Billions in oil and gas investments undermine Macquarie’s net zero commitments

Investors should question why Australia’s fifth largest bank straddles the climate change fence with large investments in both renewables and oil and gas production.

Report exposes $5b of investments in high-growth oil and gas production

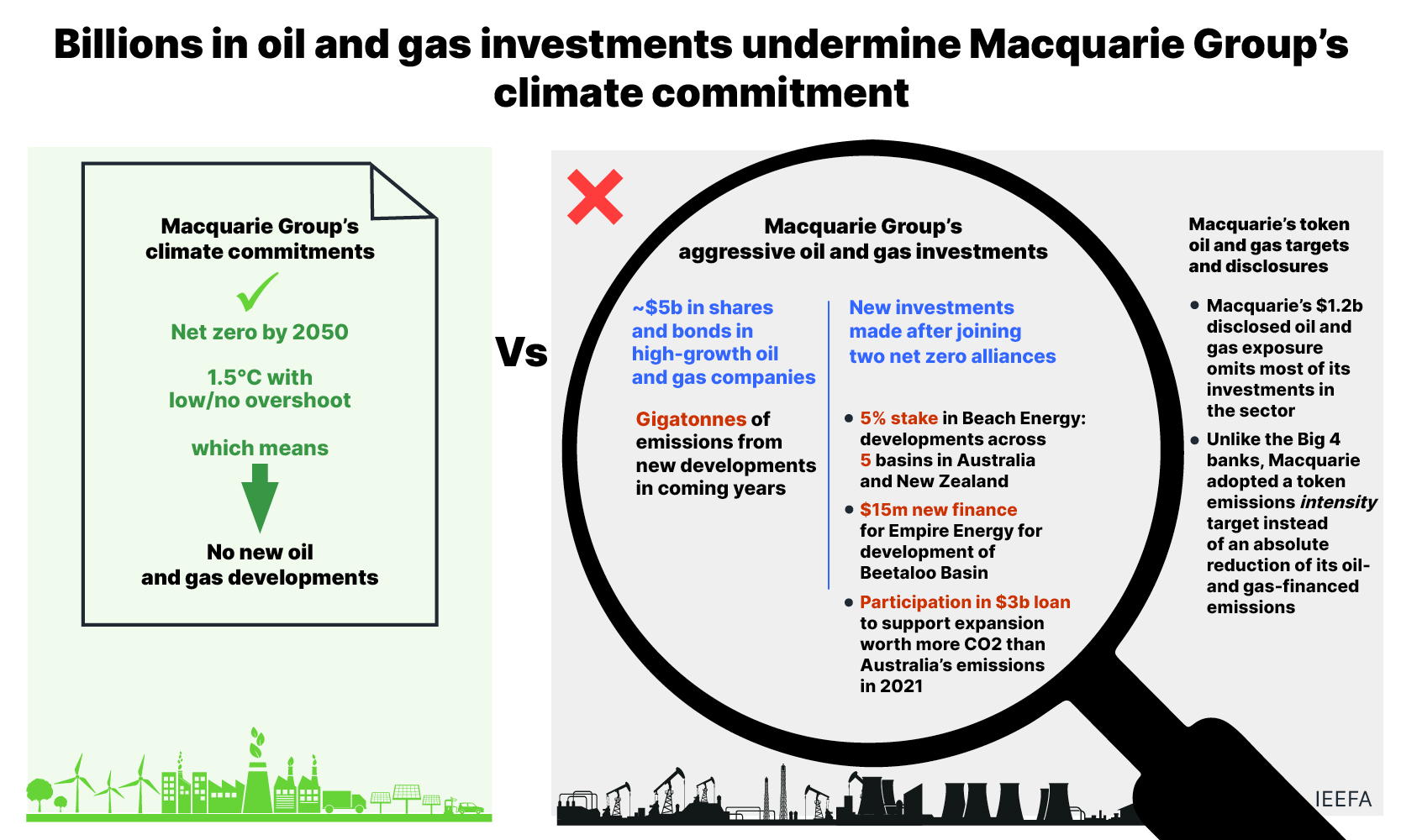

8 June 2023 (IEEFA Australia): Despite presenting itself as a leader in the global transition to net zero emissions by 2050, Macquarie Group’s oil and gas investments are at odds with the 1.5°C goal, a new report by the Institute for Energy Economics and Financial Analysis has found.

In October 2021, Macquarie Group signed up to the international Net Zero Banking Alliance (NZBA), committing to aligning the emissions from its lending and investment portfolio with the goal of restricting global warming to below 1.5°C above pre-industrial levels.

Since then it has invested heavily in oil and gas companies with aggressive expansion plans that include the controversial Beetaloo Basin gas project, the report’s authors, IEEFA Australia CEO Amandine Denis-Ryan and energy finance analyst Saurabh Trivedi, said.

“Our analysis finds that Macquarie Group’s actions directly contradict its climate commitments,” Ms Denis-Ryan said.

Macquarie Group’s oil and gas investments since joining the NZBA include:

- A 5% stake in Beach Energy, a company targeting aggressive new developments across five different basins in Australia and New Zealand in the next two years;

- A$15 million in finance to Empire Energy to support the development of the Beetaloo Basin gas project – a shale gas deposit that is Australia’s largest undeveloped gas resource, and;

- An undisclosed contribution to the issuance of a A$3 billion loan for US company Southwestern Energy, whose expansion plans would create more CO2 than Australia’s total emissions in 2021.

The science is clear on what is required to achieve the global goal of 1.5°C. Both the International Energy Agency (IEA) and the Intergovernmental Panel on Climate Change (IPCC) state that new developments in oil and gas are incompatible with that goal.

Yet Macquarie Group owns large volumes of shares and bonds in 11 of the largest global oil and gas majors, worth about A$3.5 billion. Those companies are all planning major short-term expansions, representing billions of barrels of oil equivalent and gigatonnes of CO2 emissions. It also has high stakes in nine relatively smaller oil and gas companies with aggressive growth plans – in which it has another A$1.4 billion in investments.

“The investments identified in this report add up to about A$5 billion. A more comprehensive analysis of Macquarie Group’s exposure to upstream oil and gas companies through shares and bonds (excluding loans) found about A$7.7 billion of exposure,” Ms Denis-Ryan said.

These numbers are significantly larger than the disclosed financing exposure to the upstream oil and gas sector by three of the Big 4 banks: CBA disclosed A$2.1 billion, NAB A$1.9 billion and Westpac A$1.9 billion.

The report also identifies weaknesses in Macquarie Group’s disclosures and targets.

“Macquarie Group disclosed only A$1.2 billion of financing exposure to the full oil and gas value chain.”

“The discrepancy between reported and actual exposure may be explained by the disclosures focusing only on on-balance sheet activities,” Ms Denis-Ryan said.

“If so, Macquarie Group's disclosure on financed emissions appears to be exploiting a loophole in the NZBA guidelines, which do not mandate member banks to establish targets for their fossil fuel exposure through off-balance sheet activities.”

Given that Macquarie Group has a much larger asset management portfolio than banking portfolio and is a participant to the Net Zero Asset Managers initiative, it would be a reasonable expectation that it discloses its off-balance sheet equity and bonds investments in the oil and gas sector and includes those in its targets. It already includes assets under management in its disclosed green energy investments.

The target it set for its oil and gas activities as part of the NZBA initiative is also inappropriate. As an emissions intensity target, it does not require the group to achieve any reductions in its absolute financed emissions. On the contrary, the target could provide an incentive to increase the financing of gas projects so as to decrease the average emissions intensity of its oil and gas portfolio.

Read the report: Billions in oil and gas investments undermine Macquarie Group’s climate commitment

Media contact: Amy Leiper [email protected], ph 0414 643 446

Author contacts: Amandine Denis-Ryan [email protected], Saurabh Trivedi [email protected]

About IEEFA: The Institute for Energy Economics and Financial Analysis (IEEFA) examines issues related to energy markets, trends, and policies. The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy. (ieefa.org)