IEEFA North America: British Columbia LNG project costs rising again

Key Takeaways:

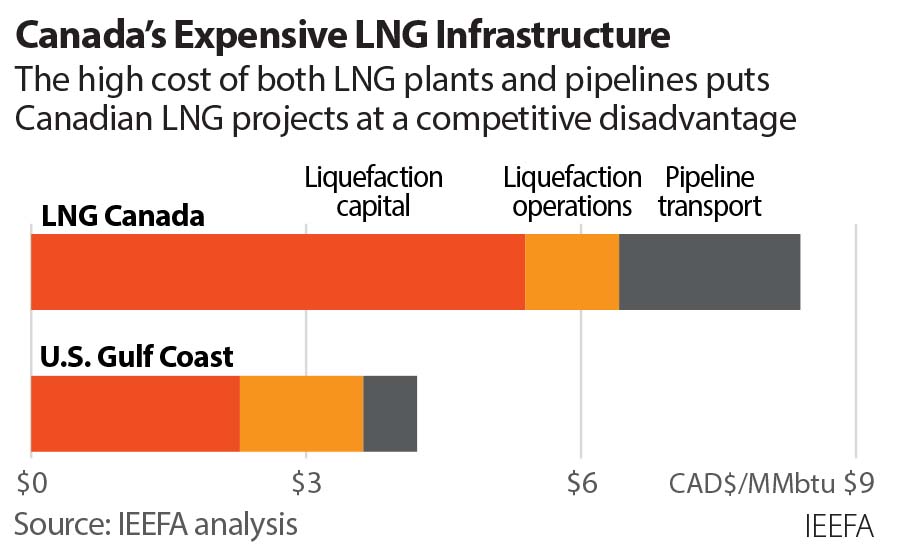

Ballooning construction costs for pipelines and liquefied natural gas (LNG) facilities are creating new financial risks for western Canada's LNG industry.

Cost estimates for the Coastal GasLink pipeline, designed to supply the LNG Canada project in Kitimat, B.C., have gone up at least 70%, undermining the project's economic competitiveness.

British Columbia's gas producers face rising costs from a new royalty regime, and producers in both B.C. and Alberta face regulatory uncertainty stemming from a successful legal challenge brought by First Nations groups.

Rising construction and gas transportation costs, coupled with mounting uncertainty about gas permitting and production, have created a challenging environment for new LNG projects, including the proposed Woodfibre LNG project in Squamish, B.C.

LNG projects in western Canada burdened by high costs

February 1, 2023 (IEEFA)— Cost overruns on the Coastal GasLink (CGL) pipeline, rising construction costs for the Woodfibre LNG plant, and new uncertainties for gas production in the Montney Basin are creating financial challenges for liquified natural gas (LNG) projects in western Canada, according to a new Institute for Energy Economics and Financial Analysis (IEEFA) report.

In early 2022, IEEFA reported that rising construction costs and policy challenges had eroded LNG Canada’s financial underpinnings, casting a pall on proposals to build more LNG export capacity on Canada’s west coast. The latest report, British Columbia LNG Project Costs Rising Again, follows up on the previous report and shows that the dour assessment may have not have been nearly grim enough.

“Although LNG Canada is moving forward with construction, new LNG projects face challenges from rising construction costs and elevated regulatory risks to gas supply. Rising infrastructure costs put even more doubt on projects that have yet to reach construction,” said Clark Williams-Derry, IEEFA analyst and author of the report. “As potential Canadian LNG markets evolve in complexity and competition, high-cost infrastructure continues to pose a challenging hurdle for Canadian LNG projects.”

In July 2022, the developer of the CGL pipeline announced that total pipeline construction costs had escalated by 70%. At the end of November 2022, the company said that costs had risen again, and that the company would provide a new estimate of higher costs early this year. The news came as western Canada’s oil and gas industry faced a new royalty regime and other challenges that will likely raise gas production costs and create uncertainty about future production volumes.

IEEFA’s analysis of the changing costs and challenges for western Canada’s gas industry finds that:

- Mounting CGL pipeline construction costs will likely lead to higher tariffs for shipping natural gas from northeast B.C. to the B.C. coast, which could spur independent Canadian gas producers to sell gas to U.S. markets rather than to LNG projects on the B.C. coast.

- At the same time, gas producers in B.C. face rising costs from a new royalty regime, as well as the need for their actions to be consistent with new limits on oil and gas development within the traditional territory of the Blueberry River First Nations.

- Rising gas production and transportation costs, coupled with mounting uncertainty about gas well permitting and production, have created a challenging environment for new LNG projects, including the proposed Woodfibre LNG project in Squamish, B.C.

The ballooning costs for Canadian gas pipelines and LNG infrastructure have put Canadian LNG projects at a competitive disadvantage and discouraged new investments in Canada’s LNG industry.

Full Report: British Columbia LNG Project Costs Rising Again

Author Contact:

Clark Williams-Derry ([email protected]) is an IEEFA energy finance analyst

Media Contact

Susan Torres ([email protected]), +1 908-565-3451

About IEEFA

The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends and policies. IEEFA’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.