Beetaloo a $10bn pipe dream for minor gas producers as big players desert Basin

Cash-strapped junior explorers push ahead with ambitious plans to commercialise reserves despite looming LNG glut

Key Takeaways:

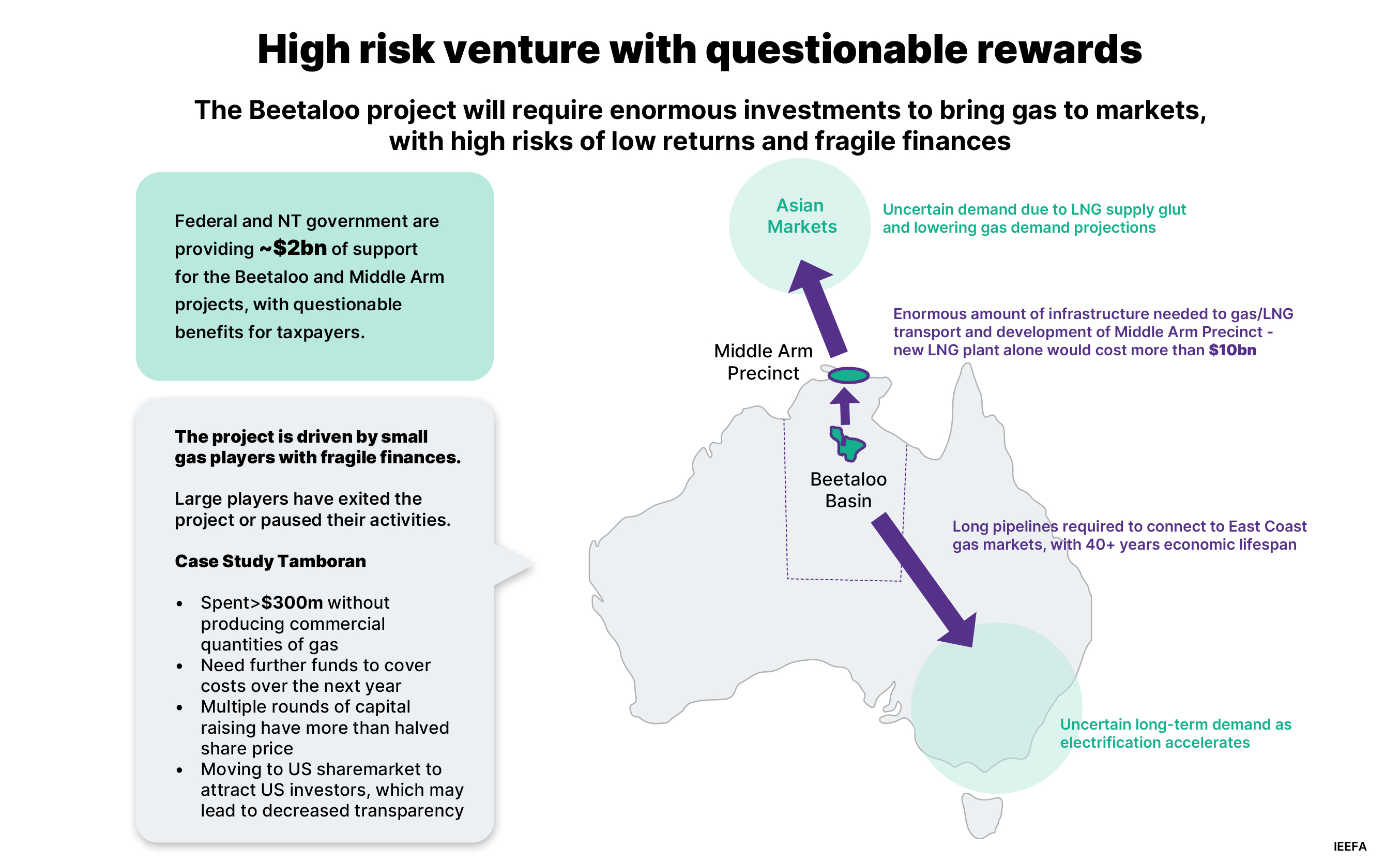

Shale gas from the Beetaloo Basin would enter a saturated global LNG market at a competitive disadvantage due to large quantities of cheaper LNG from Qatar and the US coming online.

Tamboran’s NTLNG project at Darwin could exceed A$10 billion when LNG projects under construction may not see a positive return on capital in a net zero emissions scenario.

Beetaloo gas is key to the development of Darwin’s A$3.7 billion Middle Arm precinct, which will rely heavily on taxpayer funds, and provide poor returns for public finances.

This Analysis is for information and educational purposes only and is not intended to be read as investment advice. Please click here to read our full disclaimer.

22 March 2024 - (IEEFA Australia): Despite the billions spent and pledged on the Beetaloo Basin’s shale gas reserves, it could prove to be a massive sinkhole for investors’ and taxpayers’ cash, according to a report by the Institute for Energy Economics and Financial Analysis (IEEFA) released today.

Hailed as one of the world’s most promising shale resources, the remote Northern Territory field is yet to produce any commercial gas. Yet multibillion-dollar, taxpayer-funded infrastructure developments are banking on its viability, which is called into question in IEEFA’s latest report, Beetaloo a $10bn pipe dream for gas producers.

“The remoteness of the Beetaloo means that significant new infrastructure investment will be required to process gas and transport it to end users, particularly along Australia’s east coast,” says the report’s author Kevin Morrison, IEEFA’s Energy Finance Analyst, Australian Gas.

“The NTLNG project alone will require an investment likely exceeding US$10 billion, given the high costs associated with greenfield LNG projects. Our analysis suggests that these projects may have low economic value, with high costs and risks, and uncertain returns.”

Only three relatively small companies - Tamboran Resources, Empire Energy and Falcon Oil and Gas - remain focused on developing the Beetaloo. Several big players once active in the Basin have since walked away. The exception is Santos, which holds exploration permits in the Basin but appears to be focused elsewhere.

Gas extraction in the Beetaloo will rely on fracking, a high-risk technology that poses risks of contamination that could affect the primary water source for the region and its agriculture. In addition, market forces are aligning against the Basin’s shale gas on several fronts.

“Beetaloo gas is unlikely to be competitive,” Mr Morrison says. “The unprecedented increase in LNG supply under construction means that global markets are likely to face a glut in the second half of this decade. Australia’s relatively high LNG costs will likely make it uncompetitive with lower-cost Qatar and the US, which are driving new capacity additions.

“There is also great uncertainty about the long-term demand outlook for LNG in emerging Asian markets, which are expected to replace Australia’s main markets for LNG exports.”

LNG projects in Australia have proved costly – of the 10 in Australia, seven have destroyed shareholder value due to cost overruns and construction delays.

The report focuses on the finances of junior explorer Tamboran, which has emerged as a key player in the Beetaloo following several permit acquisitions, including those of Origin Energy.

In six years, Tamboran has raised more than A$365 million from investors, and has spent more than A$300 million on exploration without producing any commercial quantities of gas.

The company, which has had a brief but underwhelming history since listing on the ASX in July 2021, has largely relied on US shale gas investors for capital.

“Tamboran is dependent on a handful of deep-pocketed shareholders,” Mr Morrison says. “Since it listed, its share price has more than halved, largely due to multiple share issues to raise funds to keep the company operating.

“While Tamboran has plans to develop a pilot project, its financial position suggests it will require additional funding to produce Beetaloo gas commercially.”

To access a bigger pool of investors, Tamboran plans to list in the US state of Delaware, where the corporate rules of anonymity may raise questions about the level of transparency available to shareholders.

“This may be a sensitive issue for Australian investors and taxpayers, particularly given the levels of past and proposed taxpayer support for the development of the Beetaloo Basin and Middle Arm Precinct,” Mr Morrison says.

“There are significant questions on the financial and economic benefits that will be delivered by the development of the Beetaloo Basin, for investors as well as for governments. The proposed public financial support offered to the project and the Middle Arm precinct should be revisited in light of the changing domestic and global outlook for both gas demand and supply.”

Read the report: Beetaloo a $10bn pipe dream for gas producers

Media contact: Amy Leiper, ph 0414 643 446, [email protected]

Author contact: Kevin Morrison, [email protected]

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)