The clean energy transition is an economic imperative for Japan’s new government

Key Findings

Japan’s energy policy, outlined in the 6th Strategic Energy Plan, remains fossil-fuel heavy and focuses on unproven technologies. The country’s electricity prices are dictated by its heavy reliance on imported fossil fuels. Excess liquefied natural gas (LNG) purchases and investments in costly, unproven technologies like carbon capture and storage (CCS) and ammonia co-firing exacerbate challenges.

By maximizing renewable energy commitments, the new Japanese government can stabilize power prices, improve domestic energy security, and unlock previously overlooked economic opportunities. Japan is currently revising its Strategic Energy Plan, but the share of fossil fuels in 2040 could reportedly remain the same as previous versions.

Renewables offer an effective way to reduce power costs. Since 2010, the global average cost of electricity from solar photovoltaic and onshore wind projects has fallen by 90% and 70%, respectively.

The clean energy transition could have vast economic benefits for Japan. Achieving net-zero targets could attract up to US$6.7 trillion in investments, fueling innovation, job creation, and regional economic revitalization.

Following Japan’s snap elections in October 2024, the Liberal Democratic Party (LDP) was stripped of its longstanding parliamentary majority. Prime Minister Shigeru Ishiba’s re-election in November marked a new chapter in Japanese politics.

However, there is a lack of clarity on the country’s future energy strategy. Although Ishiba called for “maximizing the potential of renewable energy” for energy security, decarbonization, and economic growth, Japan’s current energy plans do the opposite. Fossil fuel subsidies and policies promoting unproven technologies send contradictory signals to investors despite government commitments to triple renewable energy capacity by 2030. Meanwhile, Japan’s economy remains highly dependent on imported fossil fuels, subjecting electricity consumers to high and volatile prices in global commodity markets.

In this crucial period of Japan’s energy transition, the new administration’s commitment to maximizing renewable energy is more important than ever. Renewable energy can reduce and stabilize power prices in the country, improve domestic energy security, and unlock previously overlooked economic opportunities.

Renewables can lower power costs and increase global competitiveness

Japan has historically paid among the highest electricity prices in Asia, driven by its heavy reliance on imported fossil fuels. This dependency makes the country vulnerable to global price swings, which burden households and businesses.

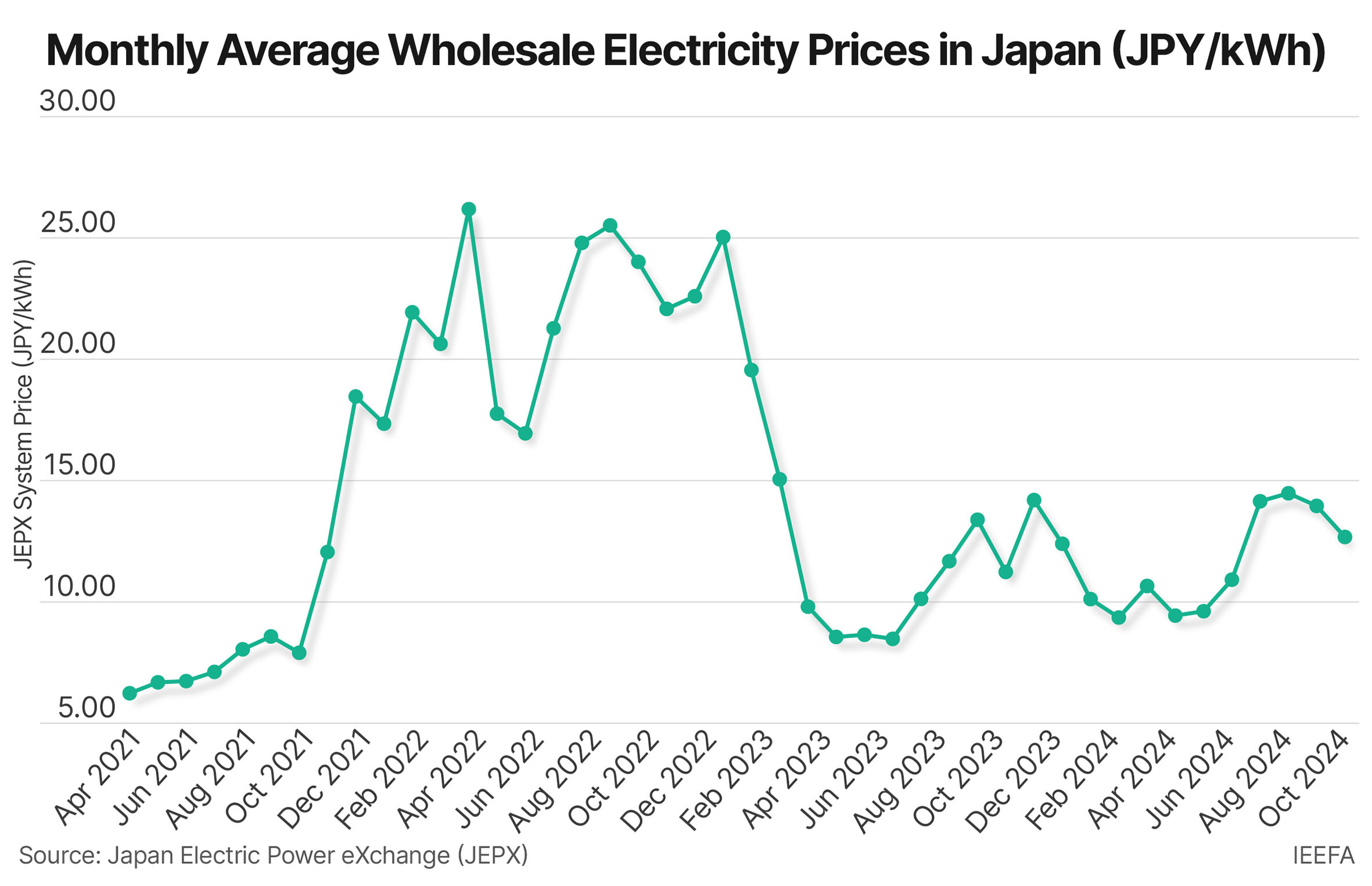

During the 2022 global energy crisis, surging liquefied natural gas (LNG) prices and a weakened yen drove Japan’s annual average electricity price to a record JPY20.41 per kilowatt hour (kWh), far surpassing the 2005–2024 range of JPY6.52–16.51/kWh. Although prices have eased to JPY12.20/kWh, they remain volatile and above pre-pandemic levels.

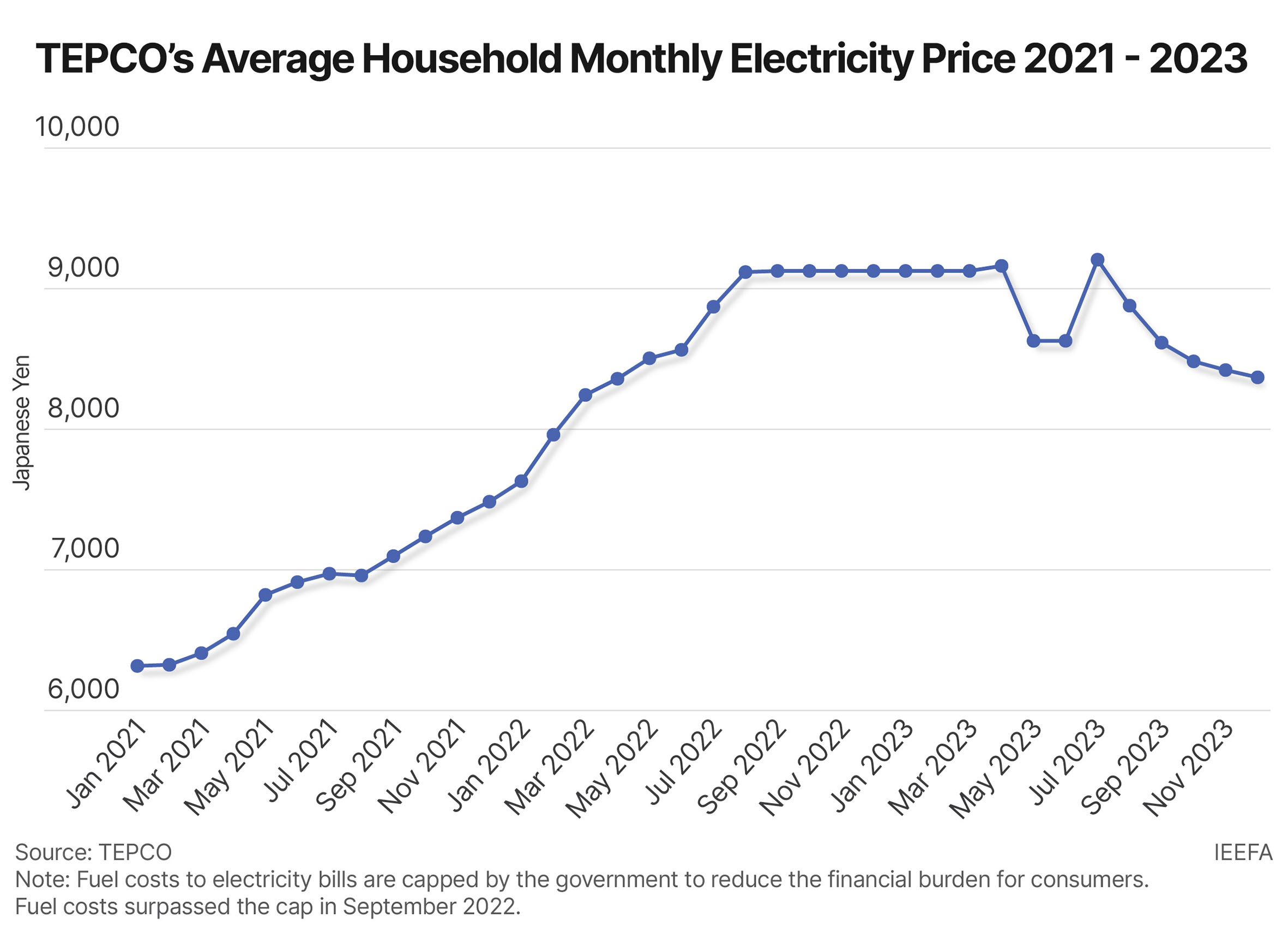

This instability burdens consumers, as reflected in the Tokyo Electric Power Company’s (TEPCO) average monthly household electricity bills, which jumped 25.8% from JPY6,871 in 2021 to JPY8,647 in 2022. In January 2023, the government capped household power bill increases, resulting in JPY3,749 billion allocated for electricity and gas subsidies between January 2023 and May 2024.

Renewables offer a way to reduce power costs. Since 2010, the global average cost of electricity from solar photovoltaic and onshore wind projects has fallen by 90% and 70%, respectively. In 2023, 81% of newly commissioned global renewable projects were more cost-effective than fossil-fired alternatives. This trend underscores renewables’ growing economic advantage and potential to reduce Japan’s wholesale electricity prices.

Global investment in renewables outpaced fossil fuels, reaching US$623 billion in 2023. However, Japan risks falling behind. Over the next decade, an estimated US$2.2 trillion in clean energy investment is needed to achieve the country’s 2050 net-zero targets. Staying tethered to fossil fuels could undermine Japan’s economic competitiveness and climate commitments.

The current energy strategy charts an unsuitable economic course

Japan’s energy policy, outlined in the 6th Strategic Energy Plan, remains fossil-fuel heavy, focusing on unproven technologies. Japan relies on fossil fuels for over 70% of its power, and while the current strategy aims to reduce this share to 41% by 2030, the target still exceeds a planned 38% share for renewable energy. Japan is currently revising its Strategic Energy Plan, though reports suggest fossil fuel targets could remain relatively similar to the previous version. The next plan also faces uncertainty due to rising electricity demand projections driven by data centers and other emerging sectors.

Under the pretext of energy security, Japan buys more LNG than needed to meet domestic demand, reselling its surplus to Asian markets. The Asia Zero Emission Community (AZEC), launched by Japan for carbon neutrality cooperation, leans heavily on fossil-based technologies. Over one-third of its agreements promote fossil fuel solutions. This approach delays the complete transition to renewables and locks Japan and Asia into short-term fixes, compromising long-term sustainability.

Japan’s investments in costly, unproven technologies like carbon capture and storage (CCS) and ammonia co-firing exacerbate the issue. International investors remain skeptical of the country’s vague commitment to phasing out coal, as evidenced by the lack of international investors in Japan’s Climate Transition Bonds. These missteps jeopardize the opportunity to attract the global green investment wave.

Clean energy as an economic catalyst

A clean energy transition has immense potential economic benefits for Japan. Achieving net-zero targets could attract up to US$6.7 trillion in investments, fueling innovation, job creation, and regional economic revitalization. Moreover, the green investment opportunity could stimulate domestic supply chains and position renewables as the cornerstone of Japan’s industrial base.

Offshore wind energy, for example, offers transformative potential and can generate 1.7 times Japan's current primary energy demand. Installing 140 gigawatts (GW) of wind power capacity by 2050 could create 355,000 jobs and generate an annual economic impact of JPY6 trillion. Similarly, rooftop solar potential has been estimated at 159GW, five times the current capacity, further improving energy security and reducing reliance on imports.

The vast potential of renewables would enhance Japan’s energy stability and reshape its energy landscape. Investing in domestic renewable manufacturing could reduce import dependency and create high-quality jobs in rural regions with abundant renewable resources. This aligns with the new administration’s vision of nationwide economic growth and revitalization of rural areas.

The new government’s approach to renewable energy is a turning point for Japan. By embracing renewables, the country can address its environmental challenges, lower energy costs, reduce fossil fuel dependency, and position itself as a leader in the global climate fight. This shift promises economic growth and a resilient and sustainable future for Japan.