Billions in oil and gas investments undermine Macquarie Group's climate commitment

Download Full Report

View Press Release

Key Findings

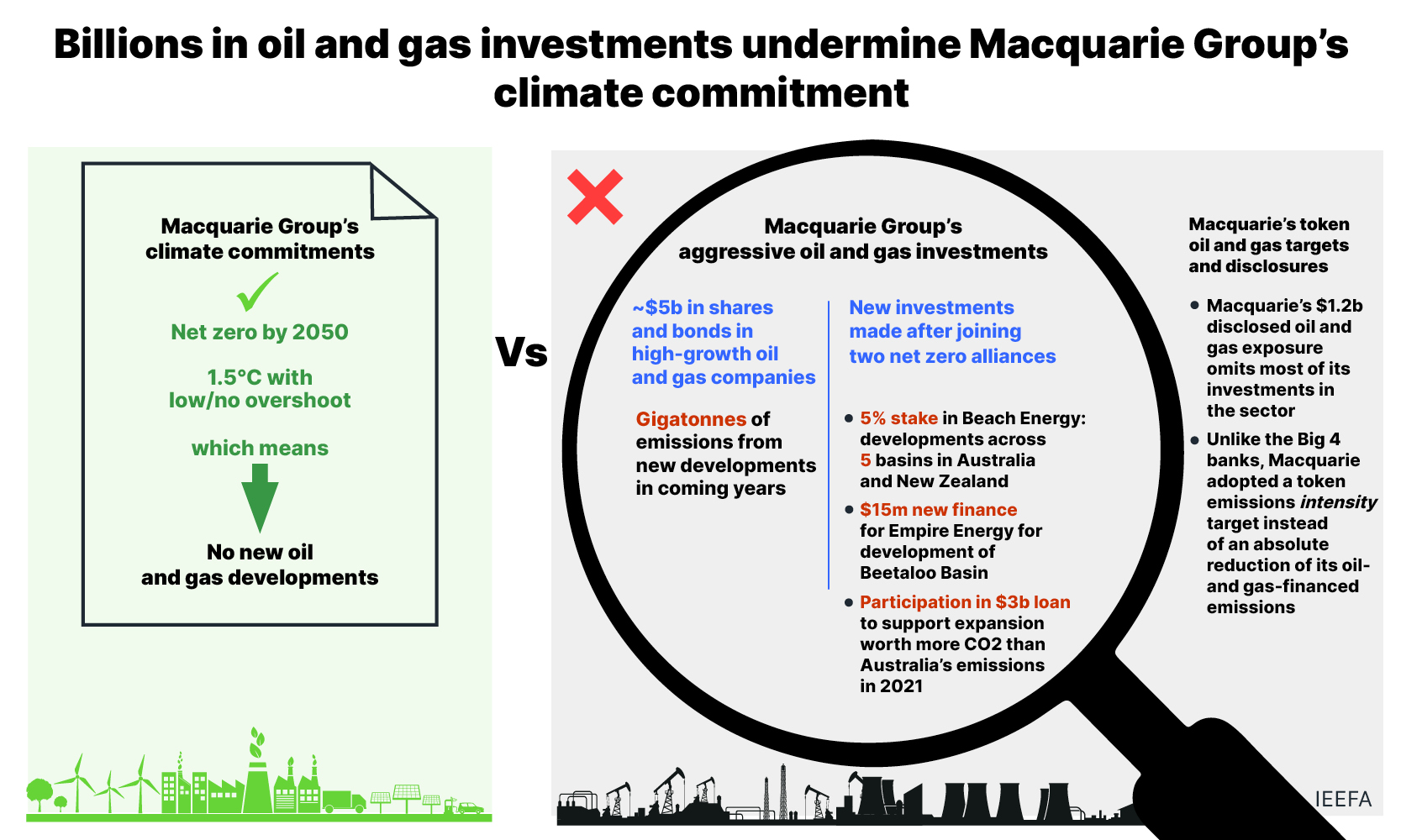

Macquarie Group presents itself as a leader in the global transition to net zero emissions by 2050, but its billions of oil and gas investments are at odds with its commitment to the 1.5°C goal.

Since the start of 2022, Macquarie Group took major stakes in, and issued loans to, oil and gas companies with aggressive expansion plans.

Macquarie Group has nearly A$5 billion invested via shares and bonds in high-growth oil and gas companies responsible for gigatonnes of emissions from new developments in coming years.

Macquarie Group disclosed only A$1.2 billion of financing exposure to the whole oil and gas value chain, which appears to be exploiting a loophole in the NZBA guidelines.

Executive Summary

This report focuses on Macquarie Group’s involvements with the upstream oil and gas sector, and in particular its exposure to oil and gas companies with aggressive expansion plans.

Macquarie Group presents itself as a leader in the global transition to net zero emissions by 2050. As a signatory of the Net Zero Banking Alliance (NZBA) since October 2021, Macquarie Group committed to aligning the emissions from its lending and investment portfolio with pathways consistent with the goal of restricting global warming to below 1.5°C above pre-industrial levels, with no/low overshoot.

The science is clear on what is required to achieve this goal. Both the International Energy Agency (IEA) and the Intergovernmental Panel on Climate Change (IPCC) state that new developments in oil and gas are incompatible with the global goal of 1.5°C with no/low overshoot.

Our analysis finds that Macquarie Group’s actions directly contradict its climate commitments. In particular:

- Macquarie Group has nearly A$5 billion invested via shares and bonds in high-growth oil and gas companies responsible for gigatonnes of emissions from new developments in coming years;

- After joining two net zero alliances, Macquarie Group took major stakes in, and issued loans to, oil and gas companies with aggressive expansion plans, and;

- Contrary to the Big 4 banks, Macquarie Group adopted an emissions intensity target which does not require it to reduce its oil- and gas-financed emissions in absolute terms.

The investments made since 2022 include: a 5% stake in Beach Energy, a company targeting aggressive new developments across five different basins in Australia and New Zealand in the next two years; A$15 million in finance to Empire Energy to support the development of the controversial Beetaloo Basin – a shale gas deposit which is Australia’s largest undeveloped gas resource, and; an undisclosed contribution to the issuance of a A$3 billion loan for Southwestern Energy, an American company with short term expansion plans which would create more CO2 than Australia’s total emissions in 2021. The new finance to Empire Energy is in addition to an existing 3.5% stake and $A11.3 million finance facility.

The investments identified in this report add up to A$4.9 billion. A more comprehensive analysis of Macquarie Group’s exposure to upstream oil and gas companies through shares and bonds (excluding loans) found about A$7.7 billion of exposure. These numbers are materially higher than Macquarie Group’s A$1.2 billion disclosed financing exposure to the full oil and gas value chain – including midstream and downstream activities. Macquarie Group appears to be exploiting a loophole in the NZBA guidelines, which do not mandate member banks to establish targets for their fossil fuel exposure through off-balance sheet activities.

It is worth noting that investments in oil and gas are also bad financial investments. Oil and gas companies have financially materially underperformed the market benchmark for the past 10 years, despite a short-lived spike in performance in the past few years. In addition, new LNG developments in coming years are likely to face a supply glut combined with a flood of uncontracted volumes.

To align its investments with the global goal of 1.5°C, Macquarie Group will need to start focusing not only on increasing its green investments, but also on decreasing its investments in fossil fuel expansions.