Coalmine approvals: Are governments up to the task?

Key Findings

State governments – in New South Wales and Queensland – are increasingly looking to the federal government’s Environment Protection and Biodiversity Conservation (EPBC) Act to regulate coalmine approvals.

Federal mine approvals do not consider climate risks, and jeopardise national and state emissions reduction targets by relying on the imperfect Safeguard Mechanism.

This is particularly so for open-cut coalmines, where new satellite monitoring technology points to significantly higher methane emissions than previously thought.

This analysis is for information and educational purposes only and is not intended to be read as investment advice. Please click here to read our full disclaimer.

In New South Wales (NSW) and Queensland (QLD), the top coalmining states, more than 30 new coalmine applications are awaiting federal environmental approval.

State governments own the coal resources in their jurisdiction, and are responsible for regulating coal mine approvals and ensuring safety standards. They can set approval obligations on greenhouse gas (GHG) emissions released by coal mining. To this end they have been drafting guidance for miners on GHG assessment and mitigation plans.

They do not, however, regulate GHG emissions. This falls to the federal government. According to the former Deputy Prime Minister and chairman of Whitehaven Coal, Mark Vaile, “It's a federal commitment because it’s the federal government that makes the commitments internationally in the international treaties forums.”

Federal government oversight may be ineffective

States can refer coalmine approvals to the federal government for assessment under the Environment Protection and Biodiversity Conservation (EPBC) Act when they involve “matters of national environmental significance”. However, the Act fails to take into account the potential climate impacts from the increased GHG emissions these mines would produce. This was evidenced in the recent approval of three thermal coalmines in NSW.

In 2023, the federal Safeguard Mechanism to manage large emitters was streamlined. It aims to bring coalmine emissions below a baseline towards an industry average. However, as many open-cut mines are already below the industry average, they could be allowed to actually increase their emissions or be rewarded with carbon credits for taking no action to reduce their emissions.

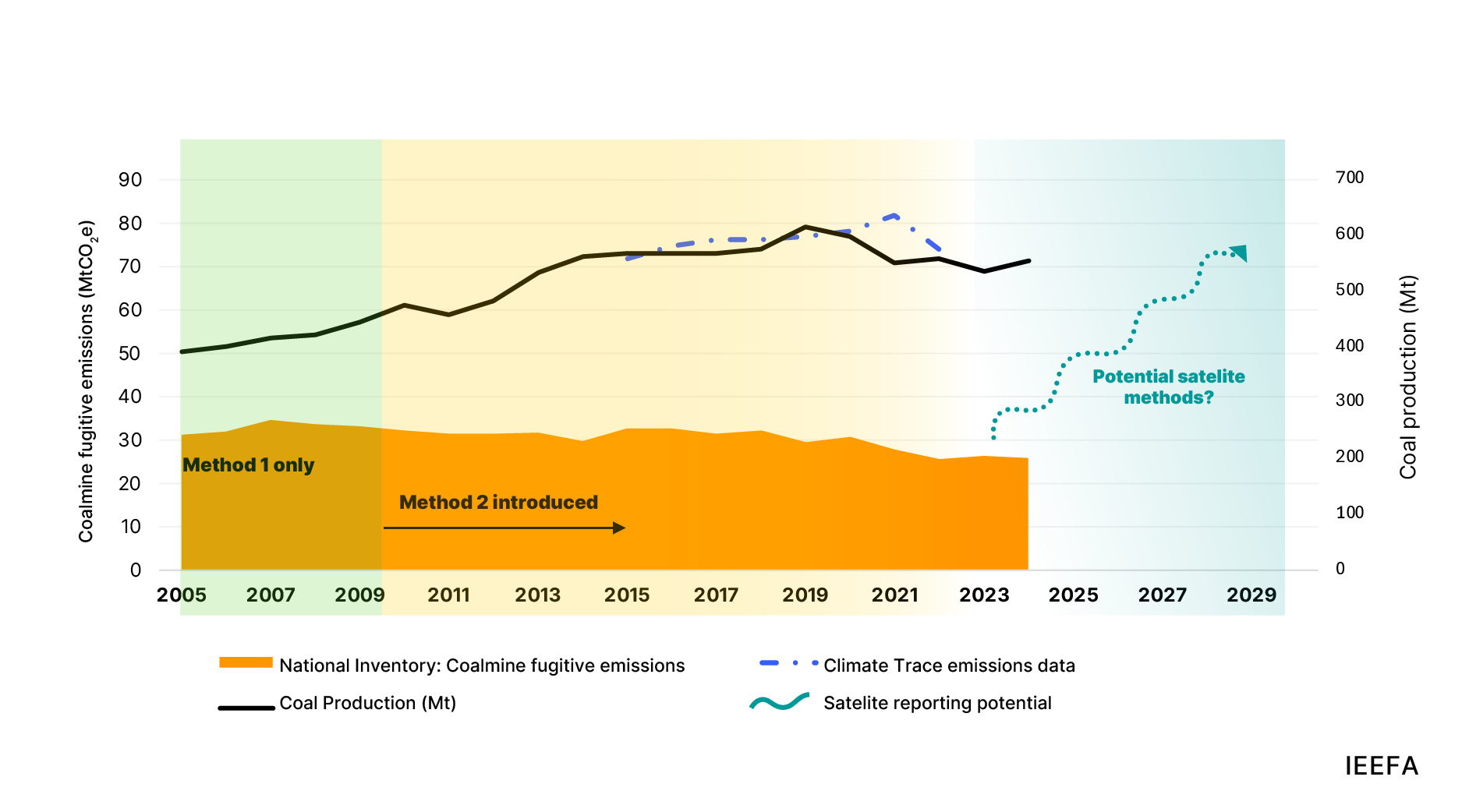

The federal government considers that the fugitive methane emissions are declining and have been for many years. However, new data indicates methane emissions may be significantly under-reported. The Open Methane platform and Climate Trace data show methane emissions may be at least twice as high as reported in Australia’s National Inventory.

Coalmining in Australia: Production and fugitive emissions

Sources: National Greenhouse Gas Inventory, Figure 12 – coal; Climate Trace: Australian coal mining (carbon dioxide equivalent (CO2e);100-year impact), satellite reporting – illustrative; Department of Industry, Science and Resources (DISR) Office of Chief Economist: Coal production, raw; IEEFA

Australia’s role as one of the world’s largest exporters of coal may come under scrutiny at the COP29 conference in Baku, Azerbaijan. The UN Environment Programme’s Emissions Gap Report 2024 says Australia is, as a G20 country, off track to meet its 2030 carbon emissions targets.

Australia exports eight times more coal than it consumes. It is a major player in the global coal trade. It also has one of the biggest pipelines of new coalmines in planning and development among all the exporting countries.

Coalminer expansion plans at odds with Australia’s and global emissions targets

Whitehaven’s Narrabri South mine extension was approved last month. It awaits approval for new mines and expansions at Winchester South, Blackwater South and Blackwater Mine-North in QLD, and the Maules Creek Continuation Project in NSW. It has yet to ramp up its recently commenced Vickery mine in NSW. It is reportedly a bidder for the upcoming Kestrel coal mine sale – a mine with its own expansion plan.

BHP said it would not develop any mine expansions in QLD, following the rise in royalty rates two years ago. It is urging the new LNP government to reverse the royalty decision, as it awaits approval for its BHP Mitsubishi Alliance (BMA) coal projects, including: the Caval Ridge mine extension; the Peak Downs Mine Continuation project; the Saraji East Mining Lease project; and the Saraji Mine Grevillea Pit Continuation Project. In NSW it is awaiting notification of approval to extend mining at the Mount Arthur mine.

Yancoal, having just received approval for Ashton-Ravensworth Underground Mine in NSW, has its Moolarben Coal Extension Project under approval consideration.

Glencore is seeking approval for the Rolleston Coal Mine Continuation Project in QLD and the Ulan Underground Mining Extension in NSW.

Yancoal and Glencore revealed last month that they have withdrawn their application for the HVO Continuation Project. It is thought that the methane-rich open-cut mine may reconsider its development scope. If it were to limit climate impacts by minimising open-cut mining in methane-rich areas, it would set an important precedent for the industry.

Anglo is selling its QLD coal assets, which include applications for mine expansion projects at Dawson West, Lake Vermont and Moranbah South.

Stanmore has purchased the Eagle Downs project and Issac South mine extension areas. It is ramping up production at its flagship South Walker Creek mine, with first coal from the Y-South pit achieved in August 2024.

Idemitsu has a decision overdue on its extension modifications at its Boggabri thermal coal mine in NSW, and Jellinbah awaits approval of its Lake Vermont coal project in QLD. There are many others in the pipeline.

New emissions tracking technology promises increased transparency

The new emissions tracking technology uses satellite and remote sensing data to estimate methane emissions. It could improve transparency and oversight, but it might surprise Australian governments by revealing a larger problem than expected. Australia relies on open-cut mining for about 80% of its coal production. Open-cut mining likely caused much of the unreported methane emissions found by satellites.

The difference is clear when estimating emissions with the new technology compared with the established methods.

NSW and QLD coal mine emissions: various reporting estimates comparison

Sources: National Greenhouse Gas Inventory, Figure 12 – coal; CSIRO and National Inventory: Compilation of data related to Australian coal-mine fugitive emissions; Climate Trace: Aus coal mining (CO2e; 100 years), Open Methane: (Jan-Jun 2023 x 2) to CO2e100 (methane (CH4) x28). *NSW mines incomplete, with several mines’ emissions under scientific review, IEEFA.

Open-cut coalmining could compound methane risks

Underground mines already report high emissions, and so the open cut mines could reveal significantly higher emissions. Large open-cut mines have been getting bigger over the past few years by adding mining and stripping capacity.

The emissions problem is compounded by abatement limitations. Methane gas drainage is not undertaken in open-cut mines, unlike in underground mines where it is done for safety reasons.

Also, open-cut mine design does not consider (or avoid) methane-rich areas, unlike underground mines. Therefore, more open-cut coal production translates into more emissions.

Opportunities for improved state regulation

States can enhance existing regulations on underground mine gas safety. They should also address methane’s climate impact.

Embedded emissions vary from mine to mine, making blanket policy responses difficult. However, this complexity should not be an excuse for inaction.

All coalmine applications should require gas management plans. They must show the potential for methane drainage and abatement. However, it is more common for approvals to only include an obligation for the miner to undertake gas studies, if at all. Once mining starts, it is too late for pre-drainage of gases. The industry need only look to the mature coal-seam gas (CSG) sector for the technological capability to manage the problem. Governments could involve CSG operators to “prepare” coalmine lands for mining, by pre-draining gas.

Capital investment needed required for methane abatement

In QLD, the Low Emissions Investment Partnership has allocated AU$520 million for decarbonisation at several metallurgical coal mines. The federal government has funded an underground coalmine in QLD, via the Powering the Regions Fund, to reduce methane in ventilation air. All the while, innovation is enabling better gas drainage, abatement technologies and reducing costs.

The Australian Carbon Credit Unit scheme awards carbon credits to underground coalmines that capture, destroy or use waste methane, mainly for electricity. However, a large abatement opportunity – pre-draining gas at open-cut mines – is not eligible.

The Australian Climate Change Authority (ACCA)’s decarbonisation pathway for fugitive emissions in coalmining only recommends open-cut gas drainage after 2030. Australia’s coalminers share the ACCA’s lack of urgency for methane abatement; as disclosed in their annual reporting, any proposed action falls under their “post-2030” strategies.

Regulating and draining methane may be complex, but it is not insurmountable. As sophisticated new methane measurement tools emerge, governments and miners may not like the data they produce. But if it’s more accurate and reliable, they may not be able to ignore it. Governments should prepare for the possibility that coalmining may emit more methane than estimated.

With COP29 focusing on 2035 emissions cuts, Australia is under scrutiny. The federal and state governments must develop a credible plan to reduce the impact of coal mining.