IEEFA: High credit ratings of China’s state-owned enterprise underplays risk

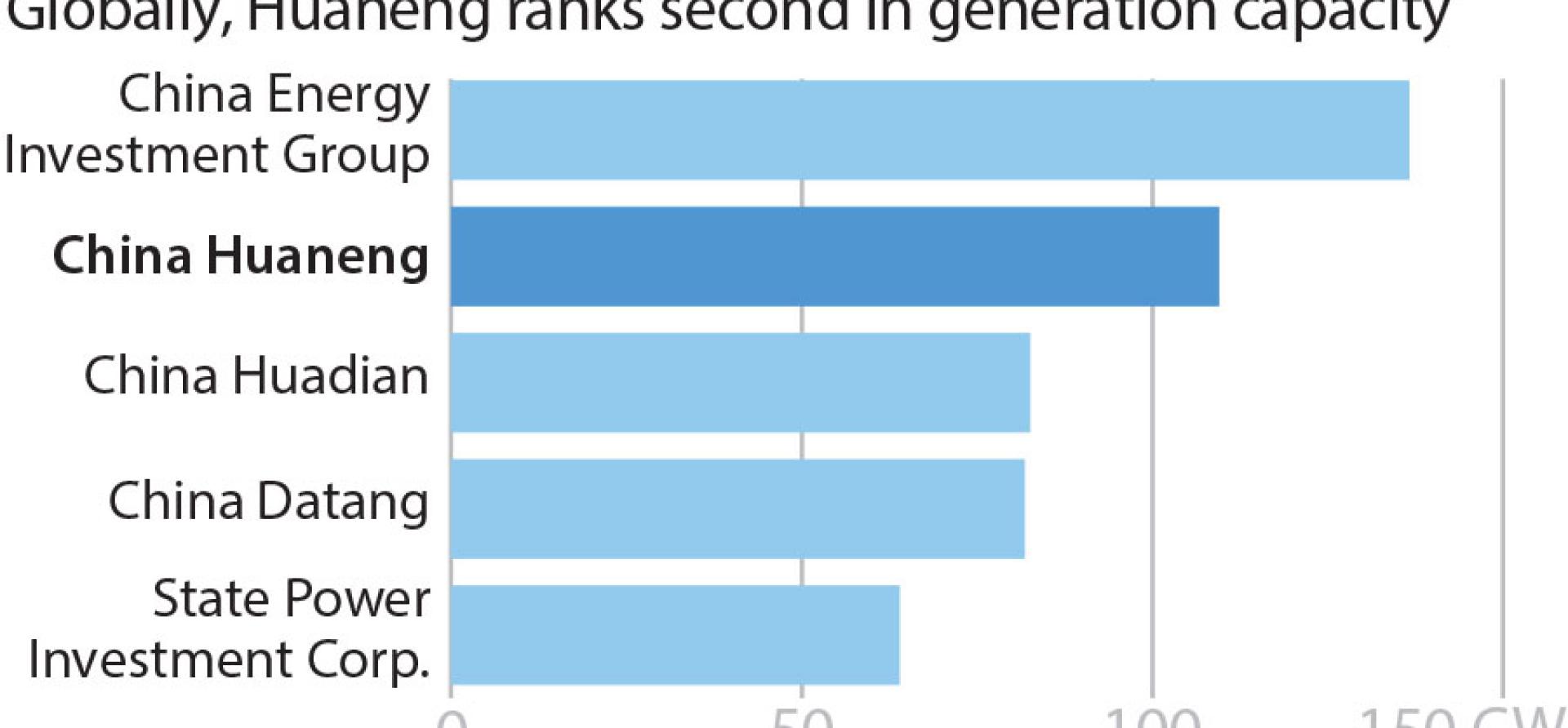

China Huaneng Group Co. Ltd (CHG) is one of the biggest coal power businesses in the world with over 100 gigawatts (GW) of coal-fired power capacity. Like many of its Chinese peers, CHG is also cash hungry. The company has been actively raising new debt including a USD 500 million perpetual bond in December 2020 and USD 1 billion worth of five-year and ten-year bonds in January 2021. The bonds were issued via a wholly owned subsidiary, China Huaneng Group (Hong Kong) Treasury Management Holding Limited, and were guaranteed by CHG.

Figure 1: CHG has the second highest coal-fired power capacity globally

In common with other State-Owned Enterprise (SOE) issuers, CHG was given a five-notch upgrade from a baseline credit assessment of Ba1 to A2 based on Moody’s methodology—signalling the power of the sovereign umbrella to offset CHG’s weak credit fundamentals. The uplift reflects CHG’s “high systemic importance as one of the largest state-owned power generation companies in China, and its full ownership and direct supervision by the central government, with a strong track record of government support”.

Like many of its Chinese peers, CHG is also cash hungry

The power of the implicit central government guarantee is also evident in Fitch’s top-down approach following its methodology, which led to a CHG rating that is one notch below the Chinese sovereign (A+/Stable). Fitch’s rating “reflects a high likelihood of government support, if needed… [its] strategic importance to China’s electricity market as one of the top five state-owned power generators, which together met 45% of China’s total power consumption in 2019”.

However, what is missing in the narrow application of credit rating policies is the fact that CHG is not just any Chinese SOE issuer.

CHG has a uniquely high level of unacknowledged political and ESG risk due to its position as one of the world’s largest coal-fired power companies. This raises questions about the potential risk to fixed income investors who may not regularly track portfolio carbon risks.

The contradiction between rigid bond rating methodologies and new ESG realities is best illustrated by the following points:

CHG’S TRANSITION PATHWAY IS FILLED WITH RISK. CHG’s asset base is dominated by coal-fired power and the company faces a complex transition as China formalizes its net zero policies in the coming years. CHG’s total 2019 generation capacity was 183GW with 72% from coal, 15% from hydro and only 13% from renewables. While the company has plans to diversify its business to incorporate clean energy investments, the fine print of its decarbonization roadmap and concrete actions against a clear strategy are lacking. Furthermore, based on the latest public information published in 2019, the company plans to add a further 29GW of coal-fired power capacity, if not more, despite the already high stranded asset risks it carries as a company.

CHG has a uniquely high level of unacknowledged political and ESG risk

CHG’s coal power business faces a number of challenges. Its coal-fired power plants are expected to have a higher risk of becoming less economical to run due to uncertainties around the ongoing ability to realise cost pass-throughs and the growing affordability of solar and wind power. In addition, the Chinese Government is increasingly focused on responding to political calls for energy transition, reorganization and peak emissions, which will almost certainly lead to stricter limits on the country’s coal power capacity and generation, and therefore create uncertainty on CHG’s core operations.

China’s new climate change commitments, along with a raft of associated policy developments, raise the risk of negative policy surprises that could disrupt the historically stable relationship between CHG and markets. In addition, a growing number of financiers and investors have adopted new policies that will exclude fossil fuel-linked businesses—a step that raises questions about CHG’s future financing and refinancing avenues.

CHG HAS WEAK UNDERLYING FINANCIAL FUNDAMENTALS that raise important questions about the company’s ability to service its debt obligations. Based on Moody’s data, the company is highly leveraged, before even factoring in its further financing need to realise plans for coal expansion and investments in renewable energy projects.

Figure 2: Overleveraged and yet issuing more debt

| Debt service cover | 0.15x |

| Debt to EBITDA | 6.65x |

| Debt to capital | 1193% |

Source: Moody’s 2019 adjusted financials and IEEFA estimates

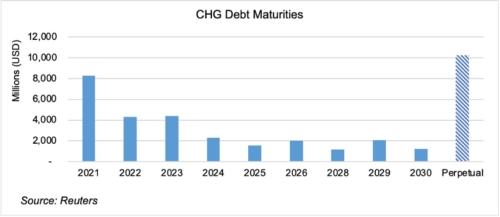

In addition, CHG’s debt burden is front-end loaded, raising risk for investors in the event that China’s economy encounters uncertainty that is not currently factored into market expectations. This should explain the push for perpetuals and longer-dated bonds, which—particularly for perpetuals which typically are not redeemable—seems at odds for a business with diminishing cash flows from increasingly redundant assets. In the absence of a disclosed decarbonization strategy, it appears that CHG is simply kicking the can down the road and non-ESG aware investors could be exposed to risks that they have failed to assess.

Figure 3: CHG’s repayable outstanding debt totalling USD 16.97 billion maturing between 2021 to 2023

2021 WILL BE A YEAR FOR RE-CALIBRATING ASSUMPTIONS ABOUT DEFAULT RISK FOR CHINESE SOEs. Fixed income investors learned some tough lessons in 2020 about the Chinese government’s newfound willingness to let SOEs default on debt obligations.

Bloomberg reported that close to 40 Chinese companies defaulted on nearly USD 30 billion of bonds in 2020. While onshore defaults dropped 3% to USD 21 billion, offshore defaults rose 120% to USD 8.6 billion. Investors in the delinquent offshore bonds—some of which were issued by state-owned entities—were unsuccessful in enforcing claims against the issuers, their parent companies, and the government. At a recent bondholder meeting of defaulting Tsinghua Unigroup, investors were told that Tsinghua’s parent company “doesn’t believe it’s responsible for honouring repayment”. Rising defaults on offshore bonds are therefore testing inexperienced and hasty investors.

CHG is a leader in many of the wrong things relative to China’s new climate agenda

In the case of CHG, a debt-laden issuer with growing asset write-down risks, it is time for investors to review their assumptions about how CHG will manage cash flow pressure linked to broader government policy initiatives and how credit fundamentals may evolve as the central government raises the focus on ESG risks in conjunction with traditional credit considerations.

While no one doubts CHG’s systemic importance, it is not uncommon to see the political fortunes of high profile SOEs rise and fall depending on how well they anticipate new policy directions. What is clear is that CHG is a leader in many of the wrong things relative to China’s new climate agenda. What is less clear is, whether CHG has the ability to expedite execution of a new strategy, and the level of reliance that can be placed on the central government’s support for CHG in the event of default.

BASED ON IEEFA’S ANALYSIS, FIXED INCOME MARKETS ARE STILL IN THE EARLY STAGES of addressing the impact of ESG risks on fixed income issuers and portfolios. This puts high carbon SOEs like CHG in a uniquely precarious position as their credit ratings are so reliant on assumptions about sovereign credit support.

It is now clear that traditional ratings do not adequately capture the full range of investment considerations needed to understand carbon intensive companies. However, alert global investors focused on the evolution of ESG analysis in fixed income markets are increasingly asking tougher questions around whether existing credit rating methodologies remain relevant for SOEs like CHG, and whether there should be higher disclosure standards, and by extension, greater transparency imposed on them.

Christina Ng is Research and Stakeholder Engagement Leader responsible for IEEFA’s fixed income work in Asia Pacific.

Related articles: