India’s rising prominence in solar photovoltaic manufacturing

Key Findings

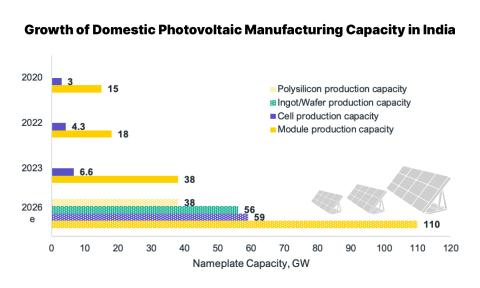

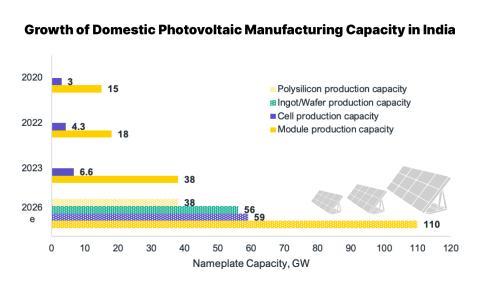

With India's module solar photovoltaic (PV) module manufacturing capacity set to reach 110 gigawatts (GW) by 2026, the country will attain self-sufficiency and be able to target the export market aggressively.

India’s policies have been supportive of local manufacturing. Not only has the government tried to curtail PV imports, but it has also taken steps to boost manufacturing through financial incentives.

India’s PV manufacturing sector does have some challenges. The biggest challenge is an overreliance on imports, particularly for upstream components such as polysilicon, ingots/wafers, ancillaries and PV machinery.

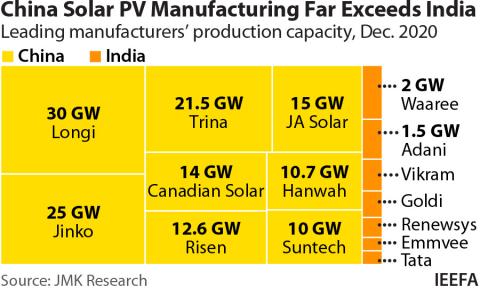

Since the early 2010s, China has been the world’s foremost photovoltaic (PV) equipment supplier. But, the dragon may no longer breathe easy, with India set to offer a stiff challenge to its dominance.

Supportive policies by the Indian government are propelling PV manufacturing in India. According to a recent report by the Institute for Energy Economics and Financial Analysis (IEEFA) and JMK Research, India's solar PV module capacity is set to reach 110 gigawatts (GW) by 2026. At that point, India will attain self-sufficiency and be able to target the export market aggressively.

World awaits an alternative

In the last 12 years, China’s share in global solar module production has increased from around 50% in 2010 to around 70% in 2021 and 2022. As a result, a disruption in China can send shockwaves across countries seeking to add solar power generation capacity.

Today, most PV importers are pursuing a "China+1" strategy for sourcing solar PV to protect themselves against any future supply chain shocks pertaining to a single manufacturing market. Some, like the United States of America (the U.S.) and the European Union (EU), seek to boost domestic manufacturing through policies and incentives.

For example, the U.S. imposed anti-dumping duties (ADD) on Chinese PV imports. In addition, it recently enacted the Inflation Reduction Act (IRA), a comprehensive plan that offers substantial incentives to encourage local PV manufacturing.

India’s policy push

India’s policies have been equally supportive of local manufacturing, arguably even better than other countries. Not only has the government tried to curtail PV imports, but it has also taken steps to boost manufacturing.

It began by introducing a safeguard duty in 2018. Over the years, it has introduced several tariff barriers, like basic customs duty, and non-tariff barriers, such as the Approved List of Models and Manufacturers.

At the same time, the government also promoted local manufacturing of PV modules through its production-linked incentive (PLI) scheme, with a total outlay of approximately US$3.2 billion over two tranches.

The results of the policy measures by the Indian government are already visible. For example, nameplate capacity for PV cells and modules in India has more than doubled to reach 6.6GW of cells and 38GW of modules in 2023, even though they operate at only 50-60% capacity.

The PLI scheme will likely play a vital role in the coming years to drive the growth of India's entire PV manufacturing ecosystem. Apart from attaining a module manufacturing nameplate capacity of 110GW by 2026, we also expect India to have a significant presence in all aspects of PV manufacturing, including cells, ingots/wafers and polysilicon.

Exports starting to rise

According to the IEEFA and JMK Research report, Indian exports surpassed 5x in value terms in the fiscal year (FY) 2023 compared to FY2022. This is because of two reasons – an already sizeable module manufacturing capacity in India and, more importantly, the restrictions imposed on Chinese goods by other countries.

All leading tier-1 manufacturers in India say they have considerable interest and demand from export markets for their high-quality and high-wattage lines of modules. Some are even earmarking 20-25% of their manufacturing capacity for export markets.

However, the U.S. accounts for nearly all (93%) of India’s solar PV exports. With the U.S. and the EU looking to augment their own manufacturing capacities, India should also start looking for other markets.

Some hurdles remain

Despite the positives, India’s PV manufacturing sector has to grapple with some challenges. The biggest challenge is an overreliance on imports, particularly for upstream components such as polysilicon, ingots/wafers, ancillaries, and PV machinery.

Competing with China on costs is another significant challenge for Indian manufacturers to overcome. China itself is augmenting its capabilities multi-fold in polysilicon and wafer manufacturing. Indian companies will find it hard to maintain cost competitiveness after Chinese companies set up their upstream manufacturing plants.

Indian companies also continue to face the ongoing challenge of a shortage of skilled manpower to handle advanced machinery for cells and other upstream components.

Policy stability required

Solar PV manufacturing in India needs the continued support of the government till it truly becomes competitive on the global stage.

The government recently announced ALMM deferment by one year until March 2024, which is a big relief to the developers but a temporary setback to domestic manufacturers. Over the next decade, the government must strike a balance between the requirements of developers and supporting PV manufacturers.

The sun seems to be shining bright on the future of India’s solar PV manufacturing sector. The government must maintain policy stability to keep the dark clouds of uncertainty away. Doing so will give India the opportunity to become a key cog in the world’s future energy supply chain.

This article was first published by Renewable Watch.