IEEFA update: Problems mount for PTTGCA petrochemical plant

New disclosures by Thailand-based PTT Global Chemical America (PTTGCA) regarding its proposed petrochemical plant planned for Belmont County, Ohio, illuminate the financial risks facing the project. Interested citizens, community advocates and elected leaders should understand these risks and the disturbing implications for the future of the community.

New disclosures by Thailand-based PTT Global Chemical America (PTTGCA) regarding its proposed petrochemical plant planned for Belmont County, Ohio, illuminate the financial risks facing the project. Interested citizens, community advocates and elected leaders should understand these risks and the disturbing implications for the future of the community.

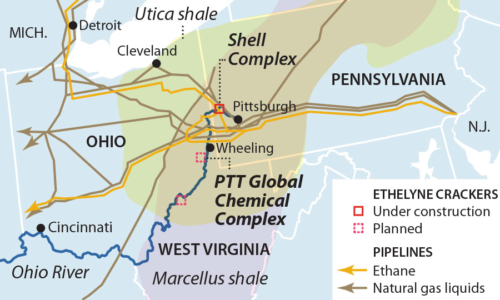

PTTGCA has delayed this proposed petrochemical plant numerous times since it first introduced the project in 2013. The facility, a $5.7 billion petrochemical complex that would produce plastic resins, has promised jobs, taxes and economic growth for the state. PTTGCA has set and missed several deadlines to make a final investment decision. Most recently, the company has said it would make an announcement either by the end of this year or by the first quarter of next year.

PTTGCA’s request raised questions about whether the company can meet even the extended deadline

Additional, relevant information became available when PTTGCA asked Ohio EPA for a one‑year extension on an environmental permit that expired on June 21 this year. While the agency has granted the extension, the disclosures that PTTGCA made in its request raise questions about whether the company can meet even the extended deadline.

Environmental permits come with time certain deadlines. The law assumes that the public is best protected if, once approved, projects move forward expeditiously. As time elapses between the granting of a permit and the actual commencement of project construction, science, environmental conditions, laws and regulations, financial variables and outside events can and do change. A permit granted based on stale information is not protective of the public.

Time-certain performance deadlines also prevent the environmental process from being used as a tool for financial speculation. The abuse: A permit is granted, the project remains unbuilt and the project sponsor benefits from improved short-term investor confidence, but the project itself perhaps never gets completed. Meeting the deadline is a measure of financial discipline and project viability. Permits are usually coordinated carefully with financial and other development benchmarks as a way to protect the public.

In setting forth its arguments for receiving an extension of the permit deadline, PTTGCA’s letter makes several revealing statements about the financial risks facing the project:

-

- PTTGCA’s project needs financial partners, yet after seven years, it has still failed to secure them. It was not evident from the company’s public statements until January 2018 that additional financial partners would be necessary or that any investor interest existed. The letter says PTTGCA is seeking financing from UK Export Finance, Bank of Korea (KEXIM) and the Korea Trade Insurance Corporation (KSURE). The need for additional financial partners beyond PTTGCA’s South Korean partner Daelim suggests that, as changing conditions have weakened the project’s viability, PTTGCA has been looking for other investors to share the risk. The lack of financial partners, even after many years of seeking them, suggests substantial weaknesses with the deal.

- PTTGCA asserts that the U.S.-China trade controversy has prevented the company and Daelim from moving forward with contracts for (unspecified) goods and services to supply the project. If the U.S.-China trade dispute must be resolved before the Ohio project can move forward, then expecting a final investment decision by the first quarter of next year is optimistic. Current tensions run high, and even if some compromise can be reached, whichever political party controls the White House is likely to establish new trade rules in 2021 and these are unlikely to be codified and implemented in the first quarter.

- PTTGCA’s letter claims that the coronavirus pandemic has hindered it and Daelim from moving forward with design, financial and legal aspects of the project. PTTGCA’s characterizations of the finance sector during the pandemic, however, are at odds with actual market dynamics and its own strategic direction. The corporate bond market issued $265 billion in debt from January through the end of April, twice as much as last year. Revenues at the world’s leading banking industries were up considerably during this period due to central bank interventions in the markets. Finally, a June 6, 2020, article in the Bangkok Post states: “PTT Global Chemical (PTTGC) is planning to acquire new assets related to specialty polymer production during the recession.”

PTTGCA doesn’t mention severe market weakness

What PTTGCA fails to say in its letter to Ohio EPA is that market conditions have seriously deteriorated, and that the problem started well before the pandemic. Earlier this year, in pre‑pandemic disclosures, IHS Markit had removed the project from its inventory of new supply resources. Leading industry consultants with ICIS made clear that market forces over the last several years have had a negative impact on the financial landscape for this and many planned-but-unbuilt cracker facilities. An important dimension to the weaker financial outlook is the excess amount of cracker capacity that’s already been built in the United States and globally.

Oversupply, exacerbated by pandemic-related disruptions, will slow the market’s ability to absorb excess capacity

Also, PTTGCA fails to acknowledge that the pandemic has depressed demand even further. Existing market oversupply, exacerbated by pandemic-related disruptions, will slow down the ability of markets to absorb excess capacity. This should cause investors — and PTTGCA itself — to reconsider investing in this troubled project.

Why does this matter?

The people of Ohio have provided direct grants totaling $50 million to PTTGCA for this facility. The company has promised jobs, taxes and spin-off economic benefits in eastern Ohio. But major problems clearly have surfaced. The financial risks facing the project are significant and are giving rise to skepticism from industry analysts. Furthermore, low plastics prices, market oversupply, increased competition and recycling all pose significant financial risks for the project. A project with a weak economic outlook is unlikely to produce significant, permanent and dependable long-term economic growth.

Will the PTTGCA project be a boost for jobs, taxes and new economic growth for Ohio or just a shrine to wishful thinking? While Ohio EPA has granted the project a permit extension until June 2021, our best guess is that the project’s problems will not be solved by then.

In the meantime, unfortunately, prolonged attention to a project with such limited expectations also tends to preclude a robust search for more stable economic development alternatives.

So once again, the petrochemical can gets kicked down the road, while forward-looking economic planning for this important Ohio region gets left in the dust.

Tom Sanzillo ([email protected]) is IEEFA’s director of finance.

Media contact

Vivienne Heston ([email protected]) +1 (914) 439-8921

Related items

IEEFA U.S.: Ohio petrochemical project faces high risks and shaky outlook

Developers Put a Plastics Plant in Ohio on Indefinite Hold, Citing the Covid-19 Pandemic

IEEFA Ohio: Mountaineer NGL storage project loses its environmental permit