IEEFA Report: What’s Wrong With FirstEnergy, Part 3

By Tom Sanzillo and Cathy Kunkel —

FirstEnergy Corp., which provides electricity to more than six million customers in Ohio, New Jersey, New York, Pennsylvania, Maryland and West Virginia, continues to be hobbled by flaws in its forward-looking business strategy.

We detail those flaws in a paper we published Monday, “FirstEnergy: A Major Utility Seeks a Subsidized Turnaround,” and in today’s blog post—the third of five we’re doing this week—we’re going to discuss some of our argument for why the company’s forward-looking strategy doesn’t work.

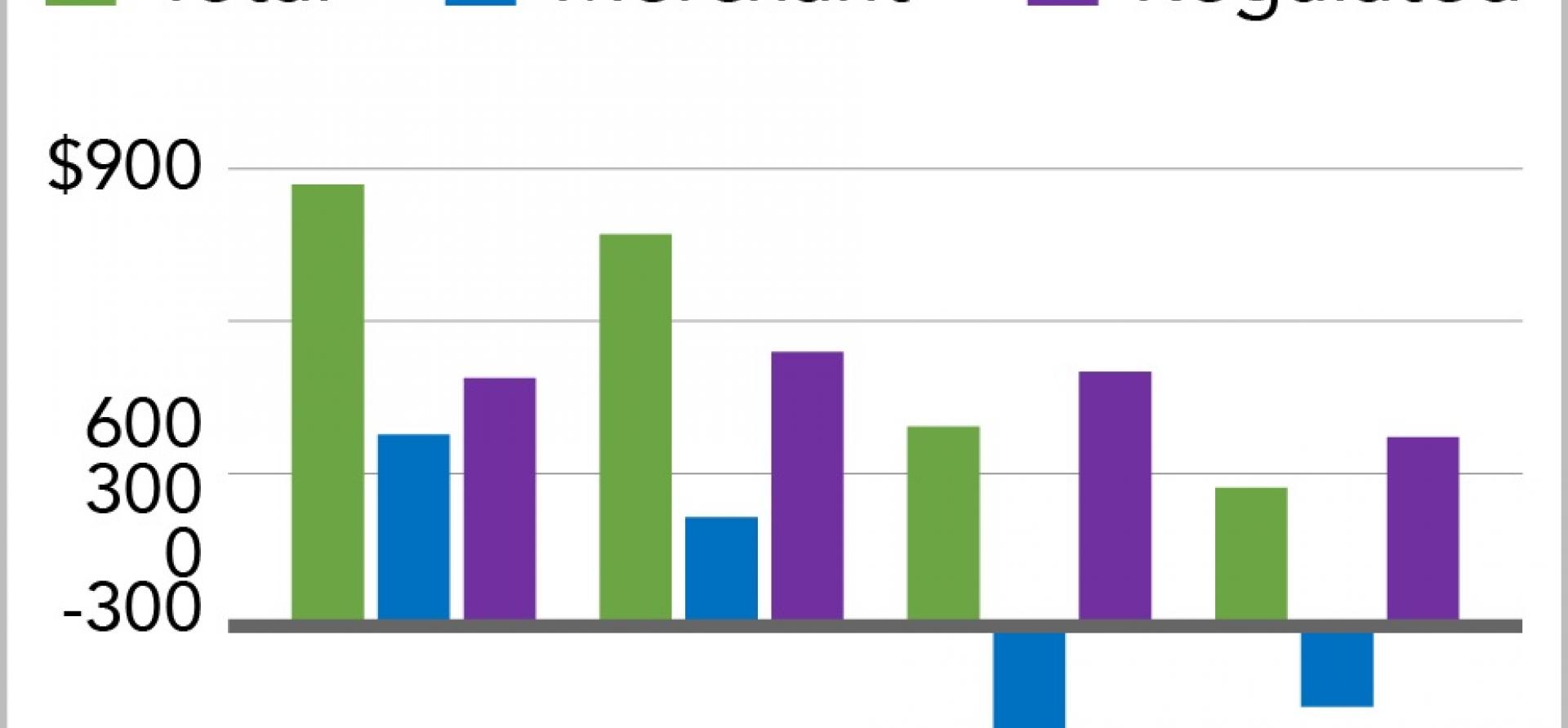

Historically, FirstEnergy has focused on profiting from “merchant coal plants,” those plants whose output is sold on the wholesale electricity market and whose profit margins are determined by wholesale prices. There has been a virtual collapse of the coal fired generation market in the last few years. The wholesale market in general has struggled in the face of competition from natural gas and alternative energy sources, so FirstEnergy has abandoned its wholesale-market strategy to focus instead on opportunities for growing profits in its regulated business.

This means aggressively pursuing rate increases, seeking bailouts of its merchant power plants from ratepayers, and advocating for policies that stifle competitors to coal. This change in direction is unlikely to lead to a significant recovery for the company in the short to medium term, however, because of a more fundamental problem: its continued choice of coal as a fuel source.

Coal is a particularly dangerous strategy for a utility in mid-Atlantic and Midwest markets. The incursion of natural gas, renewables and energy efficiency as new, permanent investments in the nation’s electricity grid point to a broader, more diversified energy-generation mix for the region. In fact, a coal-driven strategy is increasingly risky anywhere in an era of global change characterized by low power prices, a glut of natural gas, the rising importance of renewable energy and popular opposition to coal. Even the most technologically advanced new coal plants cannot keep pace with changing science, innovation and public concerns for a cleaner and safer economy.

First Energy’s coal-fired capacity is at about the same level as it was before its milestone merger with Allegheny Power in 2011, and it relies on coal for roughly 66 percent of its actual power generation today. This risky strategy is made riskier by the company’s underlying financials, which include a heavy debt load.

How might an under-diversified company with limited debt options put itself on a course of recovery? FirstEnergy’s leadership by all indications sees the answer in government-regulated markets.

This strategy comes with its own risks, of course, not the least of which is public and perhaps shareholder backlash.

Will it work? We’ll get into that in our post tomorrow.

Tom Sanzillo is IEEFA’s director of finance. Cathy Kunkel is an IEEFA research fellow.