peak in April 2023 of 6,513 gigawatt hours (GWh), based on statistics from Corporación de Reservas Estratégicas de Productos Petrolíferos (CORES). Spain re-exports the LNG it imports, and the biggest buyers are Italy via LNG shipments and France via the VIP Pirineos gas pipeline.

Re-exports occur when foreign LNG shipments are offloaded into storage tanks located at terminals and then subsequently reloaded onto tankers for delivery to other countries. LNG can also be re-exported via ship-to-ship transfers.

Italy also imports gas via pipelines from Azerbaijan through Greece. Could there be a possibility that gas from other sources is being transported to Italy in that same pipeline?

The majority of Greece's LNG imports in Q1 2023 came from the U.S., 11% came from Russia and 5% from Spain. While Eurostat reported that Italy imported around 750 million cubic meters (mcm) of gas from Azerbaijan in January 2023, that same month Italy reported imports of 852 mcm of gas via the Trans Adriatic Pipeline (TAP), the same pipeline that brings Azeri gas to Italy. This leaves 102 mcm of imported gas via the TAP from an unknown origin.

Italy’s gas demand has declined steadily in the past ten years

Italy’s gas consumption has been declining since 2010, when it peaked at 83.1 billion cubic metres (bcm). While Italy’s gas consumption declined 19% year on year (YOY) in the first quarter of 2023, its LNG imports increased 38%. Most LNG shipments came from Qatar and the U.S., with significant percentages also from Spain and Russia.

Comparing Q1 2023 with Q1 2022 values, Italy’s pipeline imports fell 24% and exports dropped 31%, while LNG imports increased 38%.

Based on the behaviour of Italy’s gas consumption in recent years plus the REPowerEU policies that are being put in place, IEEFA estimates that Italy’s gas demand and LNG imports will continue decreasing through 2030, resulting in a less than 50% utilisation rate of LNG terminals that will be operational at that time.

A gas hub for Europe? Italy’s infrastructure network

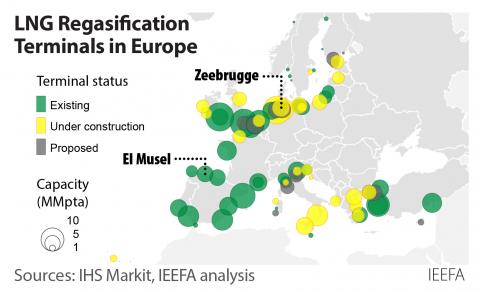

Italy has six connections to pipelines and four LNG regasification terminals.

The Panigaglia and Toscana LNG terminals are fully regulated, offering third-party access, whereas Adriatic LNG operates partly under an exemption regime, with 80% of its capacity exempted and 20% regulated. Third-party access is governed by the provisions of European Union and national law, ensuring open access to any interested party.

Italy is planning to build two new LNG terminals. Another floating storage regasification unit (FSRU) operated by Snam with 5 bcm of capacity is expected to be operational by 2024. By 2026, a large onshore LNG terminal in Sicily called Porto Empedocle with 8 bcm of capacity is expected to be operational. It will be operated by Nuove Energie.

Spain is a leading European re-exporter of LNG, including from Russia

Spain’s imports of Russian LNG have been increasing since January 2022, while imports of U.S. LNG have been declining and of Nigerian LNG have been steady.

In 2022, Spain was the biggest re-exporter of fossil gas and LNG to European buyers. 338 LNG ship unloadings were made in 2022, compared to 254 in 2021. Recharging operations for re-export—which increased 45% to 25 terawatt-hours (TWh) compared to 2021—stood out.

The largest European importer of Spanish LNG is Italy, accounting for 86% of Spain's LNG re-exports to Europe and 74% of all re-exports in Q1 2023. In the same period, Spain imported around 7.56 bcm of LNG, including around 1.77 bcm from Russia, and re-exported around 0.63 bcm to European buyers, including 0.56 bcm to Italy.

Yet there’s no clarity on the origin of the LNG re-exported from Spain to Italy.

Most of the Russian LNG imported by Spain originates at the Yamal LNG plant, which has an output capacity of around 16.5 million tons per year and is operated by JSC Yamal LNG, a joint venture of Novatek (50.1%), TotalEnergies (20%), the China National Petroleum Corporation (20%) and Silk Road Fund (9.9%).

The main long-term LNG buyers from the Yamal facility are China's CNPC, Gazprom Marketing & Trading, Naturgy (a Spanish multinational fossil gas and electrical energy utilities company), Novatek and TotalEnergies.

Is Russian gas finding other routes into Italy?

Italy imports large amounts of gas from Azerbaijan and Algeria. Imports from Azerbaijan, via the TAP, were the second-largest source of imports in Q1 2023 after the gas imported from Algeria via the Transmed pipeline.

The TAP transports gas from its eastbound entry point of Kipoi via Greece and Albania to Italy. The TAP’s capacity has been booked based on long-term gas transportation agreements. A further 5% of the capacity is offered through auctions of different standard short-term forward capacity products.

According to Italy’s Ministry of Environment and Energy Security, gas imports in Q1 2023 via the TAP at the Meledugno interconnection point were slightly higher than the reported Eurostat data on Italy’s imports of Azerbaijan’s gas.

There is uncertainty around the slight difference in gas flows into Italy from the east. Could it be Russian LNG imported via Greece's Revithoussa LNG Terminal?

A clear understanding of gas and LNG routes is needed

Italy has been showing an interest in reducing its dependency on Russian gas—new LNG terminals have been planned and built, plus new gas deals have been signed. In March this year, the FSRU Golar Tundra arrived in the port of Piombino with the intention of helping Italy diversify further away from Russian gas. And on 21 March 2023, the Italian Economic Development Minister Adolfo Urso said that Italy will be independent of Russian gas by 2023.

Yet there's no clarity about whether additional Russian LNG is being re-exported to Italy from other countries.

Finding a way to track the source of the LNG that Spain is selling to Italy or the gas being transported via the TAP pipeline is imperative if Italy is to uphold its intentions to stop importing gas from Russia.