Going beyond methodology: The credit rating committee’s vital but overlooked role in climate risk integration

Key Findings

The rating committee, as the ultimate decision-making body for final credit ratings, plays a key role in ensuring that climate risks are adequately integrated into the assessment of creditworthiness.

Agencies need to form a panel of climate risk experts on the committee to improve credit analysis and foster constructive dialogue between credit analysts and issuers.

More disclosure of details around committee debates is also necessary, to see whether or how climate risk is affecting financial risk and, by extension, the rating of an issuer.

The pressure is on, with growing concerns that credit rating firms may be misreading climate risks within the massive US$133 trillion global bond market. Moritz Kraemer, former overseer of S&P Global’s sovereign debt ratings, said that “climate change has yet to be hardwired into the methodology.” We agree.

In March, the Institute for Energy Economics and Financial Analysis (IEEFA) published a report that demonstrated how environmental, social and governance factors, particularly climate-related risk, were not directly integrated into traditional credit rating. Climate risks have had little impact on ratings due to the short-term nature of the assessment, making ratings less intuitive in providing an early warning. Because the problem is downplayed, debt issuers that face heightened climate risks in the long term may experience a cliff-edge rating change sooner than expected.

While adjusting methodologies is important to update the system, it is only one piece of the puzzle within the broader credit rating process. The rating committee, serving as sole authority in assigning eventual ratings, plays a key role in ensuring that climate risks are adequately integrated into the assessment of creditworthiness.

But are credit rating committees suitably experienced on climate-related risks and do they have sufficiently robust discussions about whether or how climate risk affects credit risk?

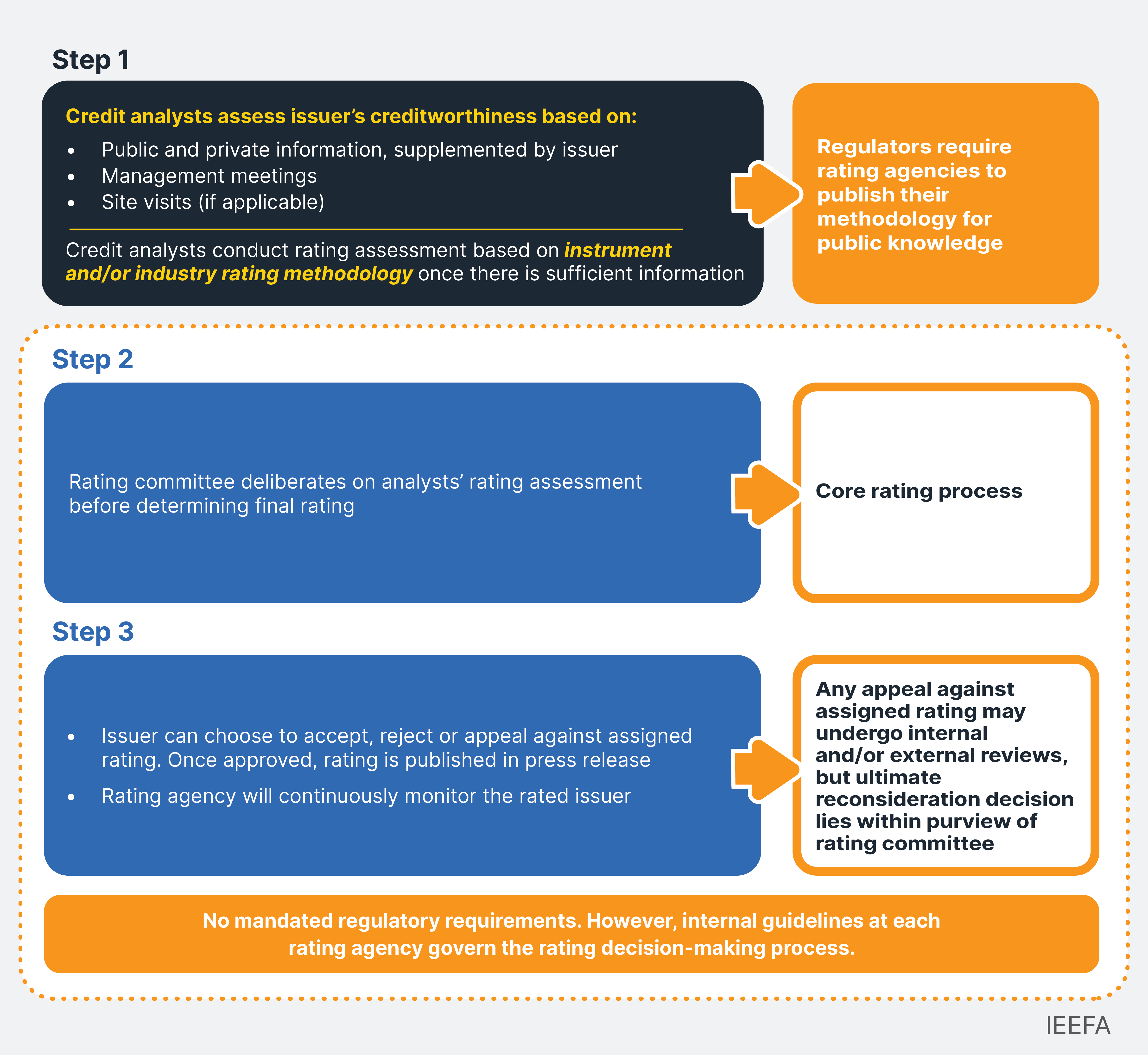

Credit Rating Process 101: Rating committee as the ultimate decision-making body

The credit rating process, comprising three critical stages, has long been established across markets. However, its subjectivity is significant enough to warrant examination in light of climate-related risks.

Figure 1: Three-Stage Credit Rating Process

Source: IEEFA compilation based on rating agencies’ practices

| Step 1 | |

|

The credit rating process begins with a credit analyst, typically possessing financial expertise, collecting and evaluating relevant information about an issuer. The analyst evaluates publicly available data, conducts quantitative analyses of audited financial statements, calculates sensitivity-based projections and key credit ratios, and holds in-depth interviews with the issuer’s management. Complementing these quantitative analyses are qualitative factors, including management track record, capital project outcomes, market position, management effectiveness and governance structure. Confidential information shared by the issuer and peer comparison are also evaluated. The analyst then produces initial ratings in a stage known as “rating preparation” based on the findings. This assessment is conducted in line with proprietary instrument or industry-specific credit rating methods. Regulators require each agency to publish its methodologies on its website. |

|

| Step 2 | |

|

At the core of the process is the rating committee – the ultimate decision-making body in each agency responsible for the final ratings assigned. The committee typically comprises lead credit analysts, the managing directors of the agency, and internal and/or external experts, each possessing qualifications, knowledge and experience in key sectors and financial markets relevant to credit ratings and the issuer’s business. While it generally follows a similar process to assign ratings, the committee’s composition, voting rights of individual members, as well as policies or internal guidelines governing the decision-making vary across agencies. Taking over from step 1, the committee receives the analyst’s rating proposal, commonly known as draft rating action, for deliberation. With the rating methodology acting as a bellwether, the committee conducts a comprehensive examination of the analyst’s proposed ratings and analysis. Its work comprises reviewing and discussing key rating factors, including the quantitative and qualitative analyses carried out in step 1. After the deliberations, the committee adjusts the analyst’s proposed credit score and framing of the credit report before publication, if necessary. Any rating action taken is based on a simple majority vote, that is, more than 50% support for a single rating outcome. Rating committee discussions are minuted for internal verification and for regulators to examine upon investigation. The records include composition of the rating committee, voting results, and internal deliberations including dissenting views. These records hold committee members accountable for their decisions. That said, there have been cases of internal processes “not being sufficiently recorded,” casting doubt on the transparency and reliability of the process. Committee debates are a black box to investors and the public. |

|

| Step 3 | |

|

Once a decision is made and communicated to the issuer, the latter has the option to accept, reject or appeal the assigned rating. Upon acceptance, the rating is released through a press release, and the agency continues to monitor the rated issuer’s performance. If an issuer appeals the rating and provides additional information that is deemed significant, the credit agency may delay publication to allow the rating committee to carefully re-evaluate the decision. If the issuer rejects the second decision, the rating will not be published. This situation typically applies to issuers being rated for the first time. Issuers with a prevailing rating can choose to withdraw ratings following an updated rating action or at their discretion. |

Essentially, these steps underscore the convention that the final credit outcome hinges on both committee expertise and rating decisions determined by a simple majority consensus, rather than driven solely by methodology.

Are climate-related risks sufficiently integrated into rating deliberations?

Steps 2 and 3 of the credit rating process validate a statement made by Moody’s, that “credit ratings are subjective opinions that reflect the majority view of the rating committee’s voting members.”

The steps also signify that, as the final decision-making body, the committee plays a crucial role in safeguarding the independence and faithful representation of rating decisions to avoid the influence of business interests, political perspectives or personal biases.

As such, it is critical that rating committees possess the right experience and inquisitiveness to adapt to a changing financial environment where climate risk is a cause for concern for many issuers and investors.

This poses the following questions:

- Expertise in climate risk assessment. Does the committee have a designated climate risk expert equipped with the capacity to provide well-informed and forward-looking insights or scenarios on the financial impacts of climate risk?

- Qualifications and expertise of committee members. Do those members with voting rights possess the essential qualifications and expertise to participate effectively in substantive dialogue about climate risks affecting creditworthiness?

- Objective deliberation of climate risk. Are climate risks objectively and thoroughly debated, or are they being overlooked?

Rating committees generally engage in thorough discussions that encompass diverse perspectives throughout the rating process. However, it is unclear whether and how climate risk is objectively integrated into rating analyses and deliberations.

Climate expertise and transparency of committee credentials

Climate issues are complex, and quickly and consistently evolving. It is a series of climatic and technical issues that have financial implications. Agencies therefore need to establish a panel of climate experts on the committee for the following reasons:

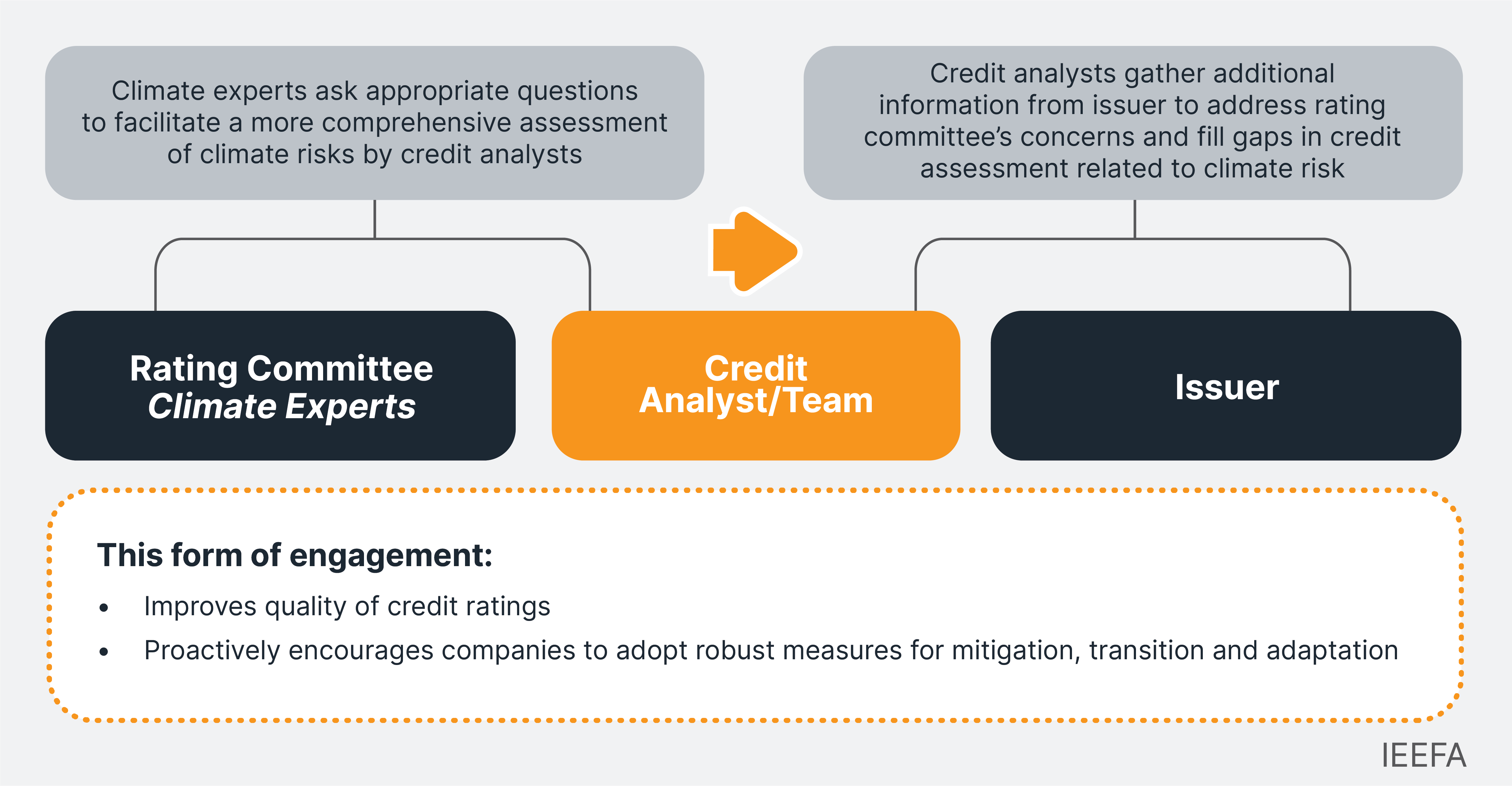

- Fostering constructive dialogue. Such experts can help credit analysts and issuers hold constructive dialogue during step 1, going beyond conventional credit assessment, with an increased focus on analyzing climate risk. This engagement not only enhances the quality of credit ratings but also encourages issuers to adopt comprehensive measures for mitigating and adapting to growing climate-related credit risks, ultimately averting the risk of potential and severe downgrades in the long term.

Figure 2: Flow Chart of Proposed Constructive Dialogue

- Improving credit analysis. Financial statements and the resulting quantitative metrics function as key indicators for both the rating committee and credit analysts under step 2. However, red flags stemming from climate risk may not be immediately and clearly evident within these statements. This makes it increasingly important for rating committees to proactively discuss the projected credit implications of these risks. Climate experts can contribute to a more comprehensive assessment of the credit landscape, enabling agencies to better address and understand the nuances of climate risk.

The climate expert, not being a credit expert, may not be granted voting rights but it should be mandated that at least one specialist, from a pool, be selected for every rating committee convened.

Credit rating committees are expected to comprise a balanced range of subject-matter and independent experts. It is common practice to have internal representatives from various sectors, who are relevant and qualified experts in their field, and external specialized professionals, as the International Organization of Securities Commissions has recommended, such as accountants and lawyers. The same should be extended to climate experts.

And in line with international best practices in credit rating, the agency should publish its committee membership and the personal credentials of the individuals on its website. The transparency will prove the agency’s commitment to maintaining a diverse team of relevant experts and foster confidence that it is qualified to evaluate climate risks.

Our research found that major rating agencies did not publicize rating committee compositions, deliberations or voting outcomes, all of which were usually internally documented instead. While rating standards and practices differ across jurisdictions, public disclosure of committee membership is not new, especially at smaller rating agencies in Asia and the Caribbean.

Table 1: Disclosure of Rating Committee Members

| Category | Major Rating Agency | Smaller Rating Agency | ||||

| Agency | S&P | Moody’s | Fitch | RAM | Acuite | CariCRIS |

| Region | US | US | US/UK | Malaysia | India | Trinidad & Tobago |

| Disclose members of rating committee | Not seen on website | Not seen on website | Not seen on website | Yes | Yes | Yes |

Source: IEEFA research. Company websites accessed in October 2023.

Objectivity and disclosure in climate risk discussions

More disclosure of details is also needed around committee debates, to see whether or how climate risk is affecting financial risk and, by extension, the rating of a debt issuer.

Fitch Ratings’ Climate.VS tool represents a noteworthy development. It functions as a screening tool for the rating committee to objectively address climate transition risks specific to an issuer, with the scores disclosed in credit rating reports. Although it has yet to address physical climate risk, this type of scoring contributes to additional analysis, transparency to stakeholders and robust discussions.

In terms of disclosure, German-based credit rating agency Scope Ratings sets itself apart by including a concise paragraph in press releases that summarizes key deliberations of the committee in addition to the rating rationale and outlook. Notwithstanding some room for refinement, the disclosure has the potential to significantly enhance transparency in whether rating committees are adequately accounting for or discussing climate risk.

Climate-enhanced credit ratings require a two-pronged approach

Rating agencies have made some progress in addressing climate risks. However, highly rated issuers that are exposed to high climate risk are providing investors with a false sense of security.

As capital markets come to terms with the financial impacts of climate events, long-term climate risk integration should be hardwired into credit rating methodology. Although it is challenging to predict every eventuality, a holistic integration, or at the very least a plausible estimation, of this risk relies equally on robust discussions and decision-making processes within the rating committee.

As the main driver of the credit rating process, the rating committee plays a central role in moving toward a credit system that better integrates climate risk. Regulators, vested with the authority to facilitate transformative changes, hold the key to achieving this crucial shift.