India could become the world’s second-largest solar photovoltaic manufacturer by 2026

Key Takeaways:

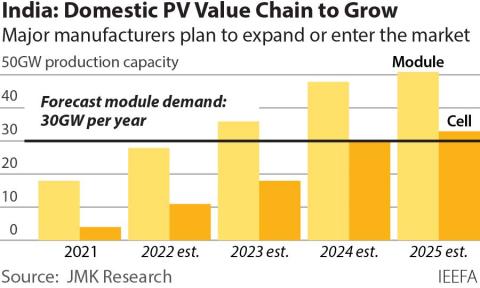

The Indian solar photovoltaic (PV) manufacturing industry is growing by leaps and bounds, with frequent announcements of expansion or new investments in the sector.

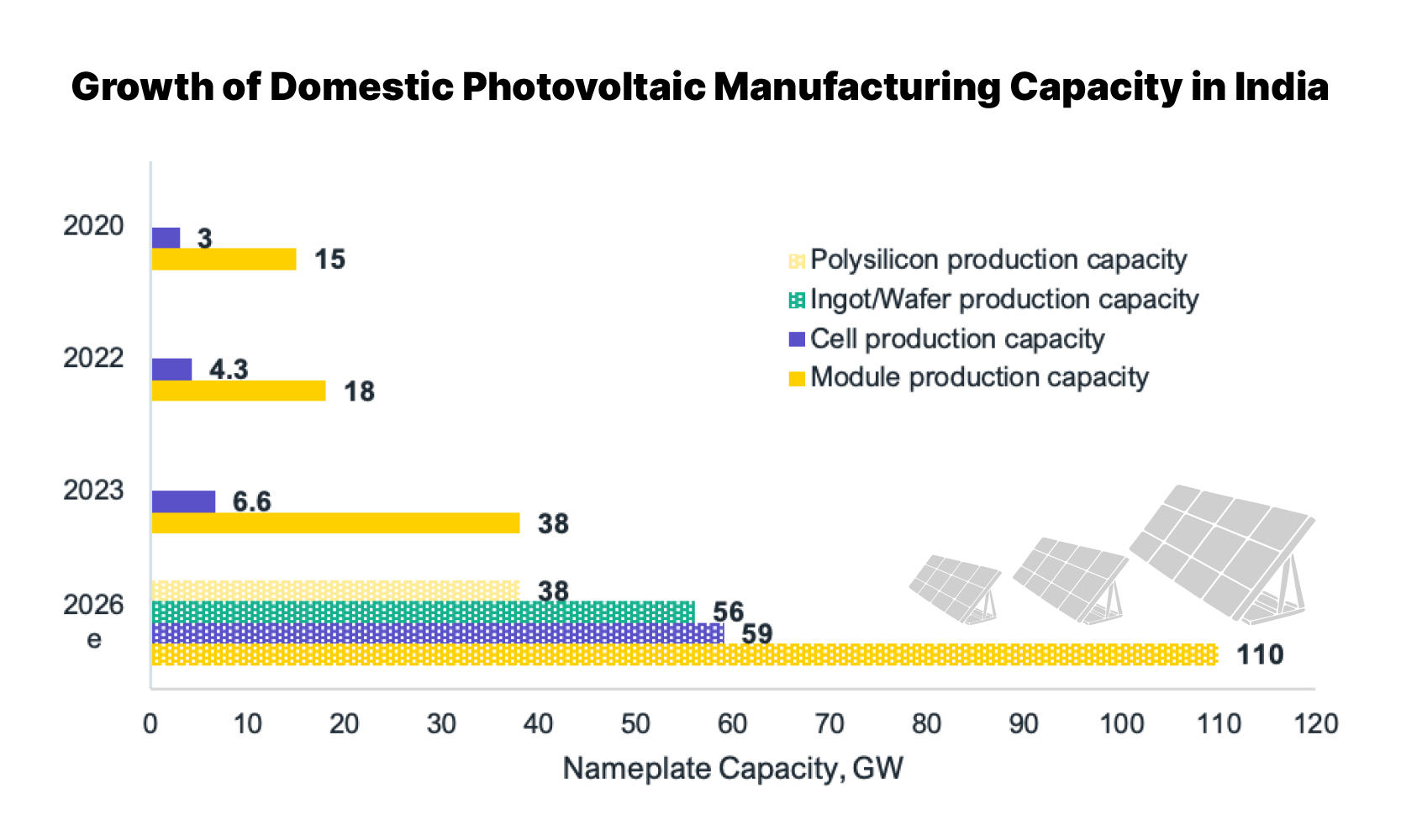

India's cumulative module manufacturing nameplate capacity more than doubled from 18GW in March 2022 to 38GW in March 2023.

Upon attaining self-sufficiency in two to three years, India must focus on expanding its reach in other global markets and offer its PV products as a viable alternative to China in terms of quality and price.

The industry still faces some headwinds, including continued reliance on imports, especially for upstream components (polysilicon, ingots/wafers), ancillaries and PV machinery.

India could see 110 gigawatts of module manufacturing capacity come online in the next three years, which will make the country self-sufficient.

4 April 2023 (IEEFA South Asia & JMK Research): With 110 gigawatts (GW) of solar photovoltaic (PV) module capacity set to come online in the next three years, India will quickly become self-sufficient and the second-largest PV manufacturing country after China, finds a new joint report from the Institute for Energy Economics and Financial Analysis (IEEFA) and JMK Research & Analytics.

“The future of the Indian PV manufacturing sector is bright. The favourable policy environment created by the Indian government is helping the PV manufacturing industry to grow rapidly, which is evident in the frequent announcements of expansions or new investments in the sector,” says the report’s co-author Vibhuti Garg, Director, South Asia, IEEFA.

“After India attains self-sufficiency in two to three years, the next course of action should be to challenge and compete for dominance in both quality and scale in the global PV module market. Despite the aggressive market drivers, there are minor hurdles that are impeding the growth of the PV manufacturing industry. Therefore, policy stability is necessary to sustain investor confidence in the market,” she adds.

The report finds that India’s cumulative module manufacturing nameplate capacity more than doubled from 18GW in March 2022 to 38GW in March 2023.

India’s cumulative module manufacturing nameplate capacity more than doubled from 18GW in March 2022 to 38GW in March 2023.

“The production-linked incentive (PLI) scheme is one of the primary catalysts spurring the growth of the entire PV manufacturing ecosystem in India. Besides the augmentation of infrastructure in all stages of PV manufacturing, from polysilicon to modules, it will also lead to the simultaneous development of a market for PV ancillary components, such as glass, ethylene vinyl acetate (EVA) and backsheets,” says the report’s co-author Jyoti Gulia, Founder, JMK Research.

The results of both tranches of the PLI scheme show that there will be an increase of 51.6GW of module capacity and at least 27.4GW of integrated “polysilicon-to-module” capacity in India in the next three to four years.

While the PLI scheme is a supply-side measure, the government has also taken steps to increase the demand for locally made solar PV modules. One such step was the introduction of domestic content requirement (DCR) for solar power in several government schemes, such as the Pradhan Mantri Kisan Urja Suraksha Evam Utthaan Mahabhiyan (PM-KUSUM) Scheme and the Central Public Sector Undertaking (CPSU) Scheme.

One of the key steps taken by the government to boost demand for domestic solar PV modules was the introduction of the Approved List of Module Manufacturers (ALMM) in 2019. The report notes that even after applying higher basic customs duty (BCD) on imported modules, the cost differential compared to domestic modules is negligible.

“In such a scenario, the ALMM acts as an absolute trade barrier protecting the interests of domestic manufacturers. Thus, over the past year, ALMM has been the most important driver for the development of domestic PV manufacturing,” says the report’s co-author Prabhakar Sharma, Consultant, JMK Research.

“The latest ALMM list, updated on 27 February 2023 by the Ministry of New and Renewable Energy, includes 70+ domestic manufacturers with an enlisted capacity of 22,389 megawatts (MW),” he adds.

The report also identifies some hurdles holding back the domestic PV manufacturing industry from realising its full growth potential. Chief among them is over-reliance on Chinese imports for upstream components of PV modules, such as polysilicon, ingots/wafers and more.

“With the Chinese government mulling restrictions on the outflow of the critical technology used in the manufacture of these upstream components, it is imperative for countries targeting integrated PV manufacturing at scale to identify alternate sources of supply for these raw materials,” says the report’s co-author Nagoor Shaik, Senior Research Associate, JMK Research.

The report recommends that the government augments the PLI scheme to also include more upstream components, PV equipment machinery and ancillary components for a more holistic development of the PV manufacturing ecosystem.

“Further, to help smaller manufacturers that have limited capital available, the government can look at a scheme providing upfront subsidies for setting up manufacturing units,” Shaik says.

The report notes that recent deferment of ALMM will provide relief to project developers. However, this decision may lead to a short-term setback for domestic manufacturers and could delay domestic manufacturers’ expansion plans, especially non-participants of PLI.

Read the report: India’s Photovoltaic Manufacturing Capacity Set to Surge

Media contact: Prionka Jha ([email protected]) Ph: +91 9818884854

Author contacts: Vibhuti Garg ([email protected]); Jyoti Gulia ([email protected]); Prabhakar Sharma ([email protected]); Nagoor Shaik ([email protected])

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)

About JMK Research: JMK Research & Analytics provides research and advisory services to Indian and international clients across renewables, electric mobility, and the battery storage market. www.jmkresearch.com