The extraordinarily profitable gas market should bring billions more royalties for Queenslanders

Download Full Report

View Press Release

Key Findings

The gas industry has experienced similar windfall profits to the coal industry.

Aligning the gas royalty structure with coal’s would maximise return.

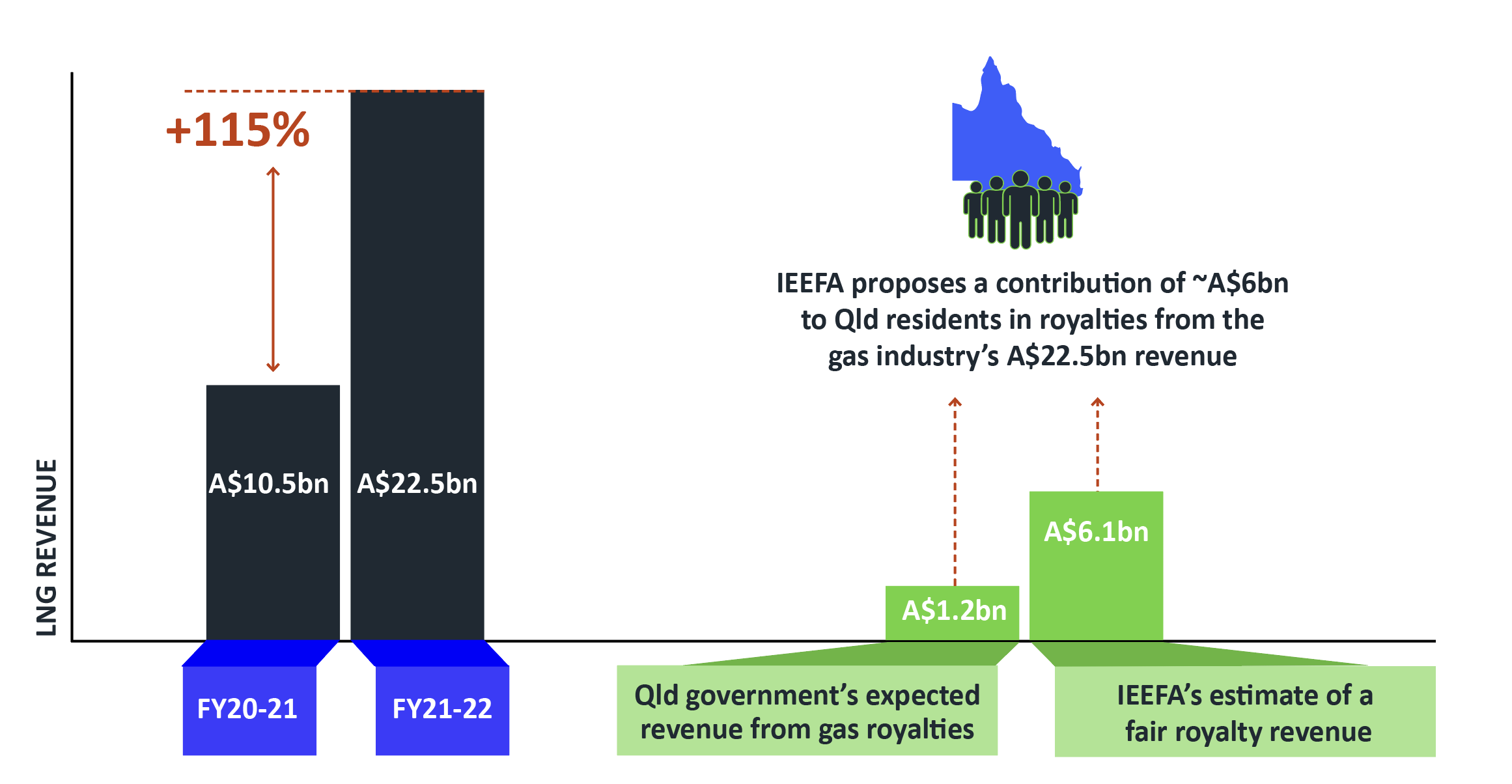

IEEFA estimates that the Queensland government will gain nearly A$5 billion in extra royalty revenue annually from the gas/LNG industry if it adopts a similar royalty scheme as designed for the coal industry.

Overview

With recent record prices for coal, the Queensland government in Australia introduced a new royalty scheme to garner some of the windfall profits from the industry.

The gas industry has experienced similar windfall profits to the coal industry. However, the Queensland government hasn’t reformed its royalty structure accordingly to take account of windfall profits in the gas and liquefied natural gas (LNG) industries.

IEEFA estimates that the Queensland government will gain nearly A$5 billion in extra royalty revenue annually from the gas/LNG industry if it adopts a similar royalty scheme as designed for the coal industry.

Queensland’s LNG Plants’ Windfall Gain

The Queensland government may wish to increase petroleum (gas) royalties in line with those of the coal industry or, alternatively, leave it to the Federal government to introduce an LNG export windfall profit tax.

In either case, there is substantial revenue to be gained from the LNG/gas industry in these times of stretched Federal and State budgets.