IEEFA/JMK: Government incentives brighten outlook for Indian solar manufacturing

24 February 2022 (IEEFA/JMK): India has made substantial progress in domestic solar module manufacturing capacity in recent years. However, according to a new report from JMK Research and the Institute for Energy Economics and Financial Analysis (IEEFA), achieving the national target of 300 gigawatts (GW) of solar power generation capacity by 2030 requires a stronger push in output and strategy.

In addition to the ambitious target, the Indian government’s support for the solar sector has made the prospects for indigenous photovoltaic (PV) manufacturing increasingly vibrant. Dozens of companies are vying to make a mark in the Indian solar sector, the report finds.

“In coming years, given the high growth potential of the domestic solar market and rising favourability of India as an alternative manufacturing hub (to China), diverse stakeholders such as solar project developers, government-run organisations, PV ancillary players etc will strive to build their stake in the solar manufacturing market,” says co-author Jyoti Gulia, Founder JMK Research.

The report’s major findings deal with government incentives, local participation, and how India best responds to China’s dominance in all areas of photovoltaics, chiefly:

- Global solar module manufacturing capacity is 358 gigawatts (GW), of which China accounts for about 61%. India’s manufacturing capacity of ~18GW is roughly equal to the annual capacity addition of the top individual Chinese PV brands, a comparison that shows the vast scope for Indian companies to match their economies of scale.

- For raw materials, India’s manufacturers rely on imports (again, China dominates) and face associated risks of shortages and price hikes, highlighting the need for a sustainable, vertically integrated domestic solar manufacturing ecosystem.

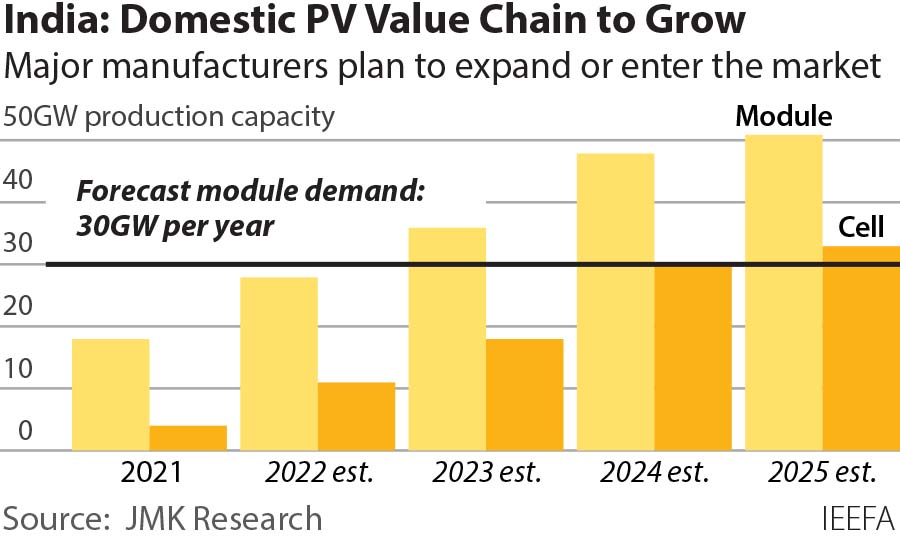

- The Government of India’s Production-Linked Incentive (PLI) scheme for integrated PV manufacturing with initial outlay of Rs4,500 crore (US$616 million), plus the additional allocation of Rs19,500 crore (US$2.5 billion) in Budget 2022, would have the combined potential to produce at least 40GW of solar modules.

Among issues for the industry are the relatively low capacity utilisation in factories producing solar cells and the type of solar cells being produced. The majority of domestic production (60-70%) employs multi-Si module technology – which is nearing obsolescence.

New major manufacturers who are planning to expand or enter the market aim to install machinery to produce mono-Si modules, the prevailing technology. This development will aid domestic players in competing with global rivals on quality and price.

“Without large-scale domestic manufacturing, from raw materials through to modules, the overarching risks of logistics and commodity price fluctuations for imports will persist,” says co-author Vibhuti Garg, Energy Economist and Lead India, IEEFA.

“The Indian PV industry also faces mid- to long-term challenges of high manufacturing expenses, inadequate research and development (R&D) and a shortage of skilled manpower.”

Large-scale domestic PV manufacturing will reduce the risks of logistics and commodity price fluctuations for imports

Co-author Gulia says: “The PLI scheme alone, if judiciously implemented, can increase the integrated solar module, cell and wafer domestic manufacturing capacity several times over in the next three to four years.

“This will help in creating a huge demand potential for the PV ancillary market – solar glass, ethylene vinyl acetate (EVA) etc – and skilled workforce. The direct investment in the country on account of PLI budget expansion would potentially rise to about Rs90,000 crore (US$11.5 billion).”

The report also addresses the uncertainty and inadequacy of relevant solar policies. It says lack of cohesive renewable energy policies among centre and state governments, and frequent fluctuations in policies, have stalled the growth of solar installations, mainly in the open access and rooftop solar market in India.

Manufacturers will have to deal with both the approved list of models and manufacturers (ALMM) policy, and the basic customs duty (BCD) on solar cells and modules. Meeting these obligations, the report says, will put undue pressure on the domestic solar industry in the near future, as the market seeks to strike a demand-supply balance, potentially exacerbating domestic module price volatility.

India, co-author Garg says, is at a critical point in solar energy adoption and advancement. “All stakeholders must now decide on a balanced and sustainable PV development roadmap. It will require a fine balance between the manufacture and consumption of solar PV equipment domestically.

“Developing significant manufacturing capacities in raw materials, especially polysilicon, will be highly capital intensive and technologically complex. Domestic manufacturing companies need to have a proactive technology partnership with innovators or research institutes.

“Rather than focusing solely on output, it’s imperative for the domestic solar manufacturing industry to create a strong foundation for sustainable development overall.”

Full report: Photovoltaic Manufacturing Outlook in India

Media contact: Rosamond Hutt ([email protected]) +61 406 676 318

Author contacts: Jyoti Gulia ([email protected]); Vibhuti Garg ([email protected])

Webinar: Register here for the webinar on PV manufacturing in India at 3pm IST, 24 February.

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. IEEFA’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.

About JMK Research: JMK Research & Analytics provides research and advisory services to Indian and international clients across renewables, electric mobility, and the battery storage market. www.jmkresearch.com