IEEFA update: ExxonMobil confronts shrinking financial status

ExxonMobil has maintained its position atop the U.S. oil industry, but both the industry and the company are not what they used to be. ExxonMobil still maintains the highest market capitalization of any U.S.-based oil and gas company: just over $280 billion, roughly one-third larger than its nearest rival, Chevron.

The company still touts its steady growth in annual dividends as a sign of financial health. But a deeper dive reveals that, by many financial measures, ExxonMobil is shrinking.

Three charts tell the story.

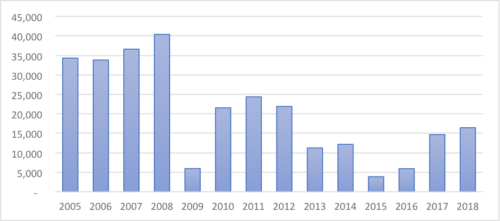

FREE CASH FLOW HAS BEEN DWINDLING

Free cash flow (FCF)—the amount of cash generated by a company’s core business, minus its capital spending—is a crucial gauge of financial health: robust free cash flows enable firms to pay down debt and reward stockholders.

Unlike the fracking sector, which has posted negative free cash flows for a decade, ExxonMobil maintained positive FCF even in tough times, such as during the depths of the great recession and the major oil price crash of 2015 and 2016. Still, the company’s long-term free cash flow trends are pointing downwards. (See Figure 1). In 2005 through 2008, Exxon regularly reported FCF in excess of $30 billion per year, roughly $40 billion per year in today’s dollars. In 2018, the last full year for which the company has posted its results, annual FCF was just $16.4 billion.

In nominal terms, oil prices were actually higher in 2018 than in 2005. Yet ExxonMobil saw its FCF fall by more than half.

Figure 1. Exxon Mobil’s free cash flow (million USD)

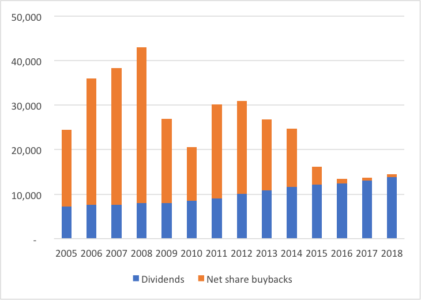

PAYOUTS TO SHAREHOLDERS ARE ALSO SHRINKING

One of the most important things an oil company does with its free cash flow is reward its stockholders. And it does so in two ways: through dividends, which are paid evenly to all shareholders; and through share buybacks, which return cash into the hands of equity owners who sell their stock, while concentrating future dividends into a smaller pool of remaining shareholders.

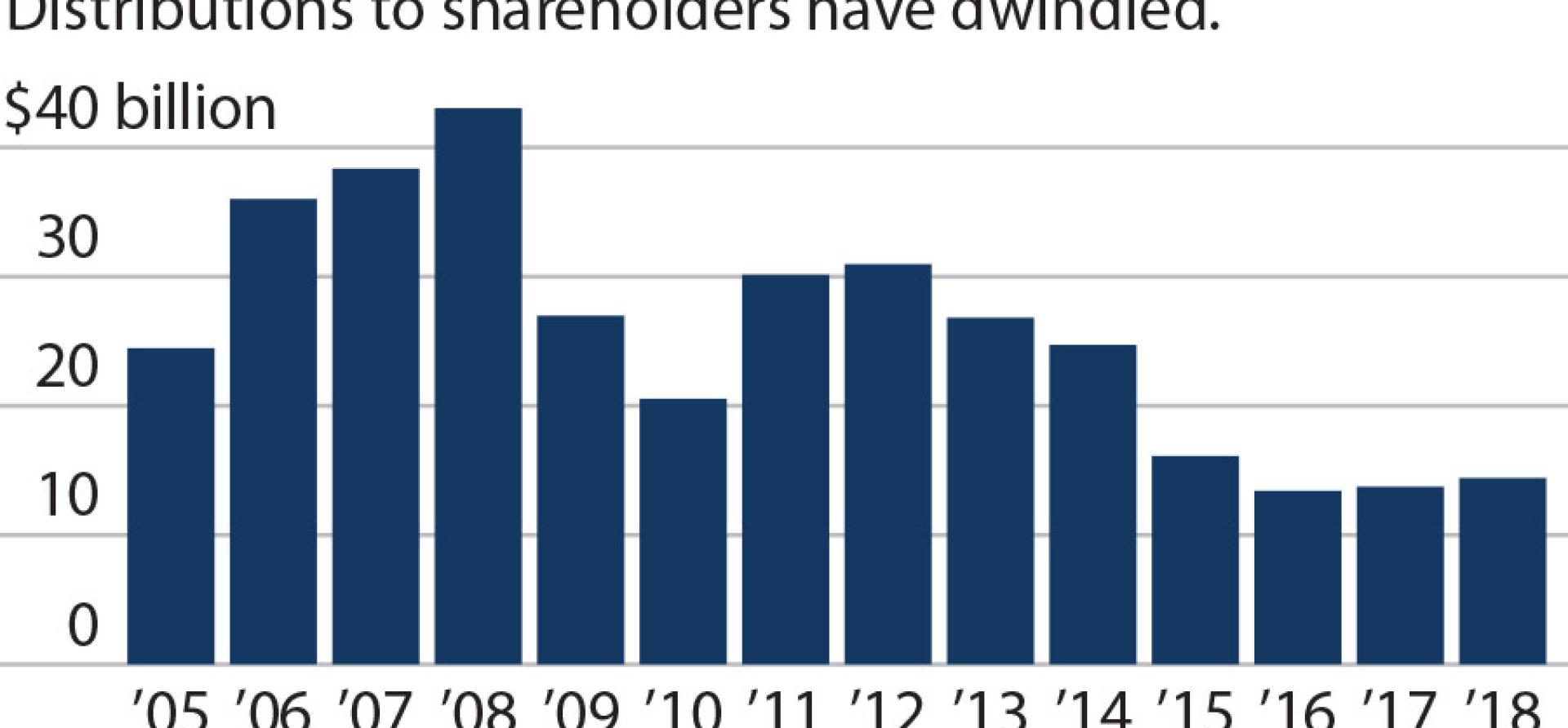

Unsurprisingly, given the company’s slumping cash flows, ExxonMobil’s payouts to shareholders have fallen dramatically since 2005. The company has kept its dividend payouts trending upwards. But in 2016 the company surprised investors by terminating its long-standing share buyback program. The company’s CEO recently floated the idea of a new round of buybacks, funded by asset sales. Still, ExxonMobil’s net share repurchases declined from a peak of $34.9 billion in 2008 down to a paltry $626 million in 2018 (see Figure 2), with an additional $421 million paid through the first three quarters of 2019.

Figure 2. ExxonMobil shareholder distributions (million USD)

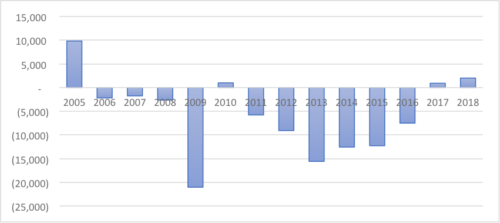

EXXONMOBIL IS SPENDING MORE THAN IT EARNS

While ExxonMobil has maintained positive free cash flows and generous (though reduced) shareholder payouts since 2005, its cash flows have not been enough to sustain shareholder distributions. All told, Exxon has paid $76 billion more to its shareholders since 2015 than its core business operations have generated—with prominent “deficit spending” through most of 2009 through 2018.

Figure 3: ExxonMobil’s free cash flow minus shareholder distributions (million USD)

The company made up these shortfalls in part through borrowing: Exxon began 2005 with $5 billion in debt, but owed $20.5 billion at the end of 2018—and borrowed an additional $5.4 billion in the first three quarters of 2019 alone. The company also raised cash for shareholder distributions through asset sales, which continue today: last fall, the company announced plans for an additional $25 billion in asset sales through 2025.

THESE THREE CHARTS HELP EXPLAIN THE COMPANY’S UNDERWHELMING STOCK PERFORMANCE. ExxonMobil has dramatically underperformed the broader stock market since 2005: the company’s share price rose by a meager 30%, compared with a near tripling of the broader S&P 500 index.

So, if you’ve ever wondered why ExxonMobil’s stock has fallen so far out of favor with investors, you can find the answer in the company’s cash flows and shareholder rewards ‒ which reveal that ExxonMobil is no longer the financial powerhouse it once was.

Clark Williams-Derry ([email protected]) is an IEEFA energy finance analyst.

RELATED ITEMS:

IEEFA update: Moody’s adjusts ExxonMobil credit outlook to negative

IEEFA update: ExxonMobil abandons goal of “quick cash” from Permian fracking