IEEFA update: When will renewables dominate EU power markets?

LONDON – Market analysts are projecting relentless renewable energy growth in the European Union over the next two decades, but to become a reality, this trend will need to be backed by clear, stable policy, private financing and grid integration solutions. This is especially true for the larger economies, such as Britain, France and Germany, if they are to follow the lead of early movers such as Denmark.

There is no doubt that renewables are the future of power generation in Europe, and worldwide, backed by unstoppable trends including cost reduction, decarbonisation, digitalisation, and the electrification of heat and transport, but the speed of this transition is still up for grabs.

How will wind and solar be financed?

In their set-piece analyses last year, both Bloomberg New Energy Finance (BNEF) and the International Energy Agency (IEA) projected rapid growth in wind and solar power.

The IEA projection appeared in its World Energy Outlook (WEO), an annual overview of global energy sector trends that features its baseline New Policies Scenario. The IEA has also developed a Sustainable Development Scenario based on the conditions needed to limit average global warming to “well below 2°C,” in line with the Paris Agreement on climate change.

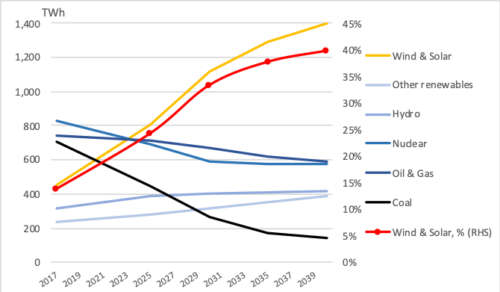

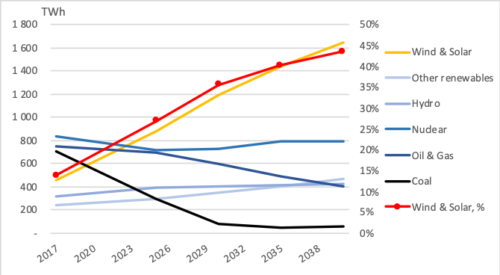

Both IEA scenarios project rapid growth in wind and solar power in the EU, becoming the main source of power generation around 2023 and reaching a 40-44% market share by 2040 (see Figures 1 and 2).

Figure 1. IEA New Policies Scenario: EU generation mix through 2040 (TWh)

Figure 2. IEA Sustainable Development Scenario: EU generation mix through 2040 (TWh)

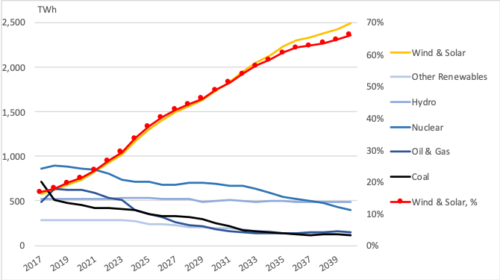

BNEF bases its annual New Energy Outlook on trends in global technology. It foresees an even bigger and faster transition to wind and solar power, to become Europe’s leading source of generation around 2021, reaching a 66% market share by 2040 (see Figure 3).

Figure 3. Bloomberg NEF: EU (plus Norway) generation mix through 2040 (TWh)

In the past, such projections have often failed to match actual growth in renewables, and solar power in particular. The IEA has a track record of getting it wrong: its latest World Energy Outlook had to revise upwards wind and solar growth projections across the board from the year before. In its 2018 WEO, for example, it upgraded global projected wind and solar under its baseline scenario to 21% market share in 2040, from 19% in its previous estimate, and 32% in Europe, up from 27%.

These repeated projection errors were due to rapid cost reductions in solar power, especially, which caught by surprise both policymakers and market analysts. However, as policymakers begin to withdraw financial support, not least in Europe, a fairer question now is whether such stellar growth will continue, or could analyst projections be overly optimistic?

Key questions include:

- How will future growth in wind and solar be financed? Many European countries previously assured premium cash flows to renewable energy projects through feed-in tariffs and green certificate schemes. Such measures have recently started to attract pension funds, interested in long-term, stable revenues that match their liabilities. New financing schemes will need to offer similar revenue stability to continue to attract low-cost capital, but such schemes are still a work in progress. One emerging alternative is the purchase of renewable electricity by corporations under long-term contracts. At present, however, this is very limited in Europe, compared with the historical market as supported by feed-in tariffs. Another alternative is a zero-subsidy contract, with government backing, which assures stable revenues, but without a premium to power markets. While the latter may offer the stable cash flows private investors need, there will be learning curve first to convince pension funds and others that the “good old days” of subsidies are not coming back.

- How will variable sources of electricity such as wind and solar be integrated into the grid? Already, several European countries have achieved a wind and solar market share above what BNEF and the IEA are projecting for the continent as a whole by 2040, at 50% or more of electricity supply. But these countries, such as Denmark, created favourable grid conditions over a decade or more, and may have been lucky enough to find themselves with certain natural advantages. Denmark, for example, is fortunate to be able to trade electricity with very large neighbours (Germany to the south, Nordic countries to the north), buffering the variability of its wind power.

Achieving renewables growth across the continent will require a methodical approach to boost flexibility, and so buffer the variability of wind and solar power. They must develop markets that support investment in demand-response and electricity storage and internal and cross-border transmission. Charts of trends in energy mix may be visually exciting but they do not capture these vital behind-the-scenes prerequisites, even though they arguably will be as important as quantities of generated electrons going forward.

Gerard Wynn ([email protected]) is an IEEFA energy finance consultant.

Related items

IEEFA Germany: RWE’s coal phaseout compensation demands defy market prices

IEEFA Europe: PGE’s pro-coal strategy in Poland under fire

IEEFA Europe: Progressive energy policies will make rooftop solar more affordable