Key Findings

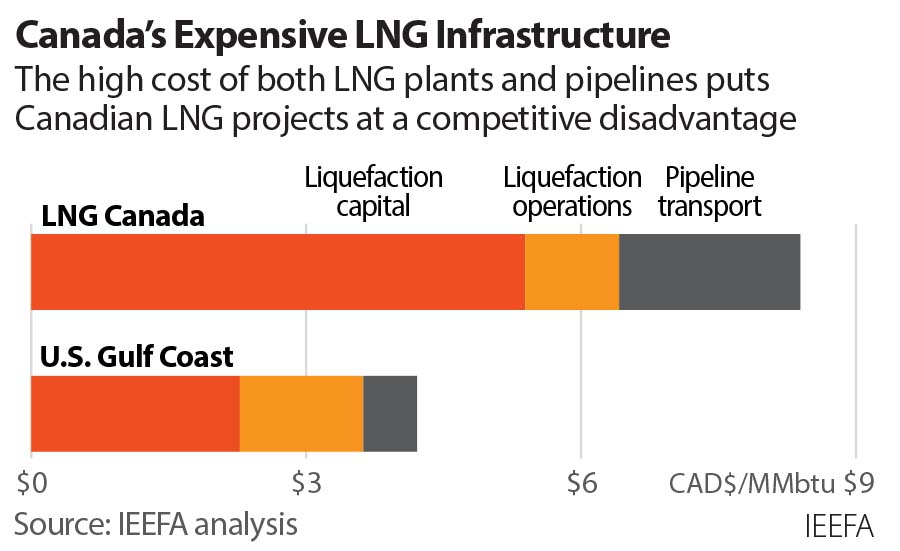

Ballooning construction costs for pipelines and liquefied natural gas (LNG) facilities are creating new financial risks for western Canada's LNG industry.

Cost estimates for the Coastal GasLink pipeline, designed to supply the LNG Canada project in Kitimat, B.C., have gone up at least 70%, undermining the project's economic competitiveness.

British Columbia's gas producers face rising costs from a new royalty regime, and producers in both B.C. and Alberta face regulatory uncertainty stemming from a successful legal challenge brought by First Nations groups.

Rising construction and gas transportation costs, coupled with mounting uncertainty about gas permitting and production, have created a challenging environment for new LNG projects, including the proposed Woodfibre LNG project in Squamish, B.C.

Executive Summary

In 2021, IEEFA reported that potential cost overruns on the Coastal GasLink (CGL) pipeline could become an impediment to further development of liquefied natural gas (LNG) projects in western Canada. The CGL pipeline is designed to supply natural gas to the LNG Canada project in Kitimat, B.C., the only LNG project currently under construction in the country. IEEFA argued that rising construction costs and policy challenges had eroded LNG Canada’s financial underpinnings, casting a pall on proposals to build more LNG export capacity on Canada’s west coast.

In retrospect, this dour assessment may not have been nearly grim enough.

The developer of the CGL pipeline announced in July 2022 that total pipeline construction costs had escalated by 70%. At the end of November 2022, the company said that costs had risen again, and that the company will provide a new estimate of higher costs early this year. The news came as western Canada’s oil and gas industry faced a new royalty regime and other challenges that will likely raise gas production costs and create uncertainty about future production volumes.

IEEFA’s analysis of the changing costs and challenges for western Canada’s gas industry finds that:

- Mounting CGL pipeline construction costs will likely lead to higher tariffs for shipping natural gas from northeast B.C. to the B.C. coast.

- Higher CGL fees, in turn, may make it more profitable for independent western Canadian gas producers to sell gas to U.S. markets using existing pipeline networks, rather than to LNG projects on the B.C. coast.

- At the same time, gas producers in B.C. face rising costs from a new royalty regime, as well as the need for their actions to be consistent with a B.C. Supreme Court decision on First Nations treaty rights.

- Rising gas production and transportation costs, coupled with mounting uncertainty about gas well permitting and production, have created a challenging environment for new LNG projects, including the proposed Woodfibre LNG project in Squamish, B.C.