IEEFA Indonesia: PLN has ‘Green Ambition’ but is short on renewable energy credibility

22 December 2020 (IEEFA Indonesia): PLN must be prepared for a much higher level of scrutiny around its continuing coal investments and lack of progress in renewable energy investment projects when the company launches its debut green and/or sustainable bonds, finds a new briefing note by the Institute for Energy Economics and Financial Analysis (IEEFA).

Indonesian state-owned electricity company PT Perusahaan Listrik Negara (PLN) is preparing to issue a “green and/or sustainable financing” instrument as early as January 2021 following the publication of its Statement of Intent on Sustainable Financing Framework last month.

Author of the briefing note Christina Ng, says although this is the right direction, PLN now needs to work hard to build investor credibility given its track record.

“PLN’s recent commitment to provide clean and sustainable energy for Indonesia in line with government expectations could be attractive to ESG (environmental, social, and corporate governance) fixed income investors,” says Ng.

“The company’s renewable energy performance however will be of concern.

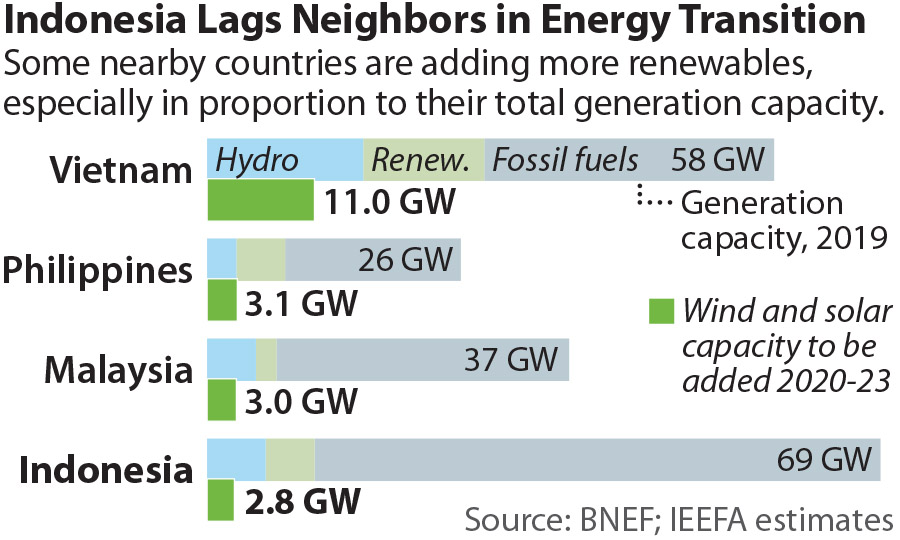

“PLN’s renewable energy plans lag its regional and global peers. The company has not implemented its project investments as planned and has a limited track record of successful implementation.”

Ng notes PLN may be better known to investors as a major carbon emitter that continues to add coal-fired power capacity.

“The company still has at least 20 gigawatts of coal projects in the pipeline,” says Ng.

PLN may be better known to investors as a major carbon emitter

“PLN management may come up against some difficult questions from ESG investors reluctant to fund issuers that continue to be fossil fuel focused, or indeed lacking in transparency.”

Ng says PLN has no meaningful experience of disclosing or reporting to investors on ESG-linked performance metrics.

“The company is going to need to provide additional specifics to prospective ESG investors on how its future sustainable financing plans will be different from the past.”

Ng suggests PLN management has a number of areas to address in preparation for next month’s issuance to boost PLN’s credibility, including:

- Building specific credible plans with policy commitments

- Being prepared for PLN’s performance to be closely examined, including its poor renewable energy performance

- Building in mechanisms highlighting enhanced transparency, internal capacity, safeguards and use of proceeds

- Undertaking serious post-issuance reporting.

PLN can show investors that the company, going forward, is committing to a sustainable, conventional mix of renewable energy projects from solar and wind with relatively low implementation risk and that will commence as soon as PLN secures financing. Further, if follow-through on a project fails, penalty costs or other redress as part of the terms of the bond could be written in to prove PLN’s commitment to delivering on stated sustainability goals.

Abandoning coal projects in the pipeline would demonstrate PLN’s seriousness

“Providing a roadmap for phasing out investment unfriendly fossil fuel energy sources, and abandoning coal projects in the pipeline, would demonstrate PLN’s seriousness in transforming into a sustainable utility business in line with government and investor expectations,” says Ng.

“A credible implementation plan will be challenging, but so is meeting expectations in the sustainable finance market. The investor rewards make it worth it.

“As Indonesia’s Finance Minister Sri Mulyani Indrawati said recently, “Developing renewables is always very challenging, but it is not impossible”.”

Read the report: PLN’s ‘Green Ambition’ Hangs In The Balance – What The Company Should Do To Be Taken Seriously By Investors

Media contact: Kate Finlayson ([email protected]) +61 418 254 237

Author contact: Christina Ng ([email protected])

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (www.ieefa.org)