IEEFA update: Fracking sector spills more red ink in Q3

November 19, 2019 (IEEFA North America) ‒ North American energy companies engaged in hydraulic fracturing (or fracking) once again failed to produce positive cash flows to match gushing production of oil and gas.

November 19, 2019 (IEEFA North America) ‒ North American energy companies engaged in hydraulic fracturing (or fracking) once again failed to produce positive cash flows to match gushing production of oil and gas.

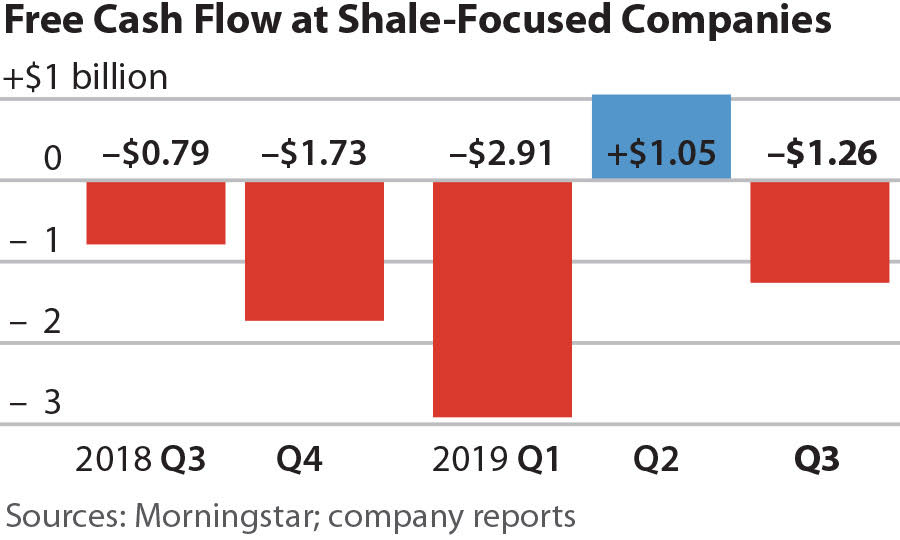

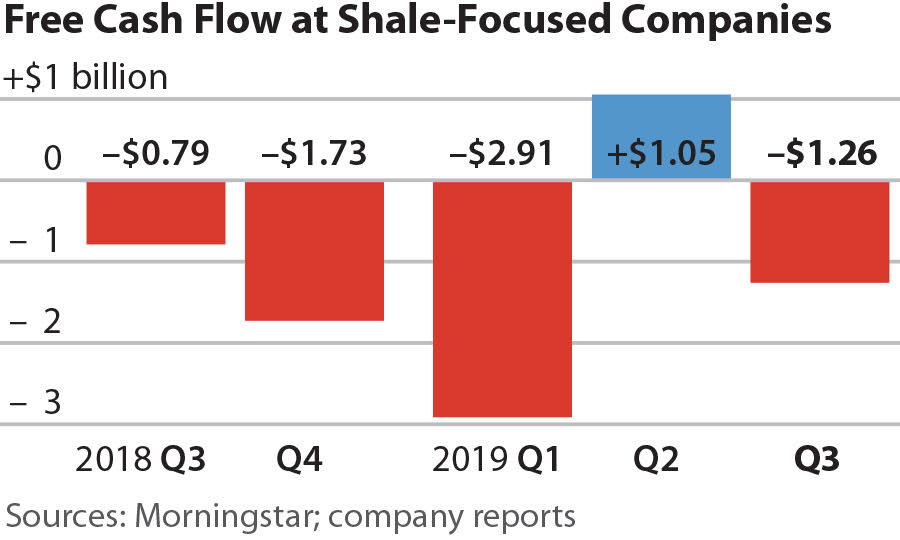

That was the finding of a briefing note released today by the Institute for Energy Economics and Financial Analysis (IEEFA). In their report, U.S. Fracking Sector Spills More Red Ink—Again, IEEFA analysts found that a cross-section of 38 publicly-traded oil and gas companies collectively spent $1.3 billion more on new capital projects during the quarter than they gained from selling product.

“Ours is a conservative estimate since we have excluded companies that have merged or declared bankruptcy or had other major changes during the quarter,” said IEEFA energy finance analyst and report co-author Clark Williams-Derry. “Fracking remains a losing proposition for investors.”

Free cash flow—the amount of cash generated by a company’s core business, minus its capital spending—is a crucial gauge of financial health. Positive free cash flows enable firms to pay down debt and reward stockholders. Negative free cash flows, by contrast, force companies to fund their operations by dipping into cash reserves, selling assets, or raising new money from capital markets.

The E&P companies hemorrhaged $4.9 billion in negative cash flows in 2019

“This is more of the same old, same old,” said IEEFA financial analyst and report co-author Kathy Hipple. “No matter how you slice it and dice it, the fracking sector has largely failed to make money for the past decade.”

Over the preceding twelve months alone, the companies in the IEEFA sample hemorrhaged $4.9 billion in negative cash flows.

“This consistent cash drain will make it difficult for these shale-focused companies to pay down the more than $117 billion in long-term debt that they owe, let alone compensate equity investors with a robust and sustainable program of dividends or share buybacks,” the report stated.

Full briefing note: U.S. Fracking Sector Spills More Red Ink—Again

Authors

Kathy Hipple ([email protected]) is an IEEFA financial analyst.

Clark Williams-Derry ([email protected]) is an IEEFA energy finance analyst.

Media Contact

Vivienne Heston ([email protected]) +1 (914) 439-8921

About IEEFA

The Institute for Energy Economics and Financial Analysis conducts research and analyses on financial and economic issues related to energy and the environment. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. www.ieefa.org