IEEFA: Dalrymple Bay Infrastructure overvalued, overleveraged, over-promised, likely to under-deliver

Coal port operator Dalrymple Bay Infrastructure (DBI) will commence trading on the Australian Stock Exchange (ASX) on Tuesday 8 December.

Under the offer, present owner Brookfield Asset Management (Brookfield) is seeking to raise at least A$656 million, equating to a market value (for 100% of the equity) of A$1.3 billion. If defensible, the valuation would represent Australia’s largest initial public offering (IPO) for 2020.

However, considering DBI’s current leverage, forecasted cash flows and earnings outlook, it may be an unjustifiable valuation in light of the structural, emissions and technological risks overhanging both coking and thermal coal medium term, especially considering the market value would imply a trading range significantly in excess of its peers.

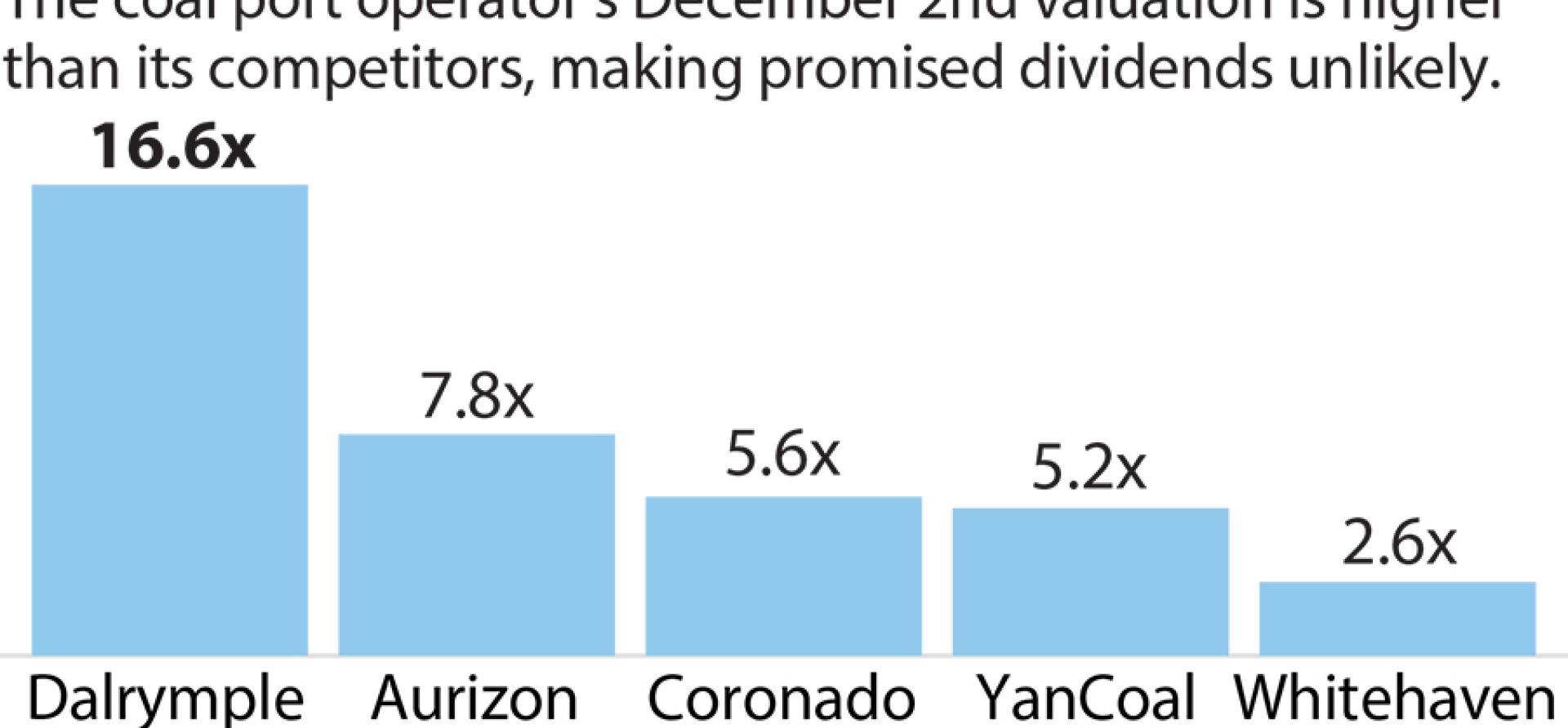

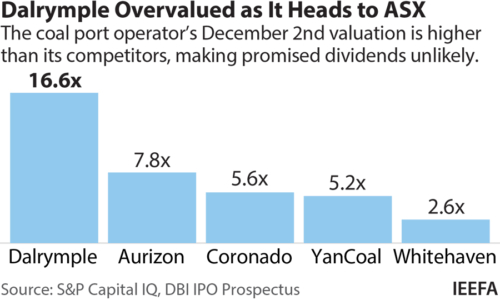

The market value would imply a trading range significantly in excess of its peers

According to the terms, 500 million stapled securities will be issued of which at least 255m will be offered to new investors, at an offer price of A$2.57 per stapled security (share). Including estimated debt at year end of A$1.87bn, the offer represents an enterprise value (EV) of A$3.1bn and an EV/EBITDA of 16.6x (i.e. Enterprise value / Earnings Before Interest, Taxes, Depreciation & Amortization (EBITDA)).

On a relative basis versus the ASX 200, the proposed earnings multiple would not only outpace the average Australian company (S&P Capital IQ found the average EV/EBITDA for ASX 200 companies was 14x in 4QCY2020[1]) but would be almost double its closest industry peers.

Over 2020, Aurizon Holdings (probably Dalrymple’s closest ASX 200 comparable) traded at 7.0x-10.1x EV/EBITDA (7.8x as of 1 December 2020). Other coal-exposed companies on the Australian big board traded at between 3.0x to 8.0x EV/EBITDA (see Table 1), suggesting that at 16.6x, Dalrymple’s valuation would be significantly higher than the median of its comparable coal peers.

Table 1: Dalrymple Bay Infrastructure Looks Expensive vs. Industry Peers

Source: S&P Capital IQ

Source: S&P Capital IQ

Such a comparatively expensive valuation may be unappealing to investors. To sweeten the offering, the prospectus pledged to investors the promise of an extraordinary (and potentially implausible) 7% annual dividend yield. Further, DBI’s dividend policy stated that it will distribute between 60-80% of Funds from Operations (FFO), targeting an additional 1-2% annual growth in distributions per stapled security (page 134 of the Prospectus).

IEEFA cautions, buyer beware, these forecasts are not in any way legally binding.

Considering Australia’s record low interest rate environment, the promise of a 7% annual distribution will undoubtedly prove irresistible to yield chasing investors unfamiliar with stranded asset risks relating to climate change and technology change. As previously highlighted by IEEFA, while Dalrymple benefits from a stable revenue stream, given current cash flows and upcoming debt obligations, the potential for a 7% yield appears to be ostensibly unachievable.

IEEFA cautions, buyer beware

Current cash on hand as of 30 June 2020 was $29.6m according to the prospectus. Forecast net cash flow for FY20 was A$60.7m, down from A$103.5m during the prior year. In the absence of any plans for future expansion (which would require additional debt financing), operating cashflow under the current regulatory framework will remain stable for the next 5 to 10 years.

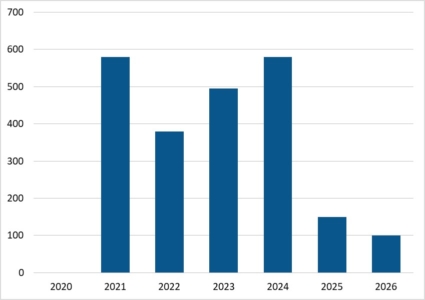

In addition to cash flow constraints, DBI’s debt obligations are sizeable (see Table 2), with total debt of A$1.8bn believed to be maturing over the next five years according to Moody’s (June 2020), and A$580m falling due next calendar year.

Access to capital and debt refinancing has already proved challenging for DBI in 2020[2], and is likely to become more so, as investors become more coal sensitive and increasingly ESG (Environmental, Social, and Corporate Governance) risk aware.

Table 2: DBCT’s Debt Obligations Are Sizeable Over The Next Five Years ($AUD Millions)

Source: Moody’s, DBCT Finance Pty Ltd

Source: Moody’s, DBCT Finance Pty Ltd

DBI is highly levered operationally and financially. Ongoing difficulties in refinancing will only magnify its current cash flow constraints. Under the present regulatory framework, DBI is classified as a monopoly by its regulator, the Queensland Competition Authority (QCA). An Access Undertaking (DAU) controls the prices DBI may charge customers. These fixed rate tariffs are set annually by the QCA, therefore DBI’s revenues (and ultimately net profit) are capped with no opportunity for growth under the current regime.

In somewhat curious timing, in 2019, prior to the IPO launching, DBI appealed to the QCA to remove all pricing tariffs and to allow the company to be free to negotiate the prices it charges. In a draft decision, the QCA rejected the proposal stating that DBI would continue to be regulated by the QCA, and that the QCA will also continue setting pricing tariffs until 2030.

This was a particularly adverse decision for the company, one which will continuously impact DBI’s profitability. On reading the prospectus however, the gravitas of the potential damage this decision could have on DBI’s growth and dividend prospects is not detailed. Rather, the prospectus reads suggestively optimistic, frequently referring to DBI’s future and operating under a ‘lighter regulatory regime’.

The prospectus reads suggestively optimistic

DBI’s bookbuild is reportedly fully covered. However, we note initial attempts at marketing to institutional investors were unsuccessful. As a result, DBI’s current owner, Brookfield, elected to retain up to 49% of the company. In a fortuitous ‘coincidence’, Queensland government-owned ‘Queensland Investment Corporation’ (QIC) will retain a further 10%, in direct contradiction of QIC’s own inhouse analysis warning of stranded infrastructure asset risks relating to climate change, plus a new paper highlighting the massive growth in investor interest in green hydrogen, particularly as a potential replacement for coking coal.

After various other institutional investors walked away from a possible investment, DBI’s brokers reportedly attempted to ring fence a group of investors; an uncommon practice designed to contractually lock in a group of investors in advance of the subscription period.

Regardless of the proposed valuation, promised dividends and a potentially lighter regulatory framework, Dalrymple Bay Infrastructure will officially list on the Australian Stock Exchange on 8 December.

The company will no longer hold theoretical value, but shareholder value; a value which appears to be over-inflated relative to its peers.

___________________________________

[1] EV/EBITDA figures represent Enterprise Value (EV) calculated based on the closing stock price on 2 December (offer price of A$2.57 for Dalrymple Bay Infrastructure). EBITDA figures are as of FY20 at 30 June 2020.

[2] In September 2020, Dalrymple attempted to refinance its loans falling due in 2021 in the local market. The bond issue failed. On the second attempt, the company had to resort to overseas markets, ultimately raising the funds in a secretive U.S. private placement deal. IFR News. Dalrymple coal port raises US$550m from US private placements. 24 September 2020.

Related articles: