IEEFA: Months after tumultuous ExxonMobil annual meeting, no substantial change expected

The ExxonMobil shareholder meeting this year will go down in the annals of business as either the start of a new era of progress on climate change or evidence of a tired, ineffectual system of shareholder rights that governs U.S. companies.

The jury is out on the long-term impact, but for the moment there has been no immediate climate change message sent regarding the board’s direction—just the opposite. A quick housecleaning was clearly not one of the results of the shareholder vote.

There has been no immediate climate change message sent—just the opposite

A statement by Darren Woods, the company’s chief executive officer who has presided over years of poor financial performance, signaled business as usual. Despite a shareholder rejection of both his slate of board candidates and climate change policy, Woods attempted to take credit for the changes and said investors “wouldn’t see huge shifts in the strategy, but you may see acceleration, additional emphasis scenarios and continuing to leverage on those cores and how they manifest themselves.

“We’re committed to leveraging the new perspectives and experiences and capabilities we brought into the board. That was part—in part, some of the reasons that we made some of those changes.”

THIS WEEK, EXXONMOBIL RELEASED AN ANNOUNCEMENT THAT IT HAS MADE ANOTHER DISCOVERY OFF THE COAST OF GUYANA. As the Permian Basin’s allure has tarnished, the Stabroek oilfield is now the crown jewel of ExxonMobil’s portfolio. With each passing month, the company is announcing new oil discoveries, presumably adding more barrels that can be extracted and sent to market for decades. Its announcement of success at the Whiptail site adds to a long list of new Guyana finds.

More importantly, it is the first major announcement after the new board has been installed. It reflects a business-as-usual approach for ExxonMobil. Earlier this year, the International Energy Agency warned there should be no new oil field developments if the planet is to mitigate catastrophic climate change. Guyana may have come in under the wire of the IEA announcement, but the new discovery (and maybe more importantly, the announcement of the new discovery) is a signal that drilling remains ExxonMobil’s primary business, now and for the future.

A new board with a new direction might have removed the CEO by now

A new board with a new direction would at least have made the announcement with some context and perspective. It didn’t. The omission is a symbolic misstep, but one that is exactly under the control of a new board.

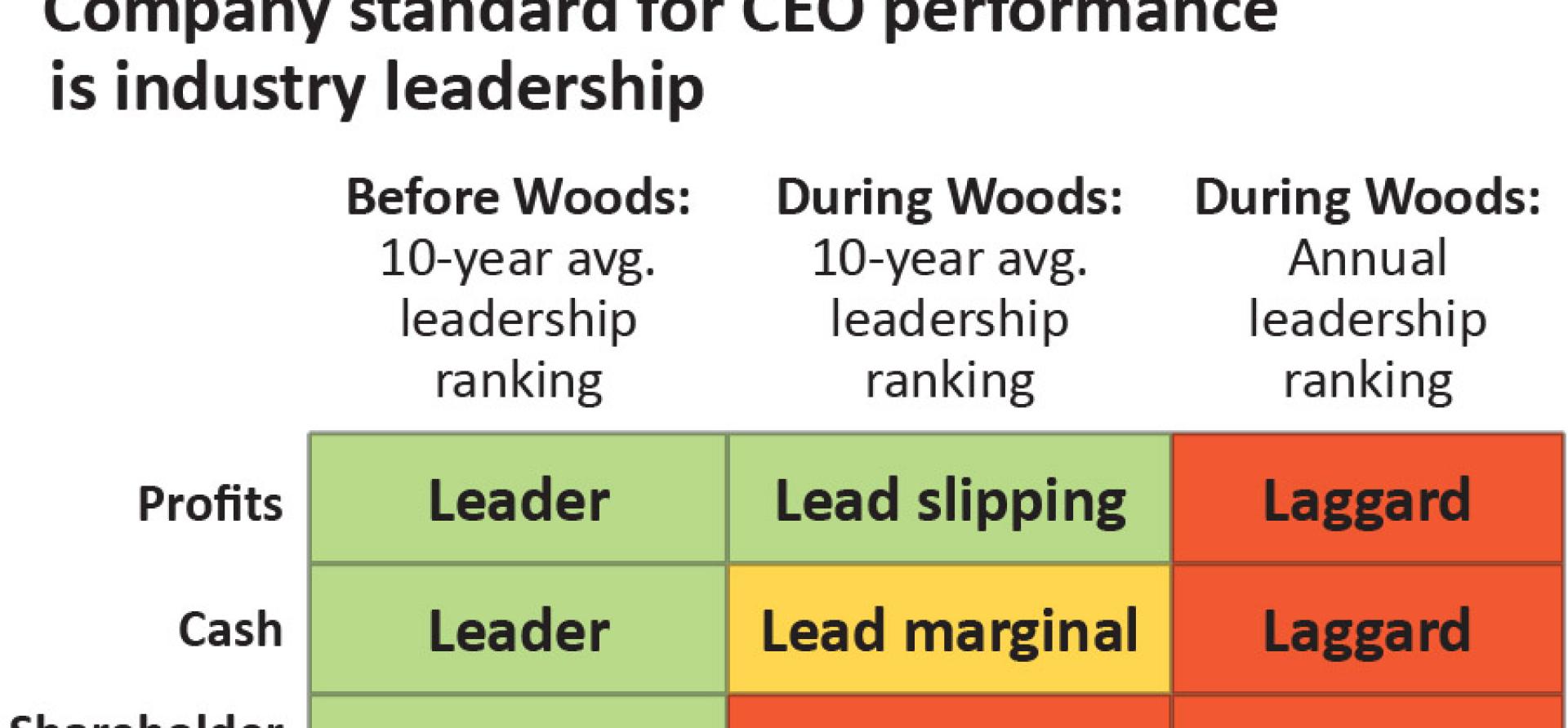

A new board with a new direction might have removed ExxonMobil’s failing chief executive by now. Under Woods, the company’s financial performance has deteriorated. He mishandled the shareholder process with several missteps regarding board composition. His leadership was rejected and the meeting proved to be a fiasco. Woods should be replaced immediately.

It is only fair to give a new board time, but the messages sent so far looks like an old guard circling the wagons to defeat the momentum from the shareholder vote. Replacing leadership is always difficult, but ExxonMobil’s new board also needs to transform the organization and bureaucracy to make real change. Replacing its failed chief executive would be a start.

Tom Sanzillo ([email protected]) is IEEFA’s director of financial analysis.

Related items:

Lack of Ring-Fencing Provision Means Guyana Won’t Realize Oil Gains Before 2030s, if at All